- United States

- /

- IT

- /

- NYSE:TWLO

Twilio (NYSE:TWLO) Q1 2025 Earnings Show Net Income Of US$20M

Reviewed by Simply Wall St

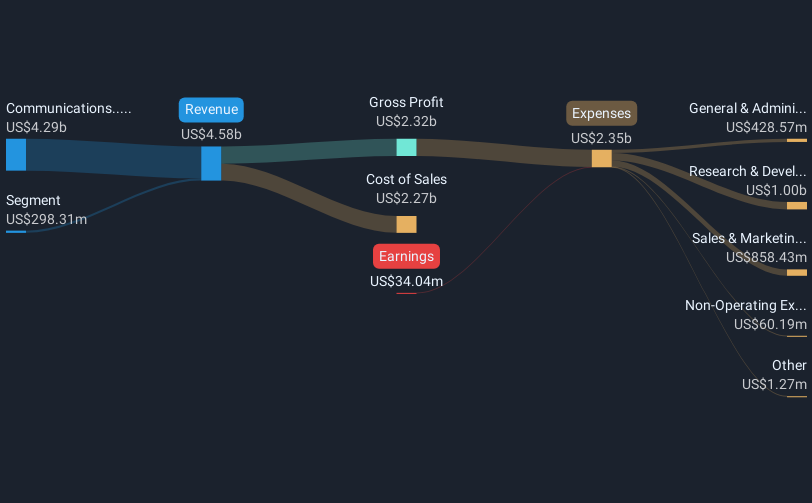

Twilio (NYSE:TWLO) recently reported robust Q1 2025 earnings, with a sales increase to $1,172 million and a net income of $20 million, shifting from a loss last year. The release of stronger earnings and the raising of revenue guidance likely bolstered investor confidence. Additionally, their completed buyback program could enhance share value perception. These financial improvements align with the broader market trend, which has risen by 3% over the past week. Twilio's significant 32% stock price rise this month contrasts sharply with the general market's yearly 12% climb, highlighting positive investor sentiment towards the company.

We've identified 1 risk for Twilio that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

Twilio's share performance over the past year has demonstrated resilience, achieving a total return of 84.09%. This substantial gain outpaced both the broader US market and the US IT industry, which returned 11.6% and 26.6% respectively over the same period. The company's performance has been bolstered by its strategic financial maneuvers and improved earnings, suggesting a positive investor response.

The stronger Q1 earnings and positive revenue guidance have likely contributed to the optimism around Twilio's revenue and earnings forecasts, enhancing investor confidence. The 32% stock price rise this month underscores the market's favorable reception of these financial metrics. However, despite this optimistic sentiment, the current share price is still trading at a discount of 26.6% to the consensus analyst price target of US$128.98, indicating potential room for future growth in the company's valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives