- United States

- /

- IT

- /

- NYSE:TWLO

A Look at Twilio’s (TWLO) Valuation Following Strong Results and Raised Revenue Guidance

Reviewed by Simply Wall St

Twilio (TWLO) has just announced a strong set of third-quarter results, with revenue climbing to $1.3 billion and a swing to profitability compared to last year. The company also lifted its annual revenue growth targets and detailed the latest round of share buybacks.

See our latest analysis for Twilio.

Following these upbeat quarterly results and the improved annual outlook, Twilio’s stock has enjoyed a solid run, marked by a 16.2% one-month share price return and a 27.4% gain over the past quarter. Investors seem to be responding to the clear momentum in revenue growth and buyback activity, reflected in a 28.6% total shareholder return over the past year, which is well ahead of many software peers, even as longer-term performance remains mixed.

If Twilio’s momentum has you curious about similar stories, this is a perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership

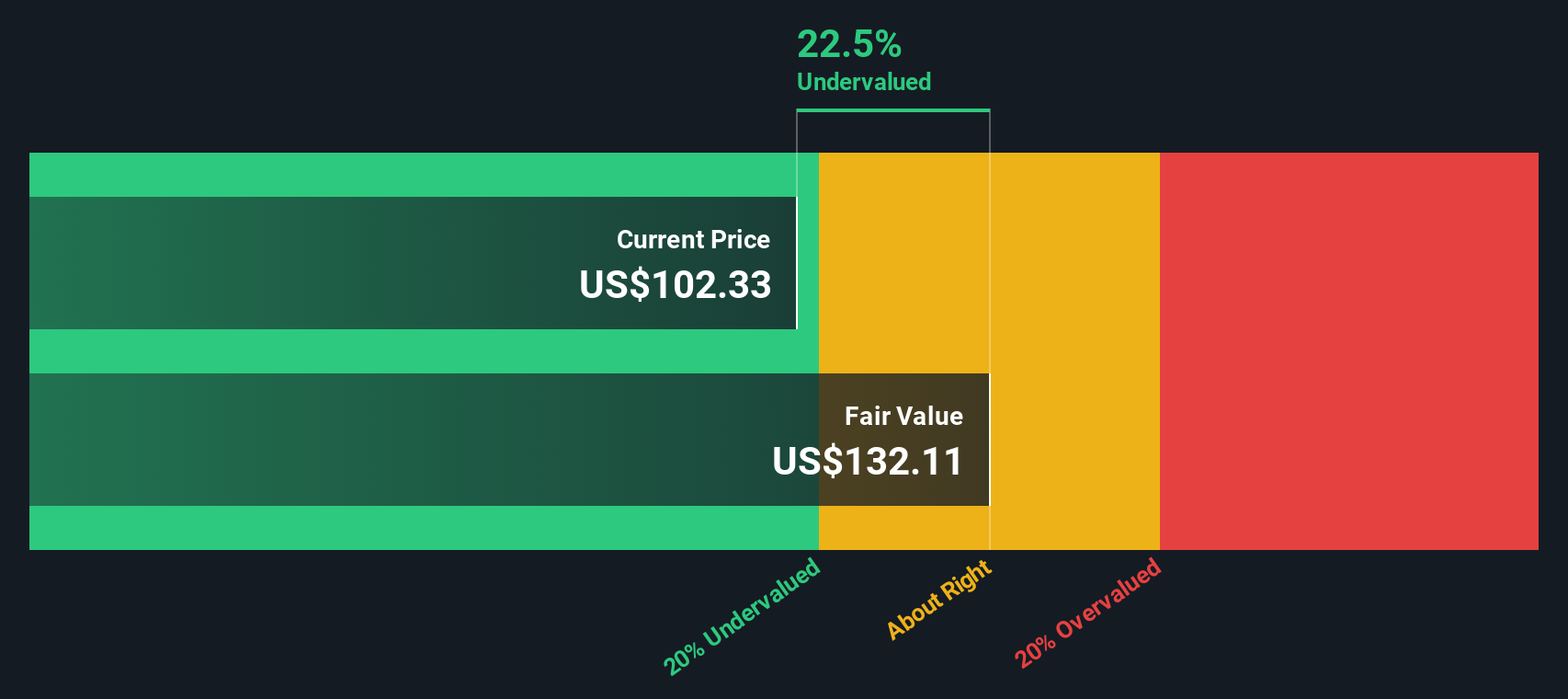

Yet with shares surging and revenue guidance raised, the key question now is whether Twilio remains undervalued or if the market has already priced in the company’s next chapter of growth. Could there still be a buying opportunity?

Most Popular Narrative: 5% Undervalued

With Twilio trading at $128.43 and the narrative’s fair value estimate set at $135.25, many believe there is still room for upside. The current valuation builds on recent earnings momentum and ongoing strength in next-generation communication solutions.

Growing adoption of AI-powered communications and automation is fueling incremental demand for Twilio's programmable infrastructure and platform products (e.g., ConversationRelay, conversational intelligence). This is expanding the company's addressable market and driving higher-margin revenue growth, which supports future revenue and net margin expansion.

What is the story behind Twilio’s uptick? There is a bold bet on accelerating profit margins and expanding revenue streams, but the details will surprise you. Curious which optimistic growth assumptions drive the fair value higher than today’s price? Unpack the numbers and see why analysts think this valuation could be just the beginning.

Result: Fair Value of $135.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including ongoing regulatory pressures and the challenge of shifting more revenue to higher-margin software products. Either of these factors could slow Twilio’s progress.

Find out about the key risks to this Twilio narrative.

Another View

Looking at Twilio through our DCF model offers a more cautious perspective. According to the SWS DCF model, Twilio is actually trading above its estimated fair value of $118.24 per share. This suggests the market might have already priced in much of the optimism from recent growth. Which method feels more grounded to you?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Twilio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Twilio Narrative

If you’d rather dig into the numbers yourself and craft your own perspective, you can have your own take on Twilio’s story in just a few minutes, too. Do it your way

A great starting point for your Twilio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip by while others act. There is a world of high-potential stocks waiting for you in the Simply Wall Street Screener. Take the next step now.

- Catch the next wave in digital innovation by reviewing these 27 AI penny stocks, which are shaping the future with artificial intelligence breakthroughs.

- Tap into stable income streams by browsing these 14 dividend stocks with yields > 3%, offering attractive yields for reliable, long-term returns.

- Seize the potential for growth and value across a curated selection of these 880 undervalued stocks based on cash flows, overlooked by the market but full of promise.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives