High Institutional Ownership Should Provide Comfort Through Visa Inc.'s (NYSE:V) Pullback

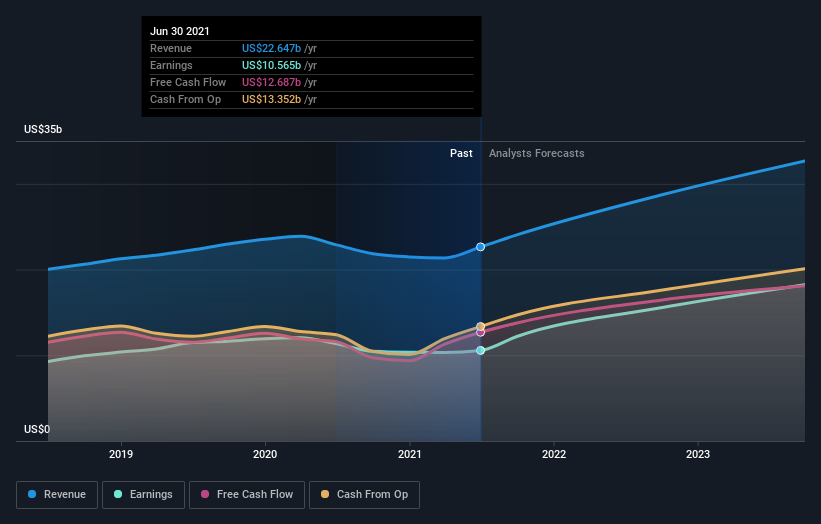

Visa Inc. ( NYSE: V ) continues pulling back after retracing over 7% since posting solid Q2 earnings. Despite investor's optimism, the stock has significantly underperformed S&P500 in 2021.

In this article, we will examine the current ownership structure to see how it impacts the situation.

While it is impossible to pinpoint the exact reason for the post-earnings decline, it is important to note 2 interesting facts:

- The new all-time high was 16% above the pre-Covid19 high

- Revenues and net income were only 5% higher

Despite high volumes, margins remain suppressed due to falling cross-border volume as global travel is still nowhere near recovered, and the threat of the Delta variant remains present.

Furthermore, online retailers are ramping up the fees, with Amazon announcing they will add a 0.5% surcharge for Visa transactions in Singapore.

Meanwhile, Visa expands, acquiring Currencycloud , a global platform for innovative foreign exchange solutions, in a US$ 963m deal.

Ownership Outlook

Visa has a market capitalization of US$492b, so it's too big to fly under the radar. We'd expect to see both institutions and retail investors owning a portion of the company.In the chart below, we can see that institutions are noticeable on the share registry.

See our latest analysis for Visa .

What Does The Institutional Ownership Tell Us About Visa?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index.

As you can see, institutional investors have a fair amount of stake in Visa.This implies the analysts working for those institutions have looked at the stock, and they like it. But just like anyone else, they could be wrong.When multiple institutions own a stock, there's always a risk that they are in a "crowded trade." When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth; however, VIsa has been a fairly steady performer over the years.

Institutional investors own over 50% of the company, so together, they can probably strongly influence board decisions.Visa is not owned by hedge funds.

The Vanguard Group, Inc. is currently the company's largest shareholder, with 6.7% of shares outstanding. With 5.8% and 3.9% of the shares outstanding, respectively, BlackRock, Inc. and T. Rowe Price Group, Inc. are the second and third largest shareholders.

Our studies suggest that the top 25 shareholders collectively control less than half of the company's shares, meaning that the shares are widely disseminated, and there is no dominant shareholder.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments.Quite a few analysts cover the stock so that you could look into forecast growth easily.

Insider Ownership Of Visa

The definition of an insider can differ slightly between different countries, but members of the board of directors always count.

Insider ownership is generally a good thing. However, it makes it more difficult for other shareholders to hold the board accountable for decisions on some occasions. Our most recent data indicates that insiders own less than 1% of Visa Inc., about US$270m.Being so large, we would not expect insiders to own a large proportion of the company anyways.

It is good to see board members owning shares, but it might be worth checking if those insiders have been buying.

General Public Ownership

The general public holds a 24% stake in Visa. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Visa better, we need to consider many other factors. Take risks, for example - Visa has 2 warning signs we think you should be aware of.

Do not miss this free report on analyst forecasts if you would prefer to discover what analysts are predicting in terms of future growth.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives