- United States

- /

- Software

- /

- NYSE:U

Unity (U) Losses Accelerate 10.8% Annually, Extending Profit Worries Versus Growth Narratives

Reviewed by Simply Wall St

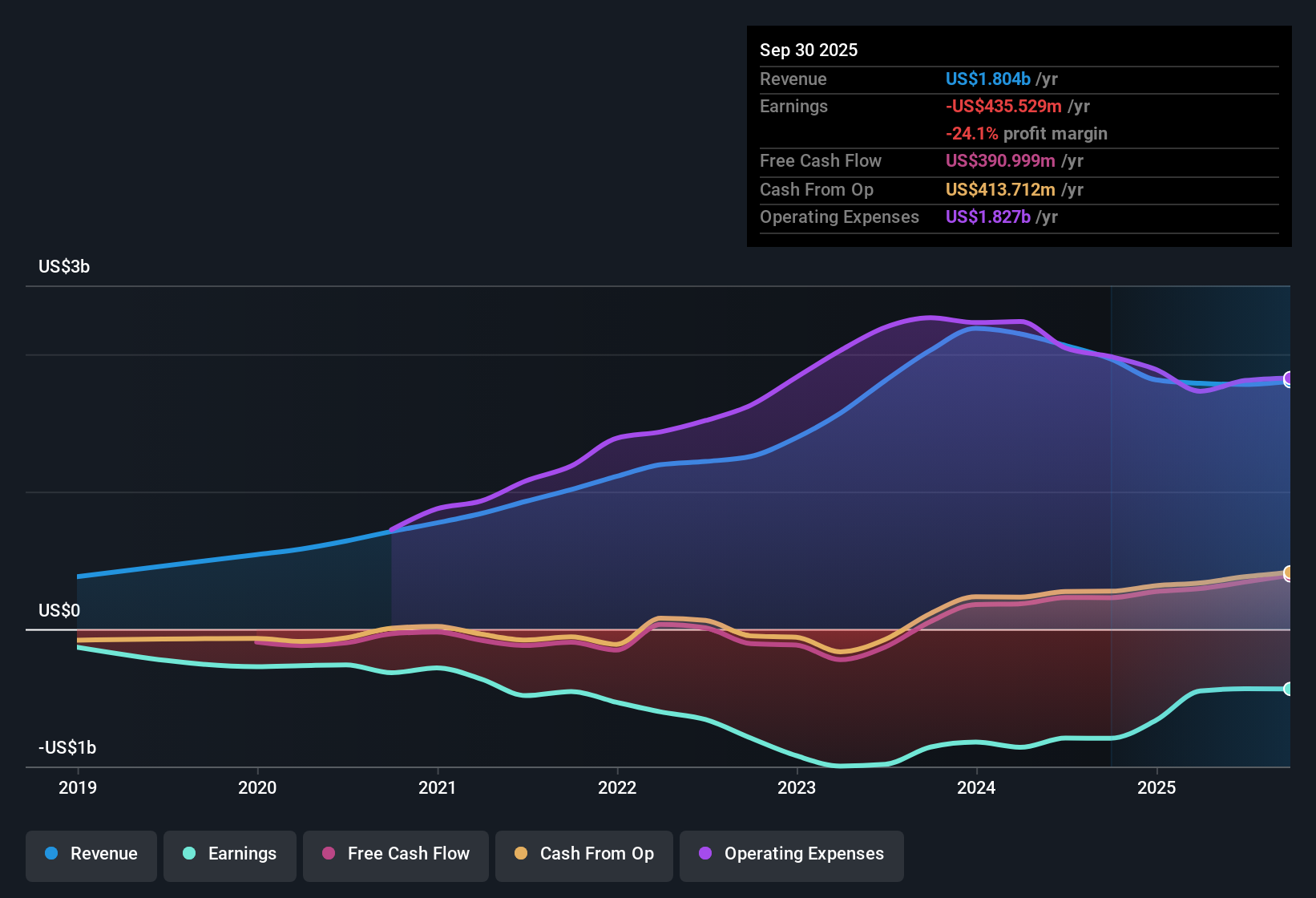

Unity Software (U) remains in the red, with losses deepening by 10.8% per year over the past five years and no notable shift in profitability metrics. Revenue is forecast to grow at 10% annually, slightly lagging the broader US market's 10.5%. With shares trading at $42.36, well above the estimated fair value of $36.45 and a price-to-sales ratio of 10.1x that surpasses both peer and industry averages, investors see a company priced for growth but still searching for sustained profits in the coming years.

See our full analysis for Unity Software.Next up, let’s see how these results measure up against the key storylines that shape opinion in the market. Some expectations will meet reality, while others may be put to the test.

See what the community is saying about Unity Software

No Profit Breakthrough Expected Soon

- Unity's net profit margin has shown no measurable improvement, with the company forecast to remain unprofitable for at least the next three years. This would extend a five-year streak of losses that have deepened at a 10.8% annual rate.

- Analysts' consensus view holds that sustained spending on AI innovation and new product initiatives could delay any path to profitability for Unity.

- Despite projected annual revenue growth of 10%, which slightly lags the broader US market, high operating expenses from aggressive AI and product investments keep net margins firmly negative.

- Consensus notes that while these moves deepen Unity’s reach in gaming and new verticals, they elevate the risk that profitability targets continue to slip beyond the three-year forecast horizon.

See what fresh analyst scenarios suggest Unity’s three-year outlook really means for investors. 📊 Read the full Unity Software Consensus Narrative.

Recurring Revenue Engines Drive Stability

- Strategic expansion of Unity's subscription-based Create business is accelerating recurring revenue and smoothing out earnings volatility, according to consensus, with analysts pointing to double-digit growth and strong adoption rates across new customer segments.

- The analysts' consensus narrative claims that broadening partnerships, including deals with top-tier gaming and enterprise brands like Tencent, Scopely, Nintendo, and BMW, are unlocking long-term customer pipelines and diversifying revenue streams.

- These relationships, alongside growing cross-platform adoption and advances in real-time 3D content, are supporting both top-line growth and margin potential. This is adding stability even as overall industry trends remain highly competitive.

- Analysts argue this diversified user base underpins Unity’s competitive position, even though profitability remains elusive for now.

Valuation Remains at a Premium

- Unity trades at a price-to-sales multiple of 10.1x, outpacing both the peer average (9.7x) and the wider US software industry (5.1x). The $42.36 share price stands well above its DCF fair value of $36.45 and the analyst price target of $37.60.

- According to the analysts' consensus narrative, this price premium signals high investor confidence in Unity’s long runway for growth. The valuation gap also reveals skepticism about the near-term ability to deliver on positive earnings or margin expansion.

- While the current share price exceeds the consensus price target by about 13%, analysts highlight that meaningful upside would require Unity to achieve a substantial swing in profit margin, from -24.4% to 13.5%, by around August 2028 to justify today’s multiple.

- The tight gap between the analyst price target and current share price further underscores tight expectations, suggesting little room for disappointment amid persistent execution risks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Unity Software on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the numbers tell a different story? Jump in and capture your perspective by building a personal narrative in just a couple of minutes. Do it your way.

A great starting point for your Unity Software research is our analysis highlighting 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Unity faces ongoing profitability struggles and a premium valuation. There is no clear path to delivering consistent earnings growth in the near term.

If you want to focus on investment ideas where valuation looks more attractive, see which stocks currently offer better value with these 837 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion