- United States

- /

- IT

- /

- NYSE:TWLO

Is Slowing Revenue Growth Reshaping Twilio's (TWLO) Competitive Edge in the Software Sector?

Reviewed by Simply Wall St

- In the past week, analysts highlighted that Twilio's annual revenue growth of 11.6% over the last three years lags typical software sector standards, with future revenue growth forecast to slow to 8.5% over the next year.

- This underperformance, combined with Twilio's lower gross margin compared to sector peers, has raised investor concerns about the company's profitability and ability to compete in a demanding market.

- We'll examine how growing concerns around Twilio's slowing revenue momentum and profitability could influence its broader investment outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Twilio Investment Narrative Recap

Owning Twilio stock relies on confidence in its ability to reinvigorate growth through innovation and margin expansion, even as recent analyst reports call out a projected slowdown in revenue and ongoing pressure on profitability. While the latest news highlights sector-lagging revenue growth and margins, it doesn't materially change the fact that accelerating demand for higher-value software and AI products remains the most important near-term catalyst, whereas a meaningful deterioration in margins is still the key risk to watch.

Twilio’s recent launch of Rich Communication Services (RCS), expanding interactive business messaging on a global scale, connects directly to these challenges and opportunities. RCS has the potential to improve customer engagement and boost topline performance, but its adoption must contribute to higher-margin, software-like revenues to offset softer growth in traditional messaging and carrier cost pressures.

However, investors should also be aware that a persistent drag from low-margin messaging revenue could still threaten margin recovery if ...

Read the full narrative on Twilio (it's free!)

Twilio's outlook anticipates $5.9 billion in revenue and $449.9 million in earnings by 2028. This scenario is based on a 7.9% annual revenue growth rate and a substantial $429.7 million increase in earnings from the current $20.2 million.

Uncover how Twilio's forecasts yield a $130.88 fair value, a 28% upside to its current price.

Exploring Other Perspectives

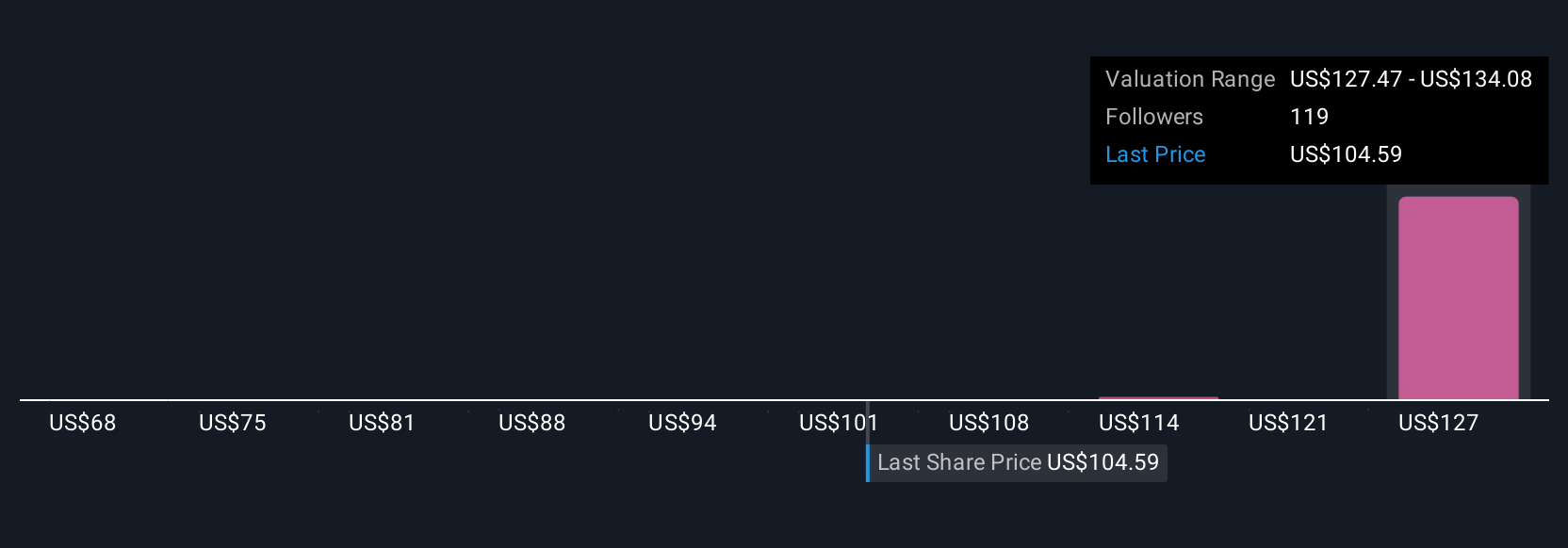

Seven member estimates from the Simply Wall St Community place Twilio’s fair value between US$68 and US$132.12 per share. While views differ widely, many recognize that margin pressure from low-margin messaging remains a central issue for the company’s future performance.

Explore 7 other fair value estimates on Twilio - why the stock might be worth 34% less than the current price!

Build Your Own Twilio Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Twilio research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Twilio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Twilio's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives