- United States

- /

- Software

- /

- NYSE:U

How Growing Analyst Optimism for Unity’s AI Ad Platform (U) Has Changed Its Investment Story

Reviewed by Simply Wall St

- In July 2025, analyst commentary on Unity Software highlighted growing optimism around the company's AI-powered advertising platform, Vector, citing higher Return on Ad Spend and improved usage metrics.

- This shift in outlook was signaled by both increased analyst earnings estimates and a stronger consensus among industry observers that Unity may surpass earnings expectations for its latest quarter.

- We'll explore how the positive momentum for Unity's Vector platform may influence the company's broader investment narrative and future outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Unity Software Investment Narrative Recap

Owning shares in Unity Software means believing in the company's ability to drive growth through its AI-powered ad platform, Vector, and its gaming development ecosystem. The recent surge in analyst optimism around Vector’s improved usage metrics and higher Return on Ad Spend directly addresses the key short-term catalyst: demonstrating Vector’s effectiveness and potential revenue upside. However, this momentum does not eliminate the persistent risk of disruption during the platform’s transition or revenue volatility in the ad segment.

The launch of Unity’s Audience Hub in June 2025, designed to optimize audience targeting for brand marketers, closely aligns with analyst commentary on the importance of improved ad targeting and ROI, highlighting concrete progress supporting the recent positive sentiment around the company’s advertising suite.

But the flip side to faster innovation is the potential for short-term disruptions, a risk investors should be aware of if Unity's transition delivers less stability than expected...

Read the full narrative on Unity Software (it's free!)

Unity Software's outlook anticipates $2.2 billion in revenue and $262.4 million in earnings by 2028. This is based on a projected annual revenue growth rate of 6.3% and an earnings increase of $926.5 million from current earnings of -$664.1 million.

Uncover how Unity Software's forecasts yield a $26.96 fair value, a 19% downside to its current price.

Exploring Other Perspectives

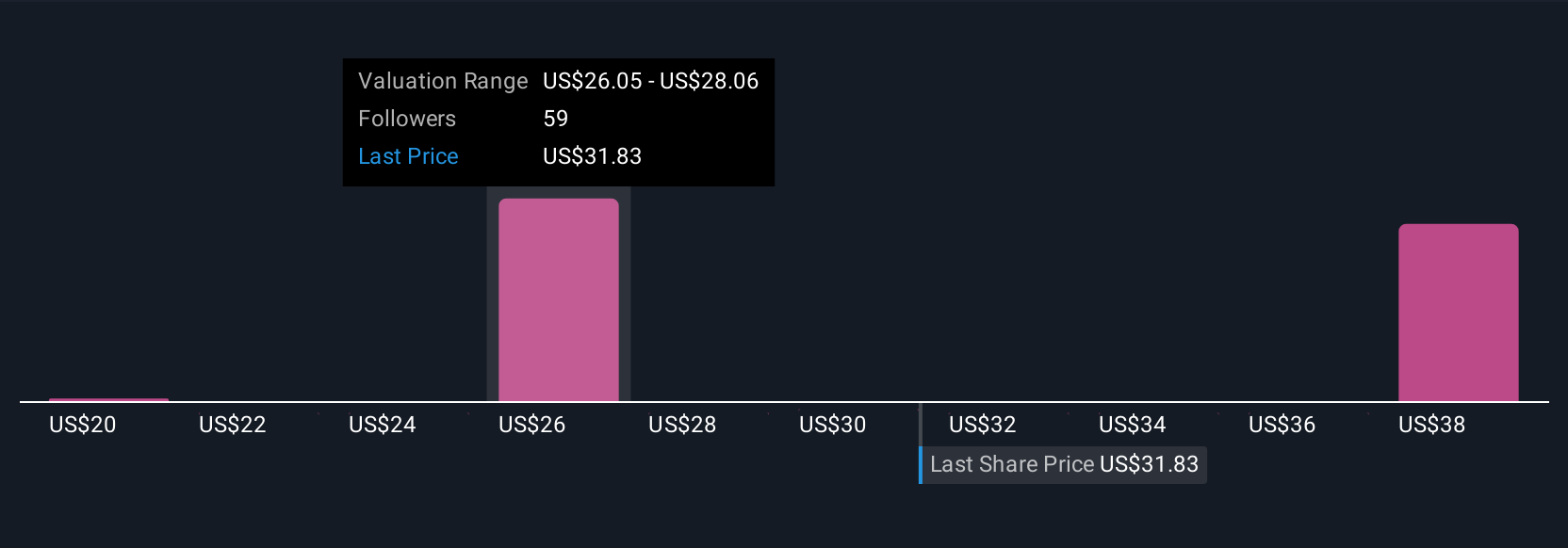

Seven members of the Simply Wall St Community placed Unity Software’s fair value between US$20.04 and US$39.97 per share, reflecting a wide range of expectations. While recent advances in the Vector platform create confidence in future revenue growth, investor opinions show that the company’s outlook remains highly debated, consider exploring several alternative perspectives before deciding for yourself.

Explore 7 other fair value estimates on Unity Software - why the stock might be worth 40% less than the current price!

Build Your Own Unity Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Unity Software research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Unity Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Unity Software's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives