- United States

- /

- Software

- /

- NYSE:TYL

A Fresh Look at Tyler Technologies (TYL) Valuation After Major Contract Wins and Acquisition

Reviewed by Kshitija Bhandaru

Tyler Technologies, Inc. (TYL) has been making headlines following a $54 million agreement with the U.S. Department of State, an acquisition of Rapid Financial Solutions, and a new contract with the Iowa Department for the Blind. Investors are keeping a close eye on how these moves may impact the company’s growth profile and valuation.

See our latest analysis for Tyler Technologies.

Tyler Technologies’ recent run of headline-grabbing wins, including its new $54 million contract and acquisition activity, highlights a business on the move even as its share price return is down 12% year-to-date. While the stock has faced a challenging year, the long-term picture is still compelling. Its three-year total shareholder return stands at nearly 50%, suggesting momentum could build if growth initiatives deliver as hoped.

If today’s big contract news has you wondering where else growth is heating up, it may be the perfect moment to broaden your scope and discover fast growing stocks with high insider ownership

After this flurry of major deals and steady long-term gains, is Tyler Technologies now trading below its true value, or have investors already factored in all the future growth prospects? This creates a tough call for would-be buyers.

Most Popular Narrative: 25.5% Undervalued

With Tyler Technologies’ narrative fair value of $678.78 sitting well above the last close at $505.60, this gap is fueling speculation about the bold assumptions underpinning the upside. This setup brings into focus the perspective driving that valuation and what could unlock it.

Tyler's strategic expansion of integrated product suites through acquisitions (such as Emergency Networking) and coordinated cross-sell/upsell initiatives, amplified by the One Tyler unified client experience, are increasing both contract size and product penetration per customer. This is expected to boost average revenue per account and drive robust top-line and earnings growth.

Curious what numbers justify such an optimistic price target? The narrative packs a surprise: analyst projections that lean heavily on higher margins, faster recurring revenue, and ambitious expansion across the public sector. See which assumptions truly drive this valuation.

Result: Fair Value of $678.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Tyler Technologies’ heavy reliance on government spending and unpredictable contract cycles could threaten revenue growth and challenge the optimistic valuation case.

Find out about the key risks to this Tyler Technologies narrative.

Another View: A Multiple-Based Reality Check

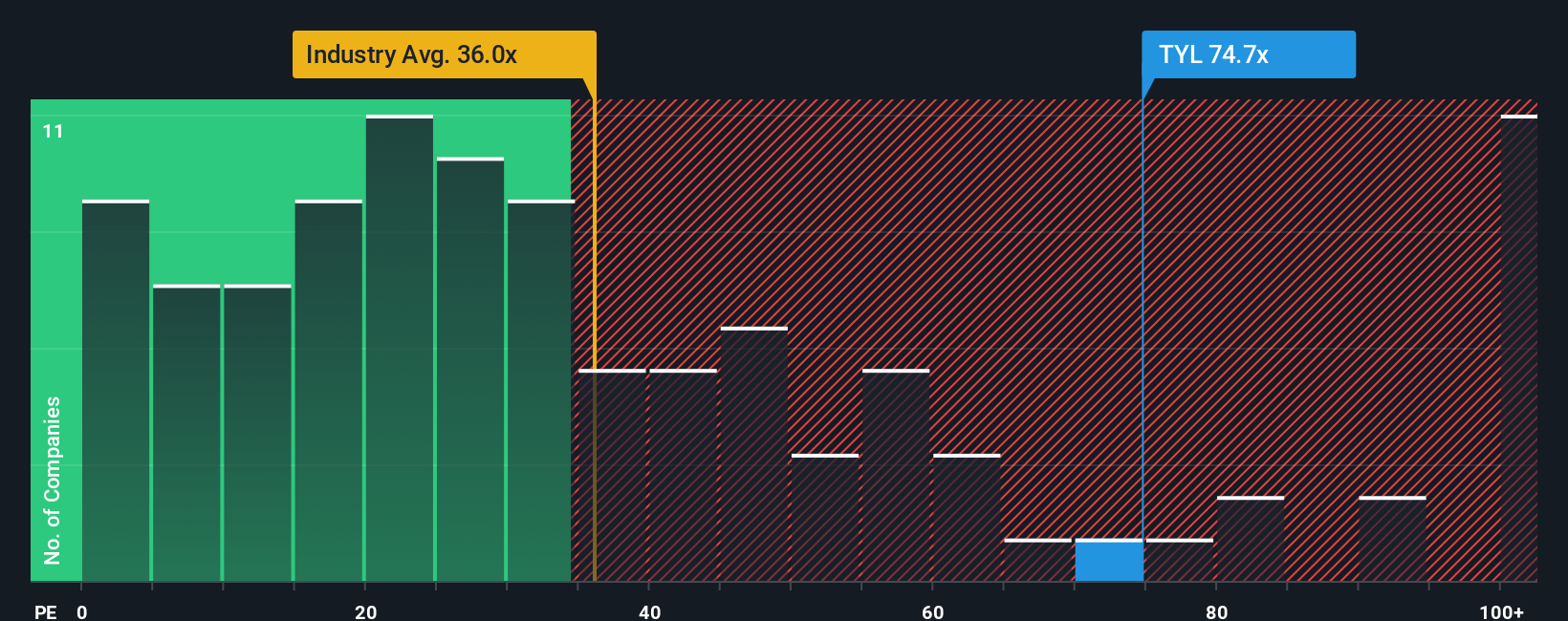

While the fair value narrative leans optimistic, traditional valuation ratios offer a different picture. Tyler Technologies’ current price-to-earnings ratio stands at 71.3x, which is more than double the US Software industry average (34.9x) and peers (56.9x). The fair ratio suggests a level closer to 35x and emphasizes the risk that the market could re-rate the stock lower if growth stalls. Could this pricing reflect too much hope for flawless execution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tyler Technologies Narrative

If you see these valuation narratives differently or want to dig into the data on your own terms, you have the power to build a personalized story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tyler Technologies.

Looking for More Investment Ideas?

Why limit your portfolio to just one story? Explore hand-picked opportunities across the market that could put you ahead of the curve before everyone else catches on.

- Capture untapped potential in underpriced companies by checking out these 877 undervalued stocks based on cash flows, which analysts believe have room to run.

- Boost your income strategy by spotting fresh opportunities with these 18 dividend stocks with yields > 3% offering yields above 3%.

- Join the forefront of disruptive innovation by seeing these 24 AI penny stocks shaping the future of artificial intelligence and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyler Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TYL

Tyler Technologies

Provides integrated software and technology management solutions for the public sector.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives