- United States

- /

- IT

- /

- NYSE:TWLO

Twilio (TWLO): Evaluating Valuation Following Launch of Advanced Segment Data Capabilities

Reviewed by Simply Wall St

Twilio (TWLO) has unveiled enhanced data features for its Segment platform, introducing granular observability, centralized alerting, expanded APIs, and no-code auto-instrumentation. These updates are designed to boost data reliability and simplify issue detection for enterprise clients.

See our latest analysis for Twilio.

Twilio’s latest product rollout comes after a solid year for shareholders, with a 1-year total shareholder return of over 54% highlighting a resurgence in investor confidence. This comes even as the share price pulled back about 18% over the last three months. With innovation continuing and recent volatility, the company’s longer-term results still reflect big swings. However, this momentum suggests sentiment may be turning a corner.

If you’re interested in companies pushing technology forward, now could be a smart time to explore See the full list for free.

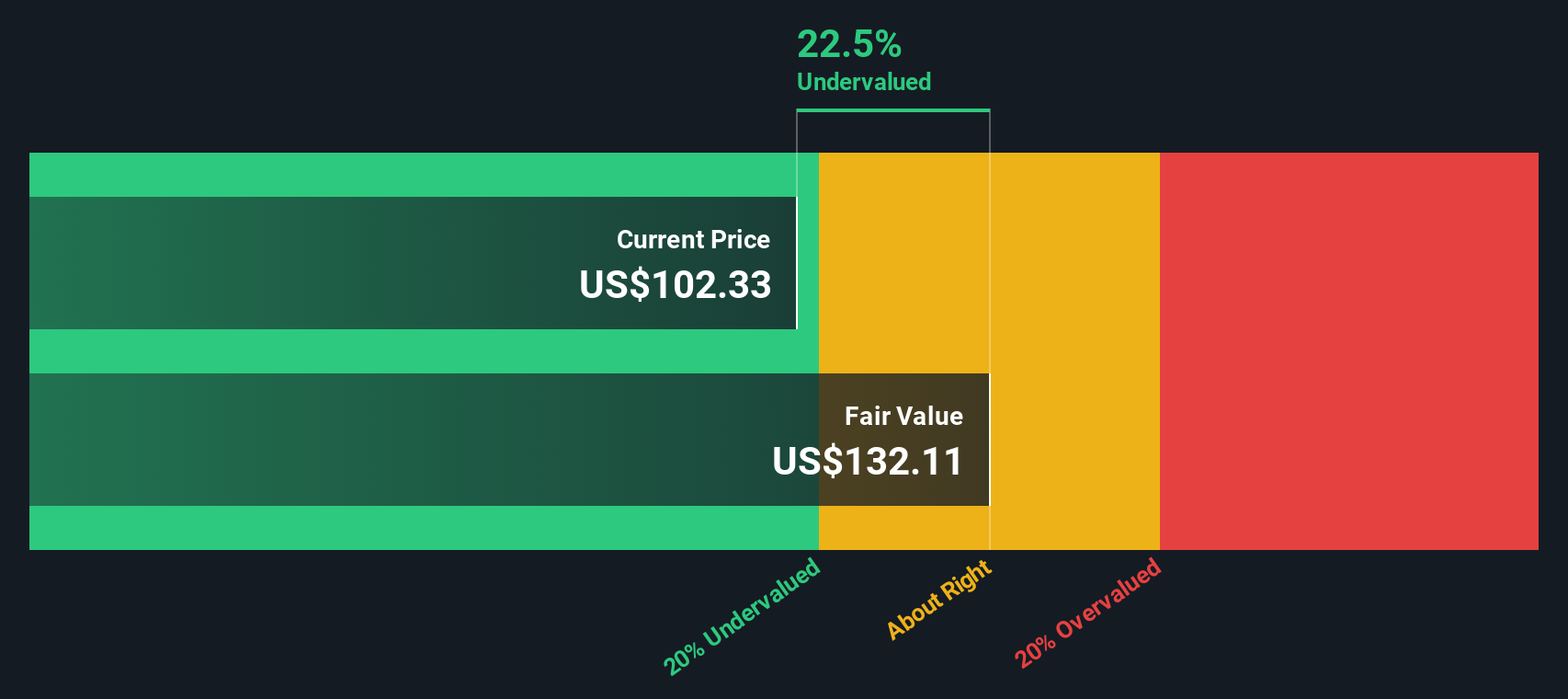

With shares trading nearly 20% below analyst targets and new product momentum building, investors now face a classic dilemma: is Twilio still undervalued, or is the market already pricing in the next wave of growth?

Most Popular Narrative: 60% Overvalued

Twilio’s most-followed narrative pegs its fair value much lower than the current $109 share price, sending a strong signal that the stock could be running ahead of business fundamentals. The narrative sets a fair value of $68, prompting a close examination of whether growth can justify today’s valuation.

A tech-heavy business model with competitive risks and a less durable moat. A valuation that does not offer a clear margin of safety. A fast-evolving industry that may feel too speculative for Buffett’s long-term, value-driven approach. Buffett might reconsider if Twilio achieves sustained GAAP profitability, strengthens its moat, or trades at a significantly lower valuation.

Want to unpack what drives such a bearish narrative? The key lies in bold assumptions about future earnings and how much risk the market should price in. Curious how these figures stack up against Twilio’s latest turnaround momentum? Find out which financial levers tilt this value calculation so far from the current share price.

Result: Fair Value of $68 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Twilio could quickly change this story if strong profitability persists or competitive advantages deepen. This could force a fresh look at today’s valuation concerns.

Find out about the key risks to this Twilio narrative.

Another View: SWS DCF Model Suggests Undervaluation

Looking from a different angle, our DCF model sets Twilio's fair value at $131.53, which is about 17% above the current share price. This contrasts sharply with the narrative’s $68 estimate, raising questions about which forecast best captures Twilio’s true potential and risk. Could the market eventually move closer to the DCF assessment?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Twilio Narrative

If you see the story differently or want to dig deeper into the numbers, you can shape your own view and narrative in under three minutes with Do it your way.

A great starting point for your Twilio research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now to ensure you’re not missing opportunities in dynamic areas of the market. Your next great stock could be just a click away!

- Tap into potential multi-bagger returns by checking out these 3596 penny stocks with strong financials, where up-and-coming companies show surprising financial strength and resilience.

- Unlock breakthrough growth opportunities by browsing these 24 AI penny stocks, connecting directly to firms reshaping industries with artificial intelligence and advanced automation.

- Secure consistent income streams and stability by reviewing these 17 dividend stocks with yields > 3% that deliver yields above 3%, ideal for building long-term wealth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives