- United States

- /

- IT

- /

- NYSE:UIS

Swelling losses haven't held back gains for Unisys (NYSE:UIS) shareholders since they're up 123% over 5 years

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on a lighter note, a good company can see its share price rise well over 100%. For instance, the price of Unisys Corporation (NYSE:UIS) stock is up an impressive 123% over the last five years. In the last week shares have slid back 5.7%.

Although Unisys has shed US$91m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Unisys

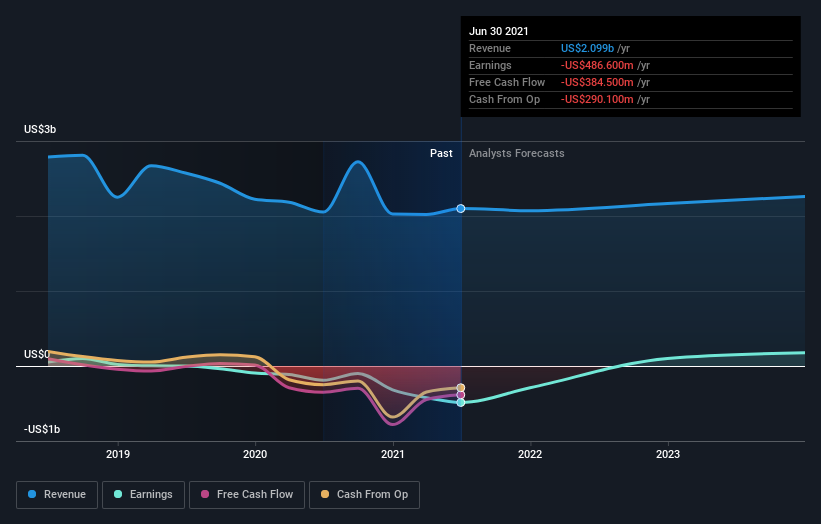

Given that Unisys didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Unisys saw its revenue shrink by 6.9% per year. Given that scenario, we wouldn't have expected the share price to rise 17% per year, but that's what it did. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, we are a bit cautious in this kind of situation.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Unisys stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Unisys has rewarded shareholders with a total shareholder return of 89% in the last twelve months. That gain is better than the annual TSR over five years, which is 17%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Unisys has 3 warning signs (and 1 which is potentially serious) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Unisys, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:UIS

Unisys

Operates as an information technology solutions company in the United States, the United Kingdom, and internationally.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives