- United States

- /

- Software

- /

- NYSE:U

Is Unity Software (U) Share Price Drop Creating A Potential Opportunity Now

- If you have been wondering whether Unity Software's current share price reflects its real worth, this article walks through the key valuation checks investors often look at.

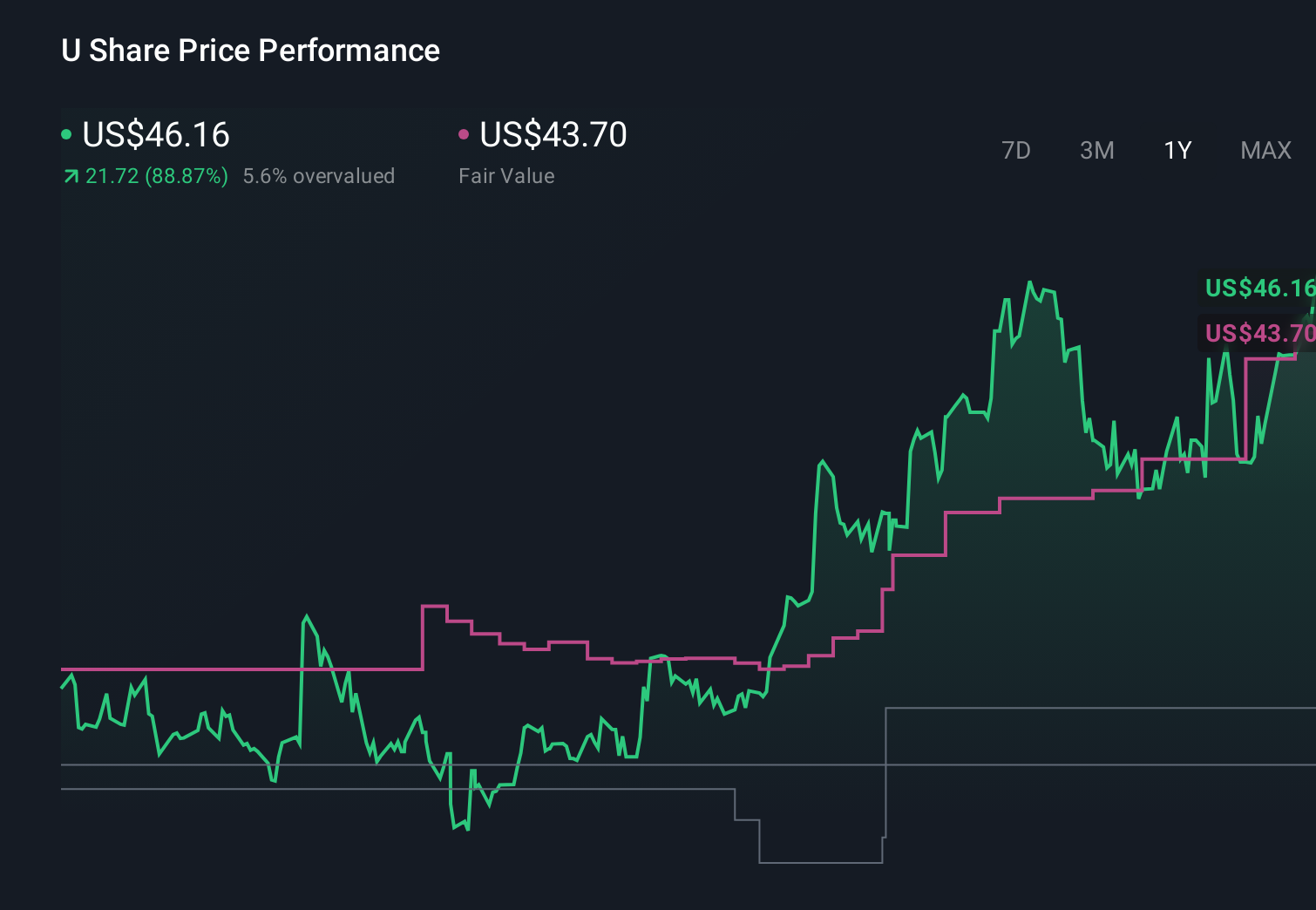

- Unity's share price closed at US$29.10, with a 31.3% decline over the last 7 days, a 34.2% decline over the last 30 days, a 34.2% decline year to date, a 31.1% return over the last year, a 22.2% decline over 3 years and a 77.4% decline over 5 years. These moves naturally raise questions about risk and potential reward.

- Recent attention on Unity has been shaped by ongoing discussion of its role as a key software platform for real time 3D content, including gaming and interactive applications. There is also debate about how its business model supports long term value creation. These themes sit in the background as investors assess whether the current share price lines up with fundamentals.

- On our checklist of six valuation tests, Unity scores 3 out of 6, suggesting a mixed picture that is neither clearly cheap nor clearly expensive at first glance. We will look at how different valuation approaches interpret that score before finishing with a way to think about value that goes beyond the usual ratios.

Approach 1: Unity Software Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of the cash a company could generate in the future and discounts those cash flows back to today, to arrive at an estimate of what the entire business might be worth right now.

For Unity Software, the latest twelve month free cash flow is reported at about $373.4 million. Analyst and extrapolated projections used in this 2 Stage Free Cash Flow to Equity model show free cash flow estimates stepping up over time, reaching $1,348 million in 2030. Simply Wall St uses analyst forecasts where available, and then extends them further out to build a 10 year cash flow path, which is then discounted to present value.

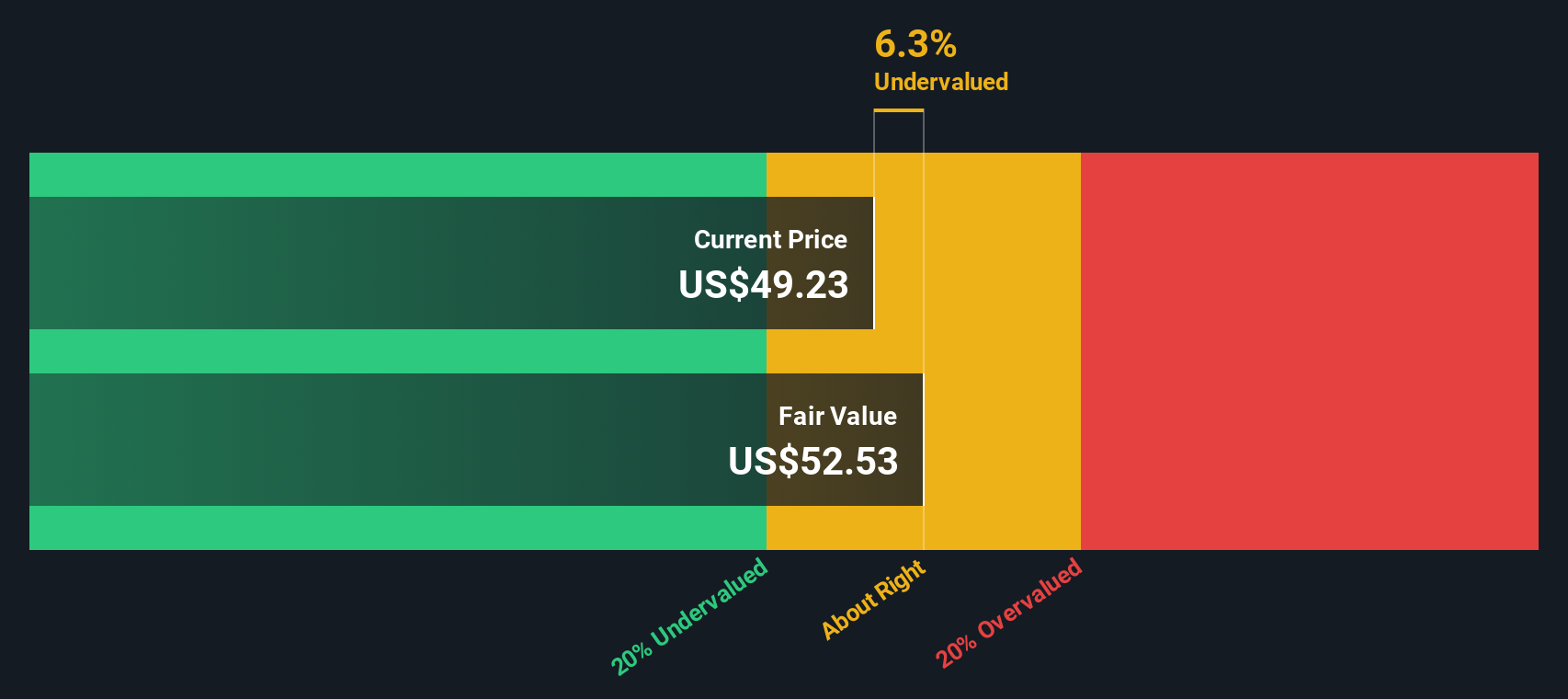

On this basis, the DCF model arrives at an estimated intrinsic value of about $55.31 per share. Compared with the recent share price of $29.10, the model implies the stock is about 47.4% undervalued according to these assumptions and inputs.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Unity Software is undervalued by 47.4%. Track this in your watchlist or portfolio, or discover 875 more undervalued stocks based on cash flows.

Approach 2: Unity Software Price vs Sales

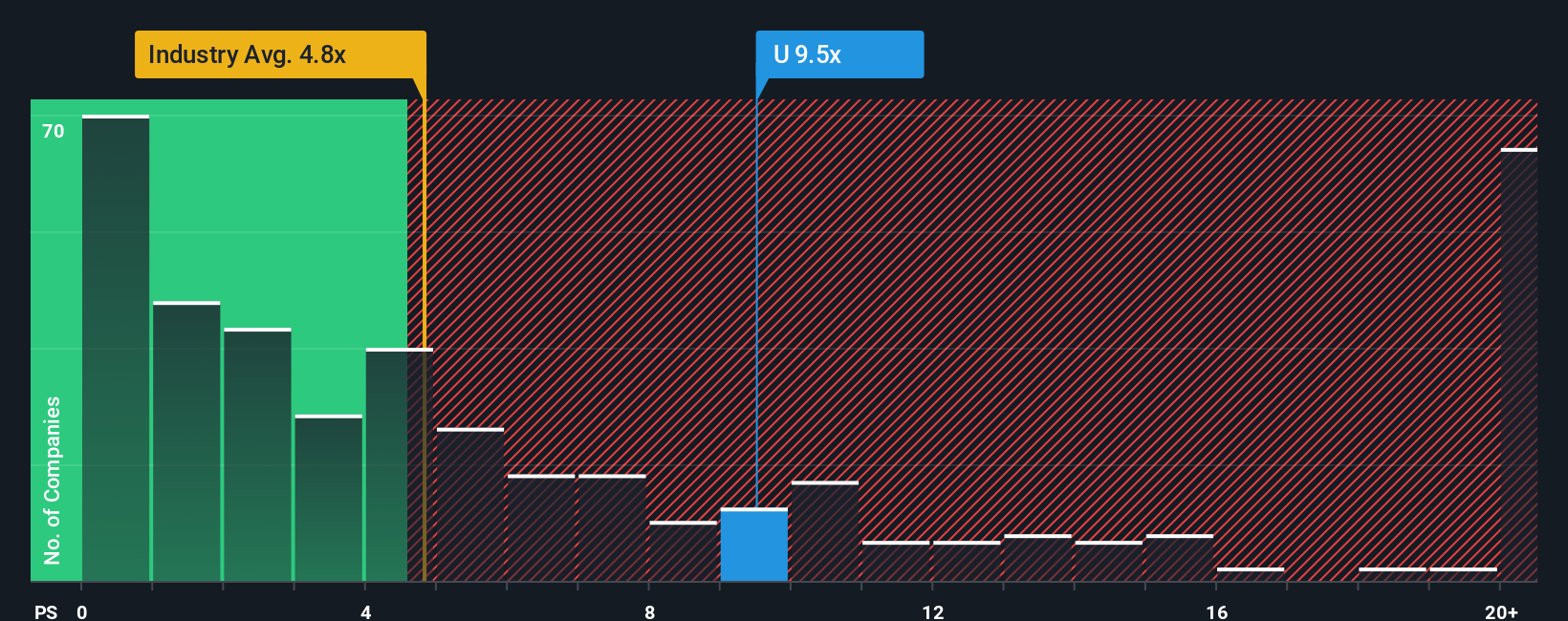

For companies where earnings are not yet a steady guide, the price-to-sales (P/S) ratio is often a useful cross check because it compares what the market is paying for each dollar of revenue rather than profit. Higher growth expectations or lower perceived risk can justify a higher P/S multiple, while slower growth or higher uncertainty usually support a lower, more conservative range.

Unity Software currently trades on a P/S of 6.90x. The broader Software industry average sits at about 4.24x, while the peer group used here averages 5.77x. Simply Wall St also calculates a Fair Ratio of 7.50x for Unity, which is the P/S level its model suggests after considering factors such as earnings growth, profit margins, industry, market cap and key risks. Because this Fair Ratio is tailored to Unity rather than a broad group, it can offer a more focused benchmark than a simple comparison with industry or peers.

Compared with that Fair Ratio of 7.50x, Unity's current 6.90x P/S looks modestly lower, which points to the shares being slightly undervalued on this metric.

Result: UNDERVALUED

P/S ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1426 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Unity Software Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which let you attach a clear story to the numbers you are using for fair value, revenue, earnings and margins.

A Narrative is simply your view of what Unity Software is, where it might be heading and how that story flows through to a financial forecast and then to an estimated fair value.

On Simply Wall St, Narratives live inside the Community page and are designed so any investor can quickly set their assumptions, compare the resulting fair value to the current share price and decide whether the gap between the two is large enough to act on.

These Narratives update automatically when fresh information comes in, such as new earnings or company news. You can see how different investors might reach very different fair values for Unity based on the same data. For example, one user might assume a relatively low fair value with conservative growth, while another might assume a much higher fair value with stronger revenue and margin expectations.

Do you think there's more to the story for Unity Software? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Otokar is the first choice for tactical armored land vehicles to meet Europe's defense industry needs.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion