- United States

- /

- Software

- /

- NYSE:TYL

Tyler Technologies (NYSE:TYL) Integrates Equifax Service For Automated Employee Verifications

Reviewed by Simply Wall St

Tyler Technologies (NYSE:TYL) has recently announced a partnership with Equifax to integrate automated income and employment verifications into their ERP software, enhancing efficiency and security. The company's amendment to eliminate supermajority voting requirements may align governance with current bylaws, reflecting ongoing corporate governance evolution. These developments occurred as the company's stock experienced a 3% price increase over the past week. While broader market movements were mixed with ongoing U.S.-China trade talks and anticipation of a Federal Reserve interest rate decision, Tyler Technologies' advancements likely contributed positively to investor sentiment, aligning with the market's performance trends.

Find companies with promising cash flow potential yet trading below their fair value.

The recent partnership between Tyler Technologies and Equifax could enhance the company's SaaS-centric growth narrative by integrating cutting-edge verification solutions into their ERP software. This addition is likely to bolster Tyler's financial stability by increasing automation and security, potentially driving subscription revenues upward. Furthermore, the elimination of supermajority voting requirements might indicate a focus on streamlined governance, which could positively influence investor perceptions of management efficiency.

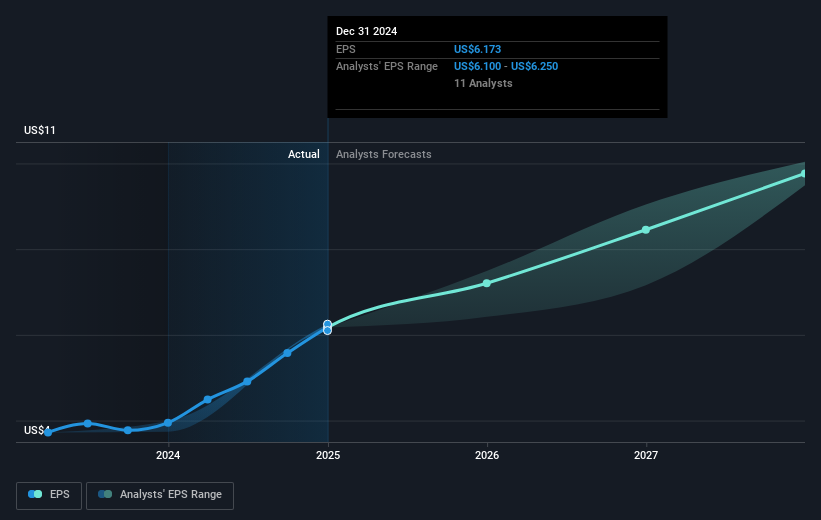

Over the past five years leading up to today's date of May 7, 2025, Tyler Technologies' shares have seen a total return of 66.52%, highlighting considerable shareholder value generation. Comparing this to the company's more recent performance, Tyler's one-year return of 8.2% aligns closely with the broader US market. Notably, the company's earnings growth of 53.2% over the past year has outpaced the Software industry's 30.9%, reflecting strong operational outcomes relative to peers.

With a share price currently at US$534.15, the 20.7% discount to the consensus price target of US$673.58 suggests room for potential appreciation, should Tyler's strategic initiatives translate into the anticipated revenue and earnings growth. The anticipated boost from SaaS and cloud operations could see earnings grow from US$289.9 million to US$468.9 million by April 2028, with corresponding improvements in profit margins. However, execution risks in contract transitions and SaaS revenue unpredictability remain potential headwinds to this growth framing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyler Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TYL

Tyler Technologies

Provides integrated software and technology management solutions for the public sector.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives