- United States

- /

- Software

- /

- NYSE:U

Unity Software (U) Rises 8.3% After Announcing Cross-Platform Publishing Partnership With Epic Games

- Unity and Epic Games recently announced they are collaborating to make it possible for developers to publish Unity games inside Fortnite, while also bringing Unreal Engine support to Unity’s cross-platform commerce tools, as revealed at Unity’s annual developer conference.

- This collaboration provides new distribution channels and monetization options for Unity and Unreal Engine developers, reflecting a shift toward more interconnected gaming and real-time 3D ecosystems.

- We’ll assess how the expanded cross-platform publishing opportunity with Epic Games could influence Unity’s future growth narrative and market positioning.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Unity Software Investment Narrative Recap

Investors who believe in Unity’s vision are typically focused on its ability to expand its real-time 3D platform across gaming and non-gaming markets, driving consistent top-line growth despite ongoing losses. The recent Unity-Epic Games collaboration signals incremental progress in cross-platform distribution, but it does not materially address Unity’s most pressing short-term catalyst, accelerating adoption of its new AI-driven products, or its largest risk, which is sustained high R&D costs delaying profitability.

Of Unity’s recent announcements, the October launch of enhanced global commerce tools stands out as the most relevant. This initiative directly affects Unity’s efforts to deepen monetization options for developers, a theme reinforced by the Epic partnership, and feeds into the core catalyst of boosting recurring revenue while leveraging Unity’s growing partner network.

By contrast, investors should be aware of the persistent risk that Unity’s heavy investment in innovation could extend its path to profitability if revenue growth fails to keep pace with rising expenses...

Read the full narrative on Unity Software (it's free!)

Unity Software's narrative projects $2.3 billion in revenue and $313.8 million in earnings by 2028. This requires 9.3% yearly revenue growth and a $747.7 million increase in earnings from the current level of -$433.9 million.

Uncover how Unity Software's forecasts yield a $42.31 fair value, in line with its current price.

Exploring Other Perspectives

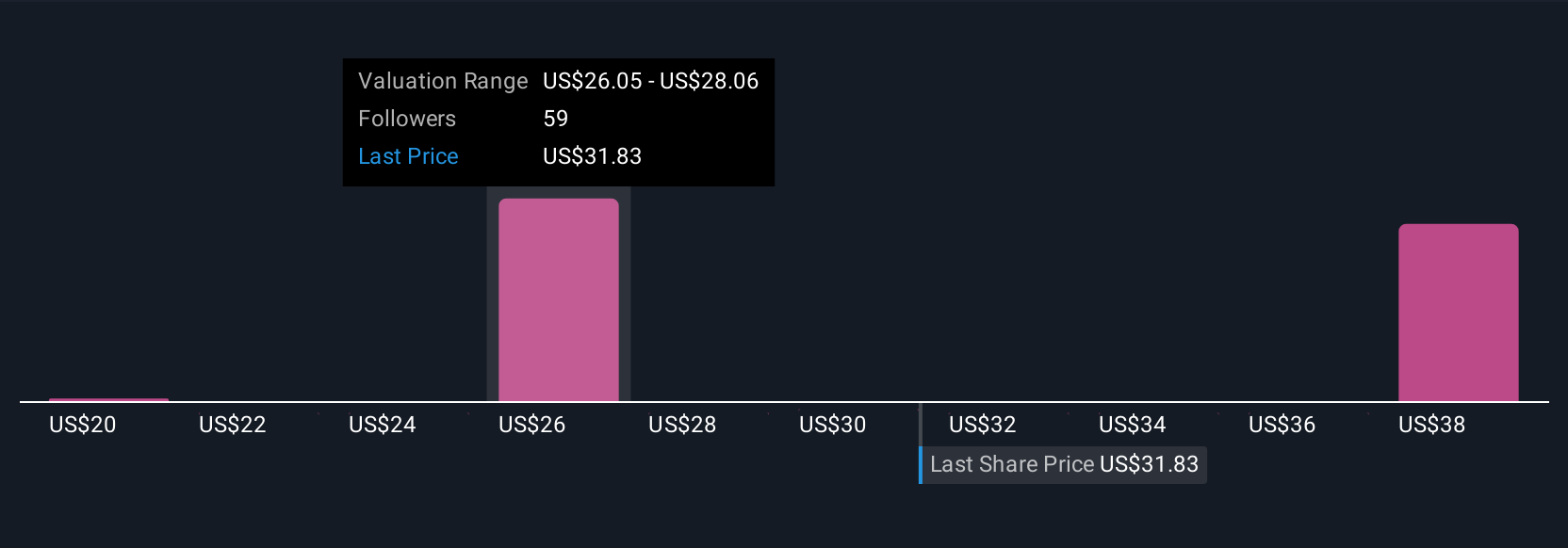

Seven Simply Wall St Community fair value estimates for Unity range from US$24.17 to US$44, reflecting wide splits on its outlook. While many share expectations for value creation through new AI and cross-platform tools, the potential for extended unprofitability remains a critical point for you to consider alongside these differing views.

Explore 7 other fair value estimates on Unity Software - why the stock might be worth 43% less than the current price!

Build Your Own Unity Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Unity Software research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Unity Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Unity Software's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Nike - A Fundamental and Historical Valuation

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Nova Ljubljanska Banka d.d. future looks bright with a profit margin change of 38%

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!