With the business potentially at an important milestone, we thought we'd take a closer look at Twilio Inc.'s (NYSE:TWLO) future prospects. Twilio Inc., together with its subsidiaries, offers customer engagement platform solutions in the United States and internationally. The US$16b market-cap company posted a loss in its most recent financial year of US$109m and a latest trailing-twelve-month loss of US$34m shrinking the gap between loss and breakeven. The most pressing concern for investors is Twilio's path to profitability – when will it breakeven? In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

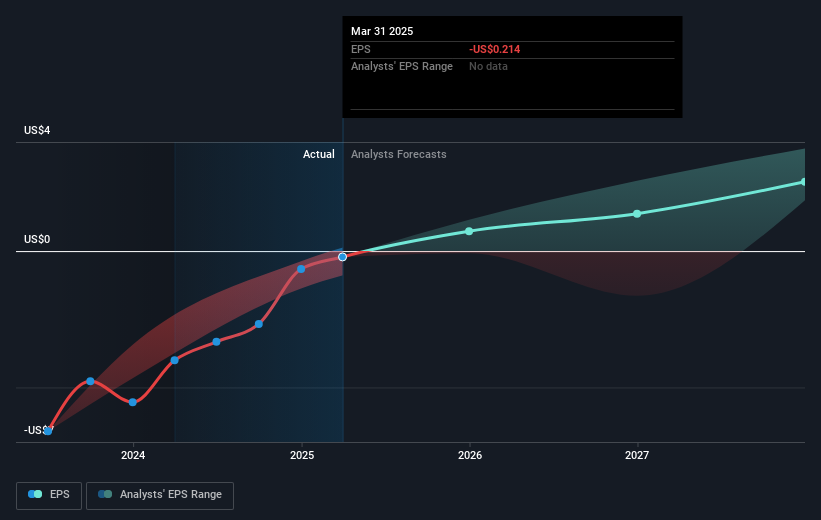

Consensus from 27 of the American IT analysts is that Twilio is on the verge of breakeven. They anticipate the company to incur a final loss in 2024, before generating positive profits of US$119m in 2025. The company is therefore projected to breakeven around a year from now or less! At what rate will the company have to grow in order to realise the consensus estimates forecasting breakeven in under 12 months? Using a line of best fit, we calculated an average annual growth rate of 46%, which is extremely buoyant. Should the business grow at a slower rate, it will become profitable at a later date than expected.

Given this is a high-level overview, we won’t go into details of Twilio's upcoming projects, though, bear in mind that generally a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

View our latest analysis for Twilio

One thing we’d like to point out is that The company has managed its capital prudently, with debt making up 12% of equity. This means that it has predominantly funded its operations from equity capital, and its low debt obligation reduces the risk around investing in the loss-making company.

Next Steps:

There are too many aspects of Twilio to cover in one brief article, but the key fundamentals for the company can all be found in one place – Twilio's company page on Simply Wall St. We've also put together a list of pertinent factors you should look at:

- Valuation: What is Twilio worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Twilio is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Twilio’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion