- United States

- /

- Software

- /

- NYSE:TYL

Tyler Technologies (TYL): Assessing Valuation After Raised Outlook and New Government Contracts

Reviewed by Kshitija Bhandaru

If you are trying to make sense of Tyler Technologies (TYL) stock right now, you are not alone. The company captured headlines this quarter by raising its full-year revenue outlook, sending a strong signal that demand for its public sector IT and cloud offerings is not only holding up, but accelerating. In addition, a fresh round of major wins with Oklahoma state agencies, including a sweeping agreement for payment analytics and regulatory platforms, is drawing increased attention from investors.

This upbeat revision to guidance gave shares a 5.4% lift after the Q2 results and renewed focus on Tyler Technologies’ potential for both new customer growth and deeper relationships with existing government clients. While its stock trailed the performance of some tech peers over the past year, there are clear indicators that momentum could be turning as these contracts begin to filter into reported results. Over the longer term, Tyler’s shares have outperformed the broader market, even though the last twelve months have seen the stock decline 7.5%, reflecting shifting risk perceptions and sector rotations.

With the recent post-earnings move and new government deals in place, some investors are considering whether Tyler Technologies now offers genuine value for long-term investors or if the market is already factoring in its future growth potential.

Most Popular Narrative: 21% Undervalued

The most widely followed narrative suggests that Tyler Technologies is currently trading below its fair value, with analysts projecting around 21% upside based on their long-term growth and profitability estimates.

The accelerating digital transformation initiatives across state and local governments are intensifying demand for cloud-based, integrated solutions. This directly supports Tyler's ongoing success in SaaS client migrations (cloud flips) and recurring revenue growth. This secular momentum is reflected in a pipeline of large deals and an expected 25% annual increase in cloud flips, translating to sustained double-digit top-line revenue expansion.

Curious what experts think is fueling the surge in Tyler’s potential? The story hinges on bold future assumptions and a high price tag that would surprise many. Want to see which specific projections have pushed analysts to set such an aggressive target? Dig into the full narrative and discover the numbers that have the market buzzing.

Result: Fair Value of $678.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent government spending slowdowns or unpredictable procurement cycles could limit Tyler Technologies’ revenue visibility and could slow its expected growth trajectory.

Find out about the key risks to this Tyler Technologies narrative.Another View: The Market’s Price Tag

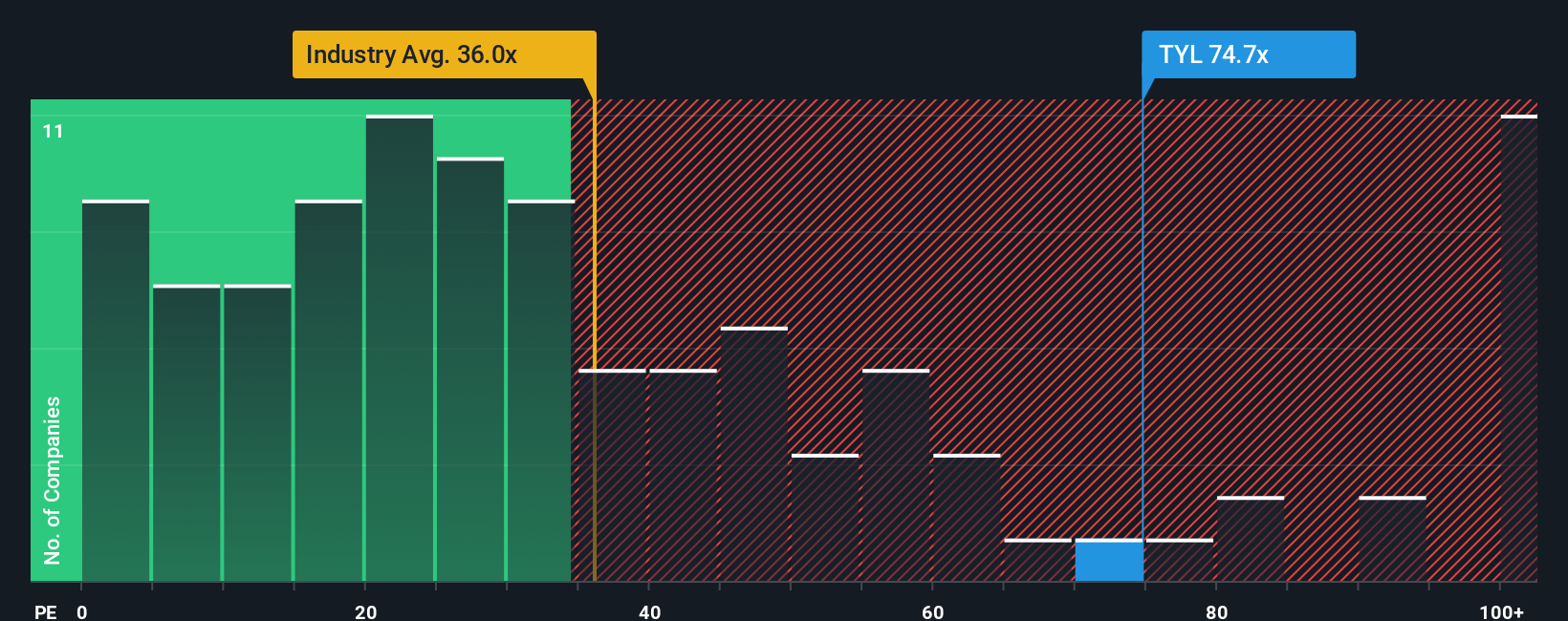

While analysts see upside based on future growth, looking at the company’s current price compared to others in the industry paints a different picture. On this basis, Tyler Technologies actually appears pricey, not cheap. Which approach better captures reality?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Tyler Technologies to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Tyler Technologies Narrative

If you see the story differently, or simply want to investigate the numbers yourself, you can shape a custom view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tyler Technologies.

Looking for more investment ideas?

Why stop at just one opportunity? You could uncover tomorrow’s market winners by targeting stocks with game-changing potential and strong financials that fit your strategy.

- Spot undervalued growth leaders before the crowd by checking out undervalued stocks based on cash flows for companies that may be poised to surprise on cash flow performance.

- Power up your portfolio with next-generation innovators using AI penny stocks and see which companies are turning artificial intelligence breakthroughs into real earnings.

- Boost your steady income with dividend stocks with yields > 3% so you never miss quality stocks yielding above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyler Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TYL

Tyler Technologies

Provides integrated software and technology management solutions for the public sector.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives