- United States

- /

- Software

- /

- NYSE:TUYA

Revenues Not Telling The Story For Tuya Inc. (NYSE:TUYA) After Shares Rise 79%

Tuya Inc. (NYSE:TUYA) shareholders have had their patience rewarded with a 79% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 78% in the last year.

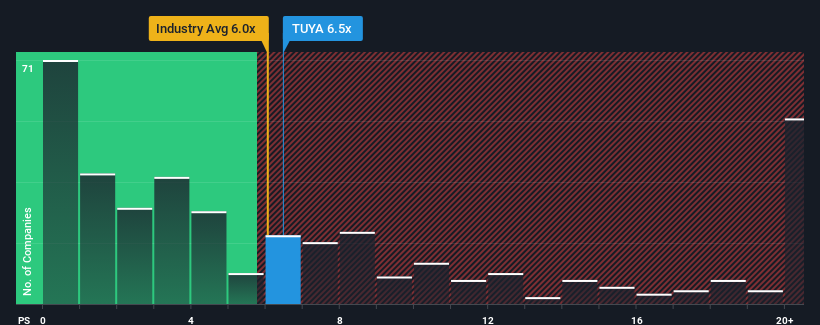

In spite of the firm bounce in price, it's still not a stretch to say that Tuya's price-to-sales (or "P/S") ratio of 6.5x right now seems quite "middle-of-the-road" compared to the Software industry in the United States, where the median P/S ratio is around 6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Tuya

How Tuya Has Been Performing

Tuya certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Tuya's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Tuya?

The only time you'd be comfortable seeing a P/S like Tuya's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 33% last year. Still, revenue has fallen 3.2% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 19% during the coming year according to the seven analysts following the company. With the industry predicted to deliver 25% growth, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Tuya is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Tuya's P/S Mean For Investors?

Its shares have lifted substantially and now Tuya's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

When you consider that Tuya's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for Tuya you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Tuya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TUYA

Tuya

Provides AI cloud platform services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives