- United States

- /

- Software

- /

- NYSE:U

Unity Software Faces Project Genie Uncertainty With Shares Flagged Undervalued

- Google has introduced Project Genie, an AI world creation tool that can generate interactive virtual environments in real time.

- The news has coincided with a sharp drop in Unity Software's (NYSE:U) share price and heightened debate about the future role of traditional game engines.

- Unity's leadership is highlighting potential synergy with generative AI, while investors weigh both the risks and possible partnerships with Google.

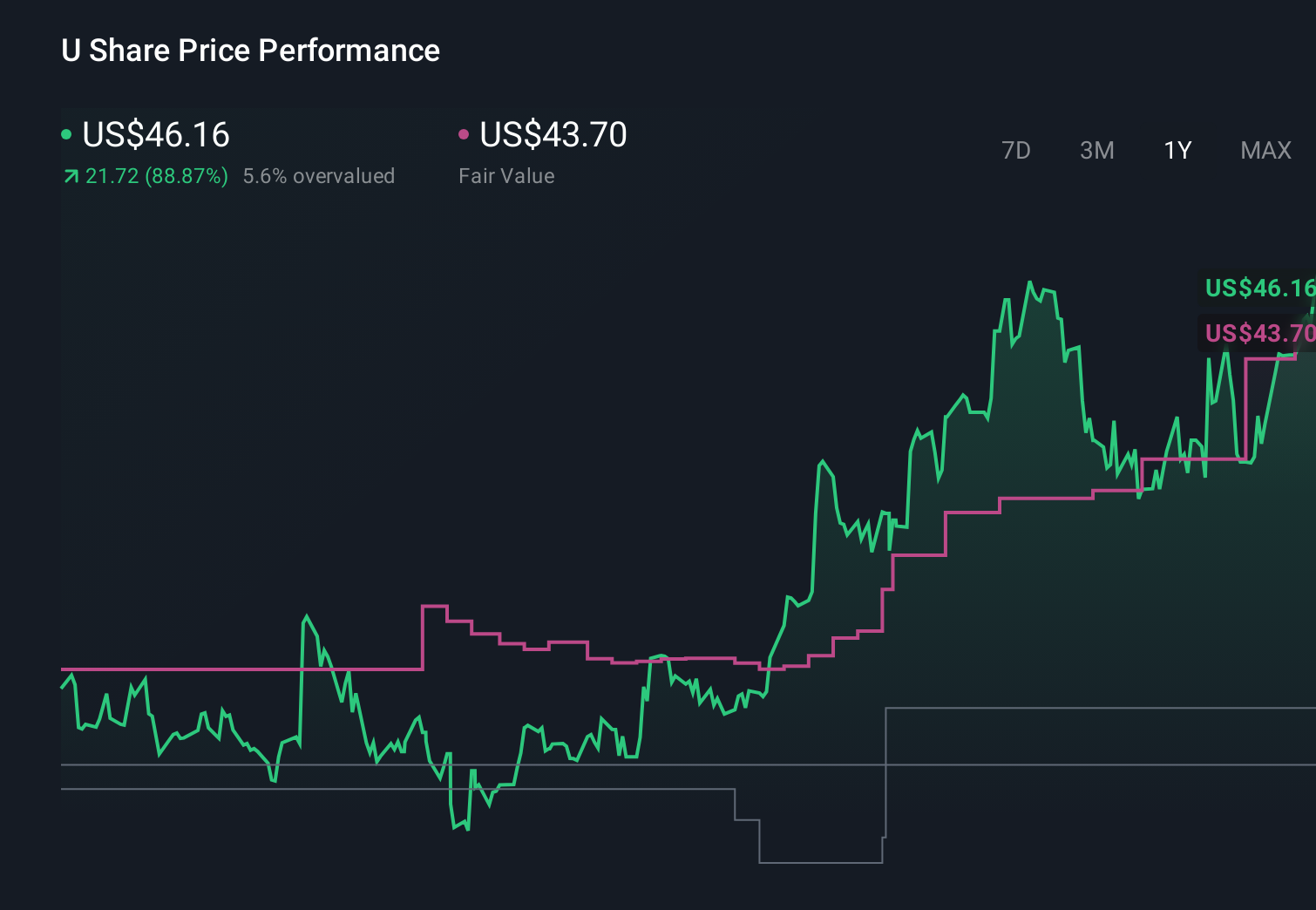

For Unity Software, the timing of Project Genie is sensitive, with the stock at $28.81 and recent returns under pressure, including a 33.0% decline over the past week and 34.9% over the past month. Despite these recent moves, NYSE:U has delivered a 34.7% return over the past year, which underscores how volatile sentiment around the company has been. With a 5 year return of 76.9% decline, many long term holders are likely reassessing their thesis.

Looking ahead, the key question for you as an investor is whether tools like Project Genie will replace engines such as Unity or plug into them as creation layers. Unity's existing collaboration with Google in areas like DeepMind could matter if it helps the company secure a role in AI driven content pipelines rather than compete head on. The next phase will likely hinge on how quickly Unity can show clear use cases where its engine and generative AI work together to create value for developers and creators.

Stay updated on the most important news stories for Unity Software by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Unity Software.

Why Unity Software could be great value

Quick Assessment

- ✅ Price vs Analyst Target: At US$28.81 versus a consensus target of US$47.47, the price sits about 39% below analyst expectations.

- ✅ Simply Wall St Valuation: Simply Wall St flags the shares as undervalued, trading around 48% below its estimated fair value.

- ❌ Recent Momentum: The 30 day return of roughly 34.9% decline shows sharp negative momentum as the market reacts to Project Genie.

Check out Simply Wall St's in depth valuation analysis for Unity Software.

Key Considerations

- 📊 Project Genie raises questions about how much value game developers will place on traditional engines versus AI driven creation tools, which could influence long term demand for Unity's platform.

- 📊 Keep an eye on any public updates about Unity's integrations with generative AI, new Google partnerships, and how quickly management communicates concrete use cases to developers.

- ⚠️ Volatile recent trading and flagged minor risks around share price stability and insider selling suggest paying close attention to governance signals and capital allocation decisions.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Unity Software analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

The Green Consolidator

EDP as a safe capital allocation with a potential upside of 28% with steady dividends

#1 Silver Play with Positive Cashflow Gold Miner (Top Notch Team)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I wrote the latest analysis on DSV, all I can say this is my #1 stock pick, my largest hold. Latest : https://simplywall.st/community/narratives/ca/materials/tsx-dsv/discovery-silver-shares/ha9axhmi-1-silver-play-with-positive-cashflow-gold-miner-top-notch-team-moui/updates/5-discovery-silver-corp-tsx-dsv-discovery-silver-is-now?utm_source=share&utm_medium=web