- United States

- /

- Software

- /

- NYSE:U

Unity Software (U): Reassessing Valuation After Analyst Upgrades and AI Advertising Momentum

Reviewed by Simply Wall St

Unity Software (U) is back in focus after multiple analysts reaffirmed their confidence, pointing to its new machine learning model foundation and steady Vector advertising business as key drivers of the next phase of growth.

See our latest analysis for Unity Software.

Those upgrades have landed after a solid stretch, with the share price now at $44.25 and a 90 day share price return of 17.91 percent, alongside a powerful 1 year total shareholder return of 83.69 percent. This suggests momentum is rebuilding after a rougher multiyear ride.

If Unity has you rethinking what growth can look like in software, it could be worth exploring other high growth tech and AI names through high growth tech and AI stocks.

With the stock up sharply over 12 months but still trading below some analyst targets and intrinsic estimates, is Unity a growth engine still mispriced by the market, or is Wall Street already pricing in the next leg of expansion?

Most Popular Narrative: 15% Overvalued

Unity closed at $44.25, while the most followed narrative pegs fair value lower, implying the recent rally may be leaning ahead of its fundamentals.

Unity Software is in a solid financial position with positive cash flow and no immediate liquidity needs.

Curious why a cash rich, growth oriented platform still screens as richly priced? The narrative leans on ambitious revenue expansion and future profitability. Want to see how those projections combine into that valuation call?

Result: Fair Value of $38.48 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating competition in gaming ads and any stumble in Unity’s non gaming diversification could quickly undermine the long term upside case.

Find out about the key risks to this Unity Software narrative.

Another Take on Valuation

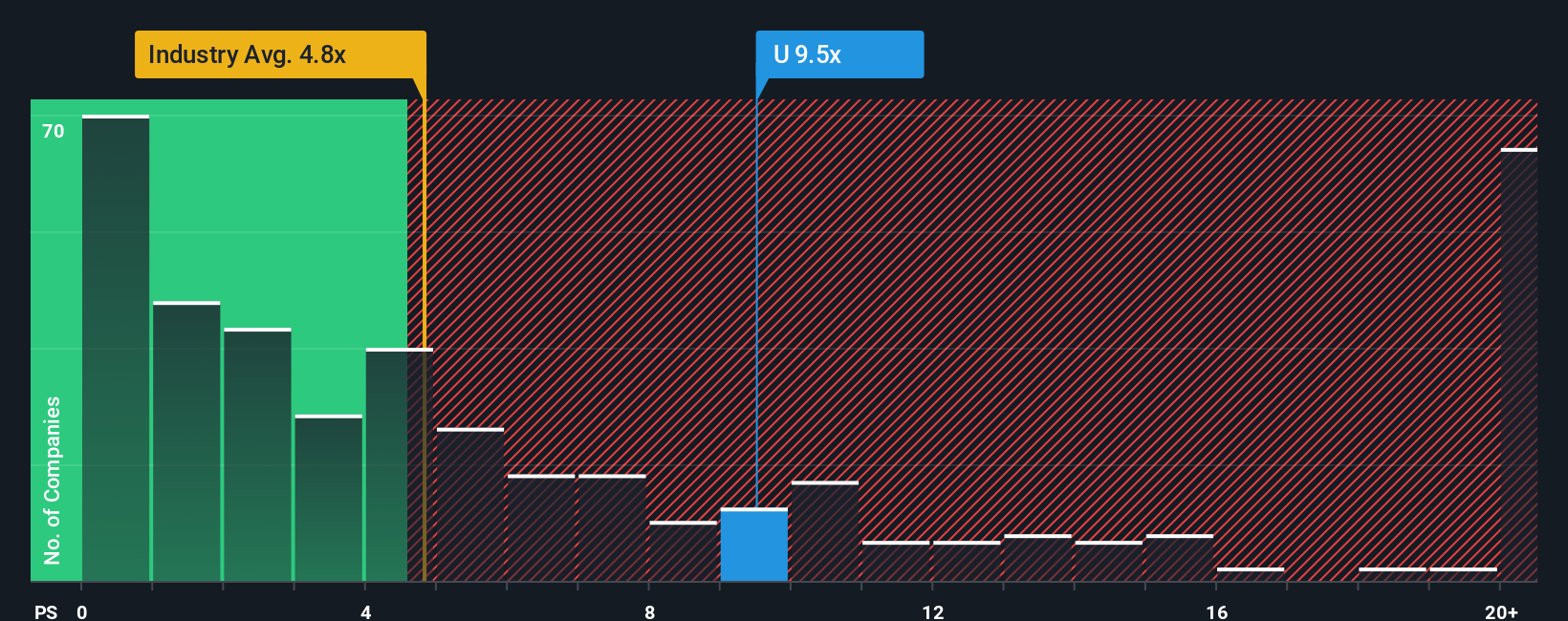

On simple sales-based metrics, Unity looks pricey. It trades on a 10.5 times Price to Sales ratio versus 4.7 times for the wider US software sector and a fair ratio of 8.6 times, yet it remains cheaper than close peers at 11.8 times. Is the market overpaying for growth, or just catching up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Unity Software Narrative

Not sold on this take or want to dig into the numbers yourself before deciding on Unity’s trajectory? Build a custom view in under three minutes with Do it your way.

A great starting point for your Unity Software research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unity might be on your radar, but do not stop there. The Simply Wall St screener can quickly surface fresh opportunities you will not want to overlook.

- Capture potential mispricings by targeting companies trading below their intrinsic value using these 875 undervalued stocks based on cash flows before the market fully catches on.

- Capitalize on cutting edge innovation by zeroing in on these 25 AI penny stocks that could power the next wave of technology driven growth.

- Secure stronger portfolio income by focusing on these 14 dividend stocks with yields > 3% that may offer attractive yields with room for long term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion