- United States

- /

- Software

- /

- NYSE:U

Unity Board And Finance Shake Up Put Spotlight On Valuation Gap

- Unity Software (NYSE:U) has appointed Bernard Kim to its Board of Directors, adding a veteran executive with experience across major gaming and consumer technology companies.

- Several longtime board members are set to depart, marking a significant refresh of Unity's board composition.

- The company has also announced the planned retirement of its Chief Accounting Officer, introducing an additional leadership transition on the finance side.

Unity Software runs a real time 3D development platform used widely across gaming and other interactive content, putting it at the intersection of game creation, advertising tools, and emerging real time applications. The industry is seeing steady interest in tools that help studios and developers build once and deploy across multiple platforms, from mobile to consoles and beyond. In this context, changes in Unity's board and finance leadership relate directly to how the company organizes itself for its next phase.

For you as an investor, this kind of governance reset is worth tracking, since it touches both oversight and core financial functions. As Unity integrates Bernard Kim's experience and prepares for a Chief Accounting Officer transition, the market will likely monitor future disclosures, capital allocation choices, and how the company describes its priorities to shareholders.

Stay updated on the most important news stories for Unity Software by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Unity Software.

Quick Assessment

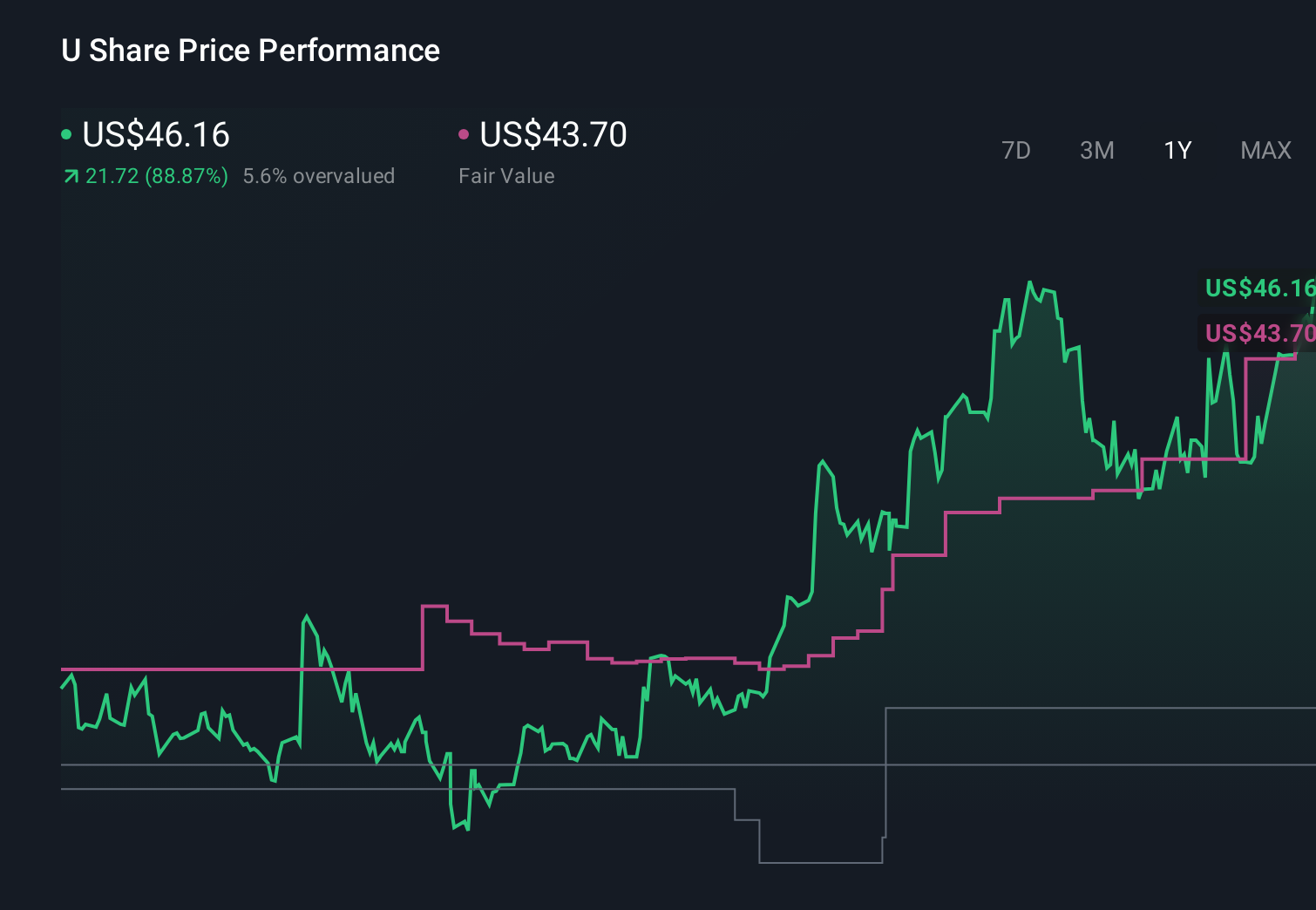

- ✅ Price vs Analyst Target: At US$29.06 versus a US$45.74 analyst target, the price is roughly 36% below consensus.

- ✅ Simply Wall St Valuation: Shares are flagged as trading about 48.1% below an estimated fair value.

- ❌ Recent Momentum: The 30 day return is about a 35% decline, which signals weak short term sentiment.

There is only one way to know the right time to buy, sell or hold Unity Software. Head to Simply Wall St's company report for the latest analysis of Unity Software's Fair Value.

Key Considerations

- 📊 Board refresh and a new Chief Accounting Officer create a governance reset that could affect how Unity sets priorities and communicates with investors.

- 📊 Keep an eye on how leadership changes align with Unity's path toward profitability, given current losses and the focus on fair value versus price.

- ⚠️ Recent share price volatility and insider selling risks already identified make execution during this transition especially important to track.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Unity Software analysis. Alternatively, you can check out the community page for Unity Software to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Inotiv NAMs Test Center

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.