Visa Inc. (NYSE:V) Can Easily Afford to Raise Its Dividend

After the latest earnings results, Visa Inc. (NYSE: V) surged, nullifying the entire January dip. While the company expects a solid cross-border recovery, we have to consider that it already trades at almost 40x the earnings.

Click here for our latest analysis on Visa

First-quarter 2022 results:

- EPS: US$1.84 (up from US$1.42 in 1Q 2021).

- Revenue: US$7.06b (up 24% from 1Q 2021).

- Net income: US$3.87b (up 27% from 1Q 2021).

- Profit margin: 55% (up from 53% in 1Q 2021). The increase in margin was driven by higher revenue.

Revenue exceeded analyst estimates by 3.9%. Earnings per share (EPS) also surpassed analyst estimates by 7.6%.

Over the next year, revenue is forecast to grow 17%, compared to a 20% growth forecast for the industry in the US. Over the last 3 years on average, earnings per share have increased by 3% per year but the company's share price has increased by 17% per year, which means it is tracking significantly ahead of earnings growth.

Reflecting on the earnings results, CEO Al Kelly noted that the company crossed the US$60b payment transaction mark for the first time in history. He pointed out that the company is well-positioned to profit from ongoing trends like Buy Now, Pay Later (BNPL), and crypto payments. Furthermore, he expects the markets like Latin America and Africa to continue delivering strong growth in the rapidly digitizing environment.

Outlining Visa's Dividend

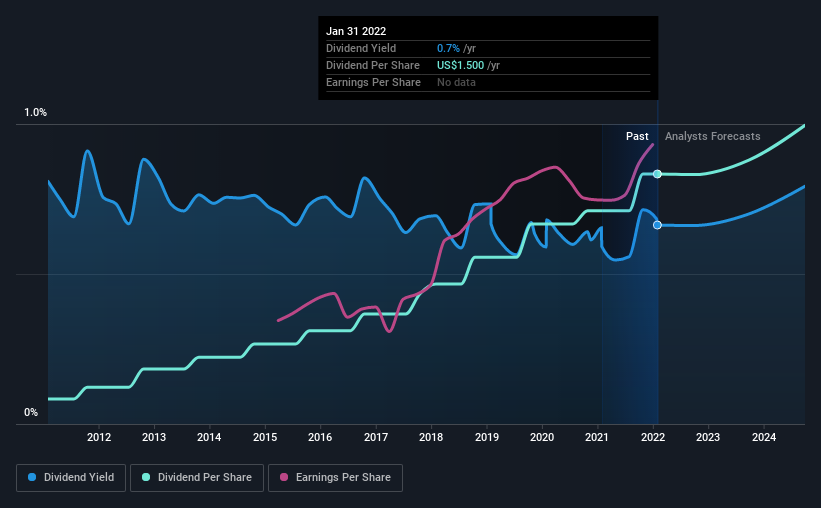

A 0.7% yield is nothing to get excited about, but investors probably think the long payment history suggests Visa has some staying power. The company also returned around 2.3% of its market capitalization to shareholders in stock buybacks over the past year.

There are a few simple ways to reduce the risks of buying Visa for its dividend.

Payout ratios

Dividends are usually paid out of company earnings. If a company pays more than it earns, then the dividend might become unsustainable. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Visa paid out 23% of its profit as dividends over the trailing twelve-month period. We'd say earnings thoroughly cover its dividends.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Visa paid out 19% of its free cash flow as dividends last year, which is conservative and suggests the dividend is sustainable. It's encouraging to see that the dividend is covered by profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

We update our data on Visa every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past and if the company has a track record of maintaining its dividend.

During the past 10-year period, the first annual payment was US$0.1 in 2012, compared to US$1.5 last year. Dividends per share have grown at approximately 26% per year over this time.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the inflation rate to maintain the recipient's purchasing power.

It's good to see Visa has been growing its earnings per share at 19% a year over the past five years. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business.

Conclusion

To summarise, shareholders should always check that Visa's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend.

First, we like that the company's dividend payments appear well covered, although the retained capital needs to be effectively reinvested. All things considered, Visa looks like a strong prospect. The only downside we see is that the yield is relatively modest at 0.7%. Should the company decide to bump the dividend to the industry average of 1.2%, it could mean a lot for yield-oriented investors.

Growing earnings tend to be the best dividend stocks over the long term. See what the 32 analysts we track are forecasting for Visa for free with public analyst estimates for the company.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives