- United States

- /

- Software

- /

- NYSE:TYL

Tyler Technologies (TYL): Evaluating Valuation After Edu.Link and CloudGavel Acquisitions Expand Public Sector Footprint

Reviewed by Simply Wall St

Tyler Technologies (TYL) just doubled down on its public sector footprint by announcing deals to buy Edu.Link and CloudGavel, moves that quietly reshape its K 12 HR and digital public safety offerings.

See our latest analysis for Tyler Technologies.

Despite the drumbeat of product expansion, Tyler's share price has been under pressure, with a year to date share price return of negative 21.68 percent and a 1 year total shareholder return of negative 25.96 percent. However, the 3 year total shareholder return of 40.99 percent shows the longer term story remains constructive.

If you like the structural tailwinds behind government tech but want more ideas, this is a good moment to explore high growth tech and AI stocks for other potential winners.

With shares down sharply this year but revenue and earnings still growing, Tyler now trades at a sizable discount to analyst targets. This raises the question: is this a mispriced compounder, or is the market already assuming years of growth ahead?

Most Popular Narrative: 30.6% Undervalued

With Tyler Technologies last closing at $450.11 against a narrative fair value near $648, the spread points to a sizable potential upside built on recurring SaaS strength.

Ongoing investment in AI powered tools and automation, evident in product launches like the AI driven Resident Assistant and enhanced budgeting solutions, caters to public sector labor challenges and the need for data driven decision making. This supports premium pricing, may help reduce customer churn, and can enable scalable margin improvements over time.

Want to see the math behind this gap? The story centers on accelerating cloud flips, richer margins, and a higher future earnings multiple. This analysis examines how those assumptions fit together over the next few years and how they translate into that projected upside before the market fully prices them in.

Result: Fair Value of $648.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained pressure on government budgets or prolonged lumpiness in large cloud deals could quickly undercut the upside that is already baked into this valuation narrative.

Find out about the key risks to this Tyler Technologies narrative.

Another Lens on Valuation

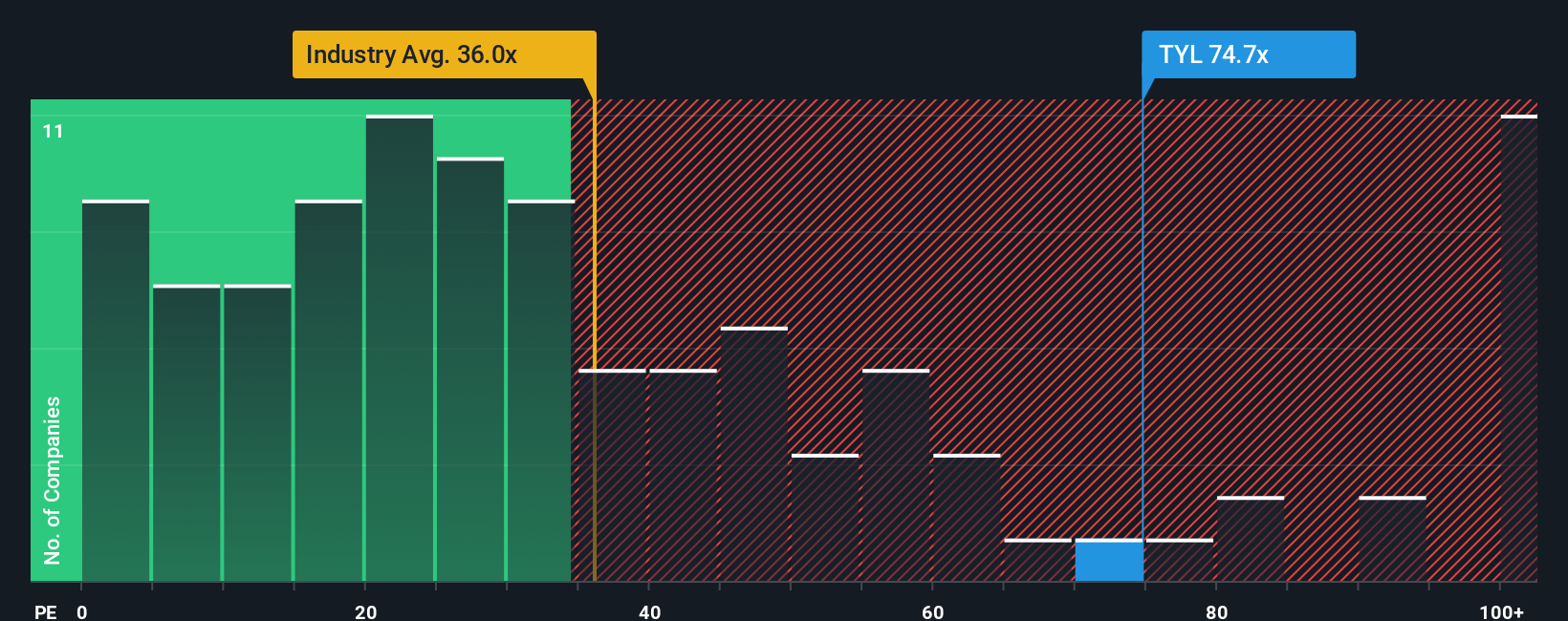

Step away from the fair value narrative and Tyler suddenly looks expensive. Its current price to earnings ratio of 61.4x sits well above the US Software industry at 32.4x and the fair ratio of 32.7x, which points to real multiple compression risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tyler Technologies Narrative

If you want to dig into the numbers yourself or challenge these assumptions, you can build a personalized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tyler Technologies.

Looking for your next investing move?

Do not stop at one opportunity; use the Simply Wall Street Screener to pinpoint fresh ideas that match your strategy before someone else acts on them.

- Explore potential income sources by scanning these 13 dividend stocks with yields > 3% that may support your portfolio’s cash flow.

- Position yourself for technological shifts by targeting these 26 AI penny stocks shaping intelligence driven business models.

- Identify possible mispriced opportunities by focusing on these 909 undervalued stocks based on cash flows where cash flows suggest there may be room for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tyler Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TYL

Tyler Technologies

Provides integrated software and technology management solutions for the public sector.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)