- United States

- /

- Software

- /

- NYSE:U

Unity Software (U): Valuation Perspective Following Landmark Epic Games Partnership and Fortnite Creator Integration

Unity Software (U) made headlines after revealing a strategic partnership with Epic Games. This partnership allows Unity developers to bring their games directly into Fortnite and participate in its thriving creator ecosystem.

See our latest analysis for Unity Software.

The partnership announcement with Epic Games, combined with persistently strong year-to-date momentum, has sparked renewed interest in Unity Software. Following a jump in options activity and upbeat sentiment, Unity’s share price returned 58.2% year-to-date, while its total shareholder return over the last 12 months reached nearly 65%. Over the longer term, the stock’s rebound remains modest after a challenging three-year stretch, but recent gains suggest that momentum could be building again.

If Unity’s deal with Epic has you watching the tech space, this is an ideal moment to discover where innovation is heading next by exploring See the full list for free.

With Unity’s stock on a tear, investors are now asking whether substantial upside remains. Does this rally hint at a true bargain, or is the market already reflecting high expectations for future growth?

Most Popular Narrative: 0.8% Overvalued

Unity’s fair value estimate sits just below the latest close of $38.77, suggesting the rally may be running ahead of fundamentals according to andreas_eliades. The narrative’s approach leans on long-term prospects and restructuring momentum, rather than short-term excitement.

Despite near all-time-low valuations, Unity remains a leader in 2D/3D content development, particularly in mobile and indie games and the XR market. With analysts predicting no real growth until 2028, Unity holds a significant upside if it executes its strategy successfully.

Do you want to know why this narrative values Unity so aggressively? The appeal lies in the possibility that long-term revenue diversification and strategic resets could drive future growth. The exact numbers, however, might surprise you. Curious what assumptions are powering such a bold outlook? Click through to dive into the full narrative and see what could be steering this valuation.

Result: Fair Value of $38.48 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in gaming and potential setbacks in Unity's restructuring efforts could challenge this optimistic long-term outlook.

Find out about the key risks to this Unity Software narrative.

Another View: What About Peer Comparisons?

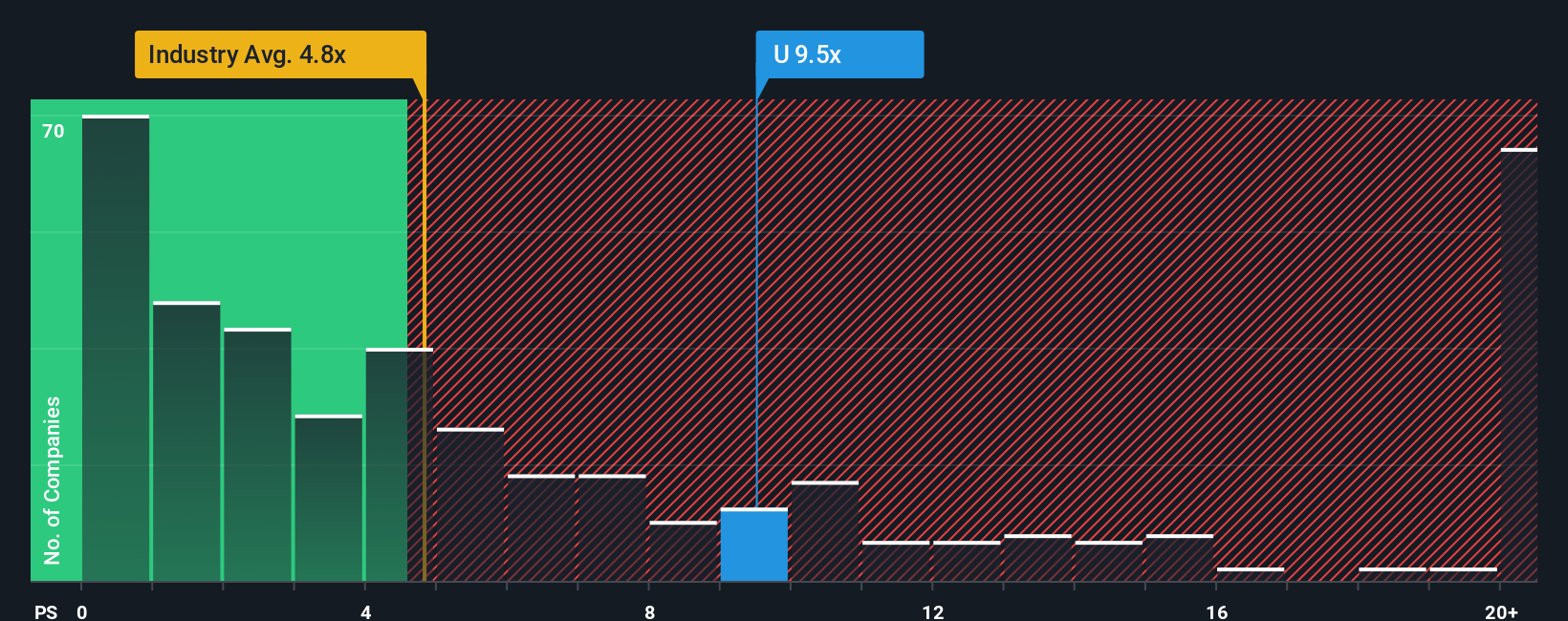

Looking through another lens, Unity’s price-to-sales ratio stands at 9.2 times. This is lower than peers averaging 11.9 times, but much higher than the US software industry’s average of just 4.6 times. While this suggests Unity could be a better value than its closest competitors, it is still trading well above what the broader sector considers reasonable. If the market moves closer to the fair ratio of 9.1, even a slight re-rating could impact the stock’s risk and reward profile. Could this expose investors to a surprising downside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Unity Software Narrative

If you think the story is missing key details or want to dig into the data yourself, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your Unity Software research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take action now and stay ahead by checking out exceptional stocks across exciting sectors before they make headlines. Don’t miss out on market-shaping opportunities:

- Target steady growth and attractive returns by finding reliable options through these 15 dividend stocks with yields > 3% with yields above 3%.

- Unlock cutting-edge opportunities in healthcare by focusing on these 30 healthcare AI stocks that are reshaping the industry with smart technology.

- Catch early-stage potential by identifying the next breakout among these 3597 penny stocks with strong financials boasting strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Why I invest in Sofina (Dividend growth)

Great dividend but share numbers have increased 100% in last 12 months!!

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.