- United States

- /

- IT

- /

- NYSE:TWLO

Is Twilio at a Turning Point After 54% Annual Stock Rally in 2025?

Reviewed by Bailey Pemberton

If you have been thinking about what to do with your Twilio stock lately, you are definitely not alone. It feels like every week brings a new angle for investors to weigh, whether it is the rapid adoption of cloud communications or the growing chorus of whispers about possible industry consolidation. Twilio, with a closing price of $108.1 and a value score of 3 out of 6 on undervaluation checks, has been riding a wave of changing market sentiment. Over the past year, the stock has gone up a staggering 54.1 percent while stretching even further to post a 51.8 percent gain over the last three years. Yet, if you zoom out five years, the picture turns on its head with a steep drop of 65.1 percent. This is a powerful reminder of how quickly investor expectations can shift in tech.

Short-term moves have been subtler, with the stock up 0.5 percent over the past week and gaining 5.6 percent in the last month. These modest upticks, combined with broader discussions about digital transformation and persistent talk of operational efficiency across the industry, have nudged investors to take another look at what Twilio is really worth. So, how do you know if the stock is truly undervalued? In the next section, we will dig into several key valuation methods you can use right now to assess Twilio, and at the end, I will share a smarter, more holistic way of thinking about value that is often overlooked.

Approach 1: Twilio Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today's dollar value. This approach calculates what Twilio is worth if you add up all the cash it is expected to generate in the coming years, adjusted for the time value of money.

Currently, Twilio generates $714 million in Free Cash Flow, according to the latest data. Analysts predict that by 2029, this number could reach around $1.26 billion. Annual estimates up to five years are based on analyst projections, with further years extrapolated. These projections reflect a belief that Twilio's cash generation will steadily increase as the cloud communication sector expands.

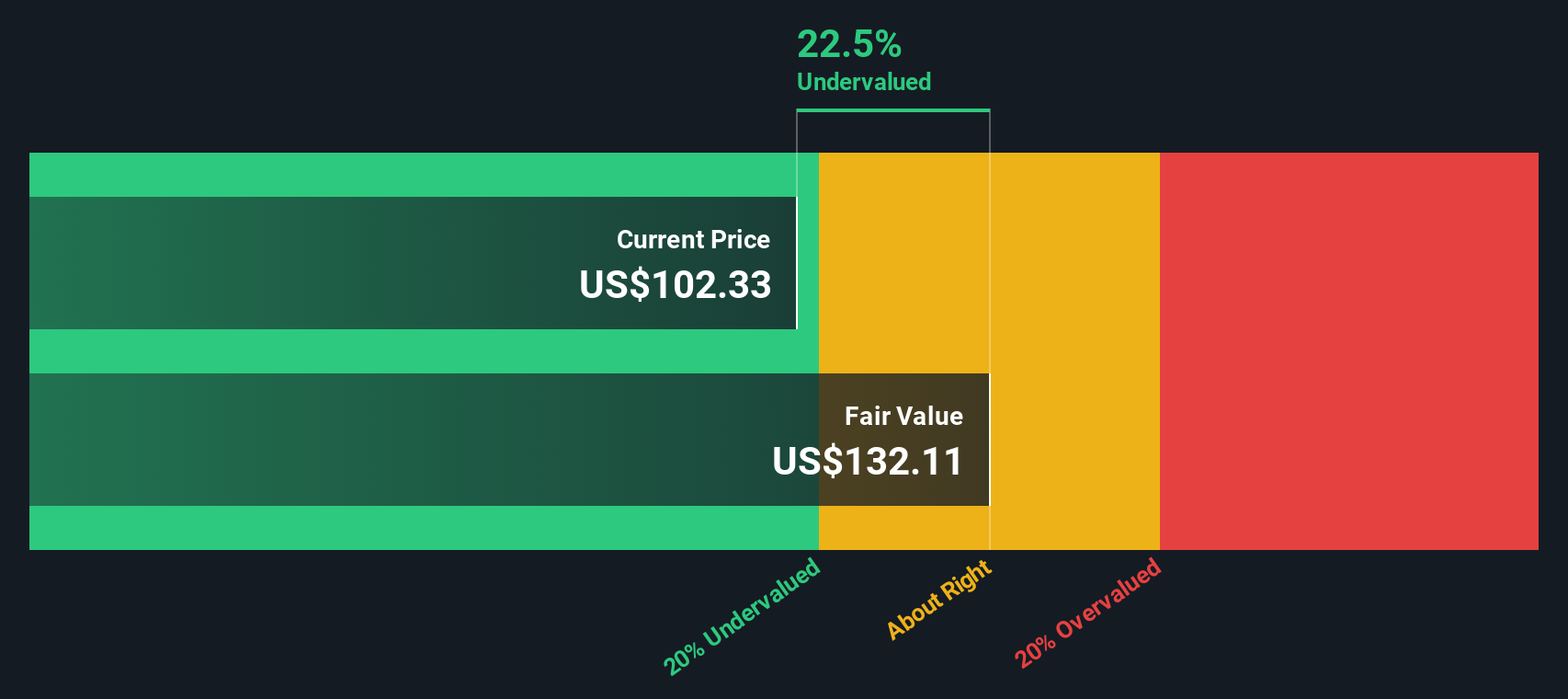

Based on this DCF model, Twilio's estimated intrinsic value is $132.80 per share. With the stock currently trading at $108.10, this implies the market is undervaluing Twilio by approximately 18.6 percent.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Twilio is undervalued by 18.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

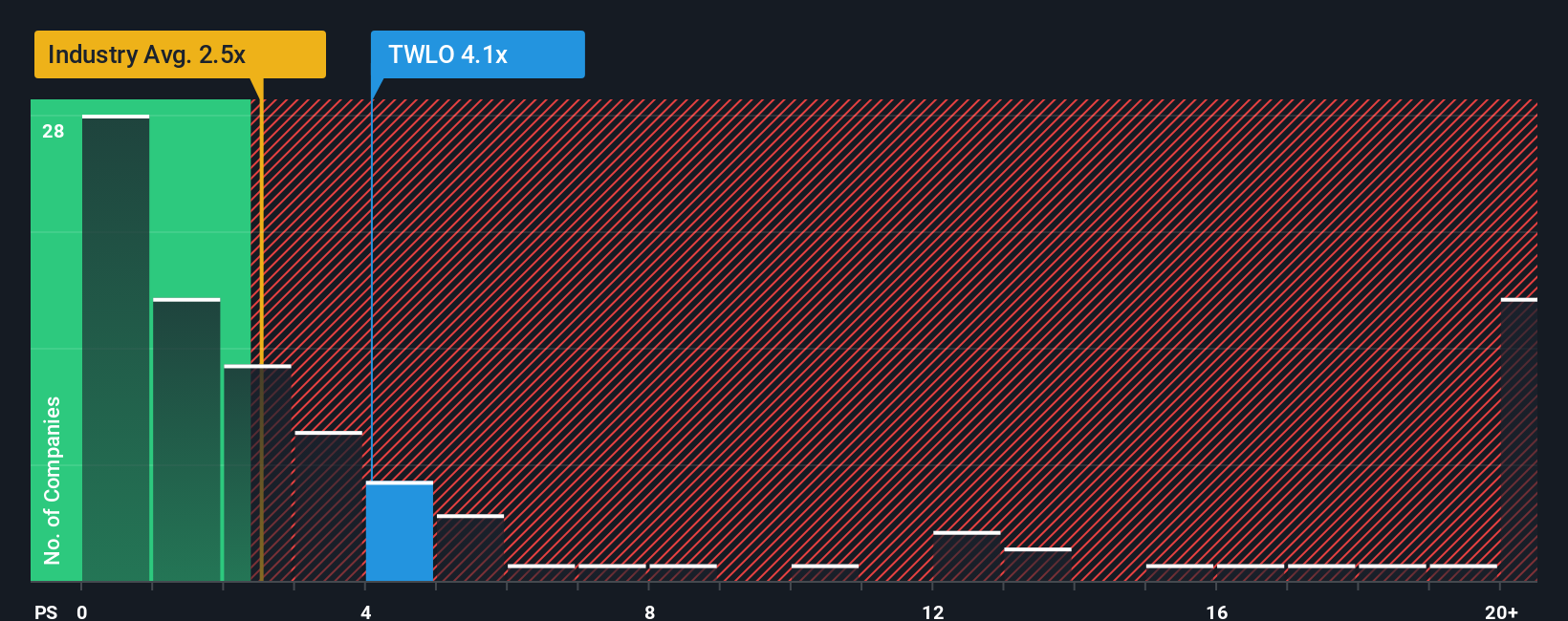

Approach 2: Twilio Price vs Sales (P/S) Multiple

For companies like Twilio that are scaling quickly but are not yet consistently profitable, the Price-to-Sales (P/S) ratio is the most fitting valuation metric. This multiple helps investors assess whether the market is fairly valuing a business based on its top-line revenue growth, rather than earnings, which can be impacted by reinvestment and strategic spending for growth.

The appropriate P/S ratio for a company will be higher when growth expectations are strong and risks are lower, reflecting investors’ willingness to pay more for each dollar of sales. Conversely, riskier or slower-growing businesses tend to justify lower P/S multiples. Comparing Twilio’s current P/S multiple of 3.51x with the IT industry average of 2.46x and a peer average of 6.91x, Twilio sits between these benchmarks. This indicates that the market may already price in some optimism but not excessive exuberance.

Simply Wall St’s “Fair Ratio” refines this further by modeling what P/S multiple Twilio deserves, taking into account not only industry and profit margins, but also company size, earnings growth potential, and specific risks. This metric offers a more tailored benchmark than broad peer or sector averages, which may not reflect Twilio’s unique position within its market or its specific future prospects and challenges.

Twilio’s Fair Ratio stands at 4.68x, just above its current P/S multiple. Because the difference is greater than 0.10, this suggests Twilio is undervalued based on its revenue profile and future growth outlook, even after accounting for its risks and operating context.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Twilio Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your perspective on Twilio’s future, a story that explains what you believe is driving its value and links your assumptions about future revenue, profit margins, and risks to a specific fair value for the company.

By turning your investment view into a Narrative, you connect Twilio’s business story directly to a financial forecast and, ultimately, to what you think the stock should be worth. This is possible through Simply Wall St’s Narratives tool, which makes it easy for anyone to publish and update a Narrative right on the Community page. Millions of investors are already using this feature to share and refine their views.

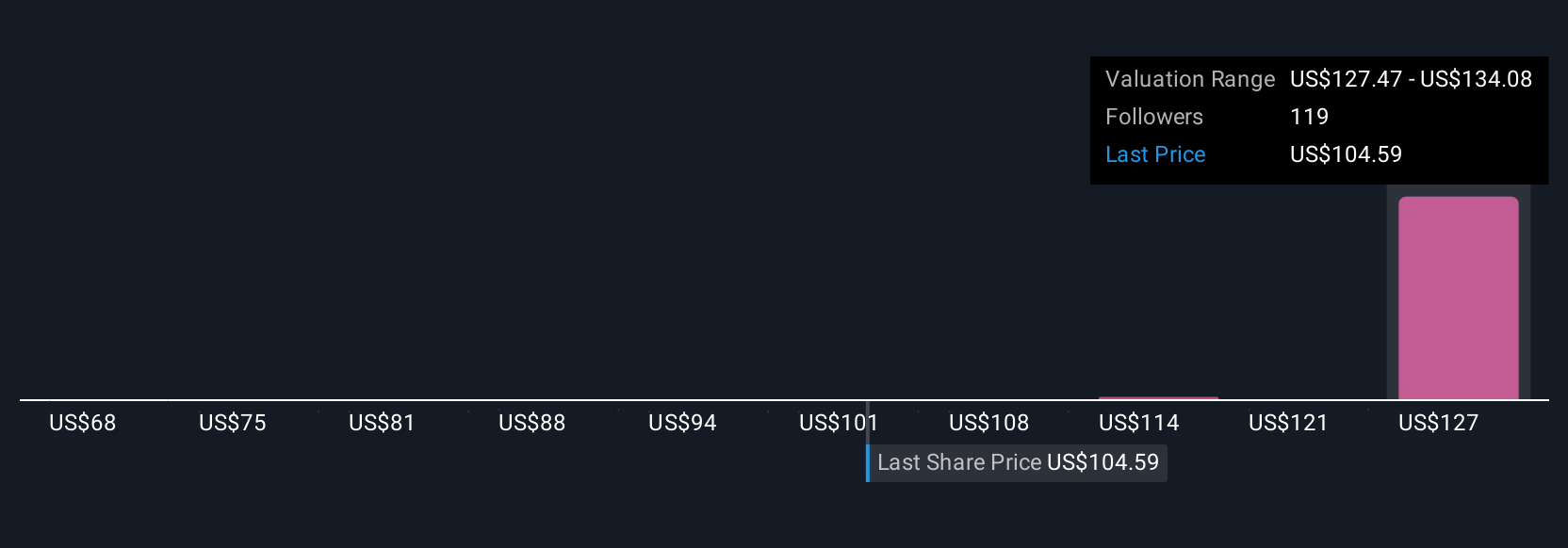

Narratives help you stay grounded by comparing your calculated Fair Value with the actual share price, so you can quickly see when Twilio is undervalued or overvalued based on your outlook, not just analyst consensus. What sets Narratives apart is their dynamism; when new information comes out, such as an earnings report or major news, your forecast and fair value are updated on the spot.

For example, one Twilio Narrative sees fair value at $68, focused on conservative growth and margin risks, while another puts it as high as $170 by factoring in global AI-powered expansion and profit improvements. Which story fits your view?

For Twilio, however, we will make it really easy for you with previews of two leading Twilio Narratives:

Fair Value: $130.88

Undervalued by approximately 17.4%

Revenue Growth Assumption: 7.85%

- Growth is driven by expanding demand for AI-enabled and omnichannel communications, which are expected to boost higher-margin revenue and customer engagement.

- Product innovation, international expansion, and operational efficiency are seen as key to improving customer retention, diversifying revenue, and increasing both margins and cash flows.

- Major risks include continued reliance on low-margin messaging, slow software segment growth, regulatory hurdles, and increased competition that could threaten Twilio’s margins and long-term growth.

Fair Value: $68.00

Overvalued by approximately 59.1%

Revenue Growth Assumption: 24.14%

- Lack of consistent profitability and unpredictable earnings make Twilio a less attractive investment under value-based criteria.

- The business model’s moderate competitive moat and industry risks are seen as insufficient to justify the current valuation, lacking a sufficient margin of safety.

- In a fast-changing and competitive market, Twilio is considered suitable for growth-oriented investors, not long-term value investors seeking stable returns.

Do you think there's more to the story for Twilio? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives