- United States

- /

- Software

- /

- NYSE:U

Unity Software Faces AI Test As Google Launches Project Genie

- Google has launched Project Genie, an AI tool aimed at creating virtual worlds, directly entering a core market for Unity Software (NYSE:U).

- The launch has raised questions about future competition for Unity's Create platform, a key product for game and 3D content developers.

- Unity's CEO has publicly addressed these concerns, pointing to current technical limits of AI tools and underlining the role of professional engines in game development.

Unity Software sits at the center of real time 3D content creation, with its Create platform widely used by game makers and other interactive media developers. AI tools like Project Genie are the latest step in automating parts of world building, which matters if you care about how much of the traditional toolchain stays in demand. For NYSE:U, the question is less about headlines and more about how developers actually choose to build their next projects.

For investors, the key issues are whether AI world builders become substitutes or mainly helpers for engines like Unity, and how quickly those tools mature. The CEO's comments on technical limitations frame Project Genie as an early entrant rather than a full replacement. The competitive bar for Unity's roadmap has moved higher, and how the company responds in product decisions, partnerships, and pricing will be central to how you think about its long term position.

Stay updated on the most important news stories for Unity Software by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Unity Software.

Why Unity Software could be great value

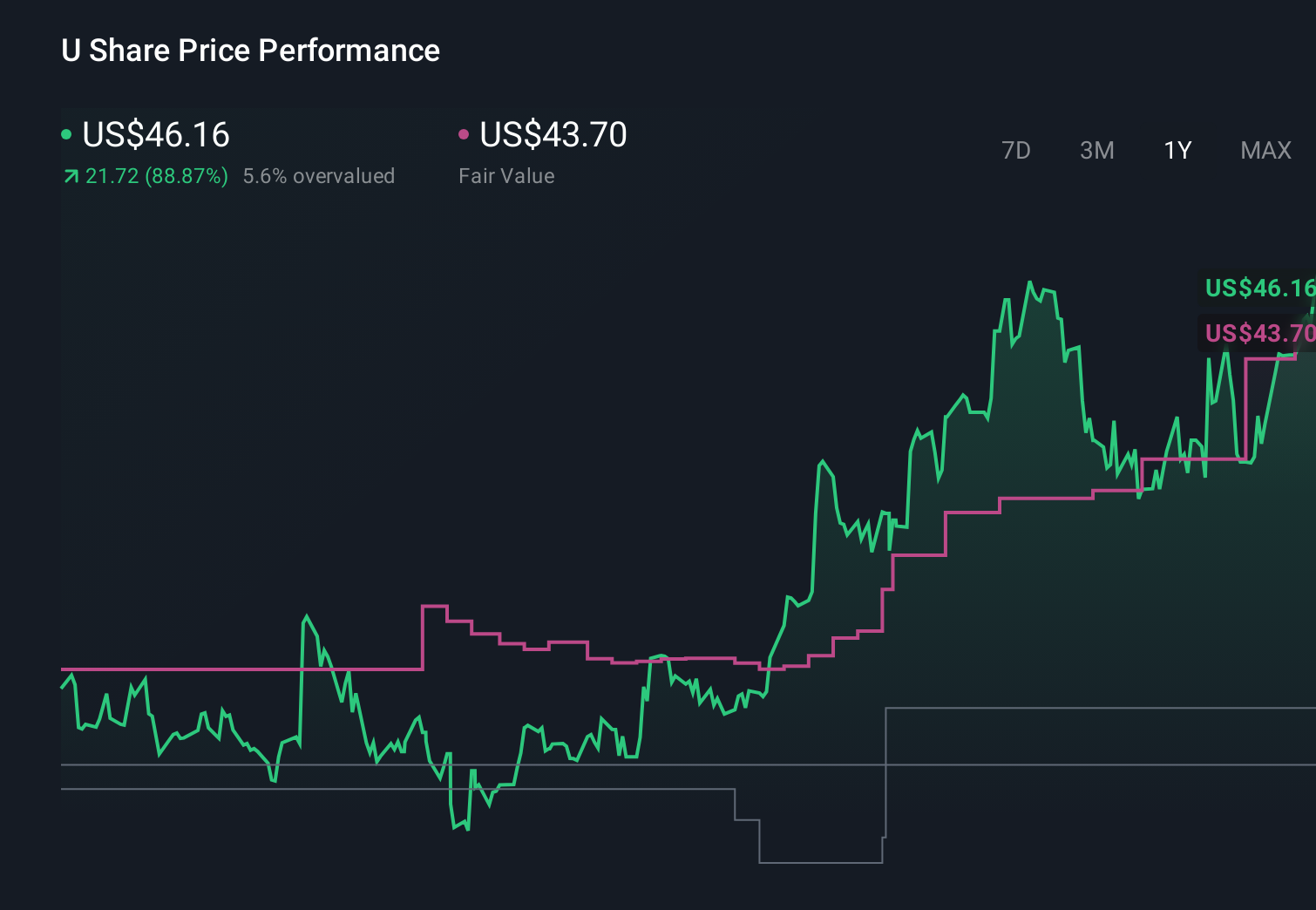

Google entering AI-powered world building with Project Genie has clearly hit a nerve, given Unity's sharp share price reaction and earlier broad software selloff linked to AI concerns. For you as an investor, the key question is whether Genie meaningfully replaces engines like Unity's Create platform, or simply feeds more content into them, especially when high end titles on Unity, Epic's Unreal Engine and, to a lesser extent, open source options such as Godot still need precision tools for production work.

Unity Software Narrative, Tested By New AI Competition

The Project Genie headlines sit squarely on top of existing Unity narratives, which already highlight a recovery story after the 2023 fee controversy and management change, as well as a push into non gaming 3D use cases. For long term holders who see Unity as a key mobile and XR engine with tough switching costs, AI tools may be viewed less as a threat and more as one more feature that engines like Unity can integrate to keep developers inside their ecosystem.

Risks and rewards in focus

- ⚠️ Short term price pressure has been severe, with recent double digit percentage declines and concerns that AI tools from larger platforms could chip away at Unity's Create user base.

- ⚠️ Unity is still dealing with operating losses and mixed analyst views, and some developers have already explored alternatives after the runtime fee episode.

- 🎁 On the positive side, some analysts continue to highlight Unity's role in around 70% of mobile games and its AI driven monetization products as reasons the business could remain relevant even as tools like Genie emerge.

- 🎁 Others suggest that AI partnerships and Unity's efforts to draw higher lifetime value clients through products like its new ad stack could help support the longer term equity story.

What to watch next

From here, it is worth watching how quickly Project Genie gains real developer traction, how Unity talks about AI integration on upcoming earnings calls, and whether the stock's recent slide attracts more long term oriented buyers or triggers further institutional selling. For a fuller picture of how different investors are thinking about Unity's long term role in 3D content creation, check out the latest community narratives on Unity Software here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Future PE of 12.8x Shines Bright for FactSet Growth

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Quintessential serial acquirer

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.