- United States

- /

- Software

- /

- NYSE:TUYA

Discovering Connect Biopharma Holdings And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market continues to rally, with major indexes like the S&P 500 and Dow Jones nearing record highs, investors are increasingly looking for opportunities in less traditional areas. Penny stocks, though often considered a relic of past market trends, remain a compelling option for those seeking growth potential at lower price points. These stocks typically represent smaller or newer companies and can offer significant upside when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.58 | $544.33M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.90 | $705.24M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9017 | $159.22M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.36 | $555.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.26 | $1.37B | ✅ 4 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $4.95 | $56.24M | ✅ 3 ⚠️ 3 View Analysis > |

| CI&T (CINT) | $4.63 | $610.14M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.90 | $6.47M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.74 | $84.05M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 340 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Connect Biopharma Holdings (CNTB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Connect Biopharma Holdings Limited is a clinical-stage biopharmaceutical company focused on developing therapies for inflammatory diseases in the United States, with a market cap of $126.90 million.

Operations: The company's revenue is derived from its biotechnology startups segment, totaling $0.76 million.

Market Cap: $126.9M

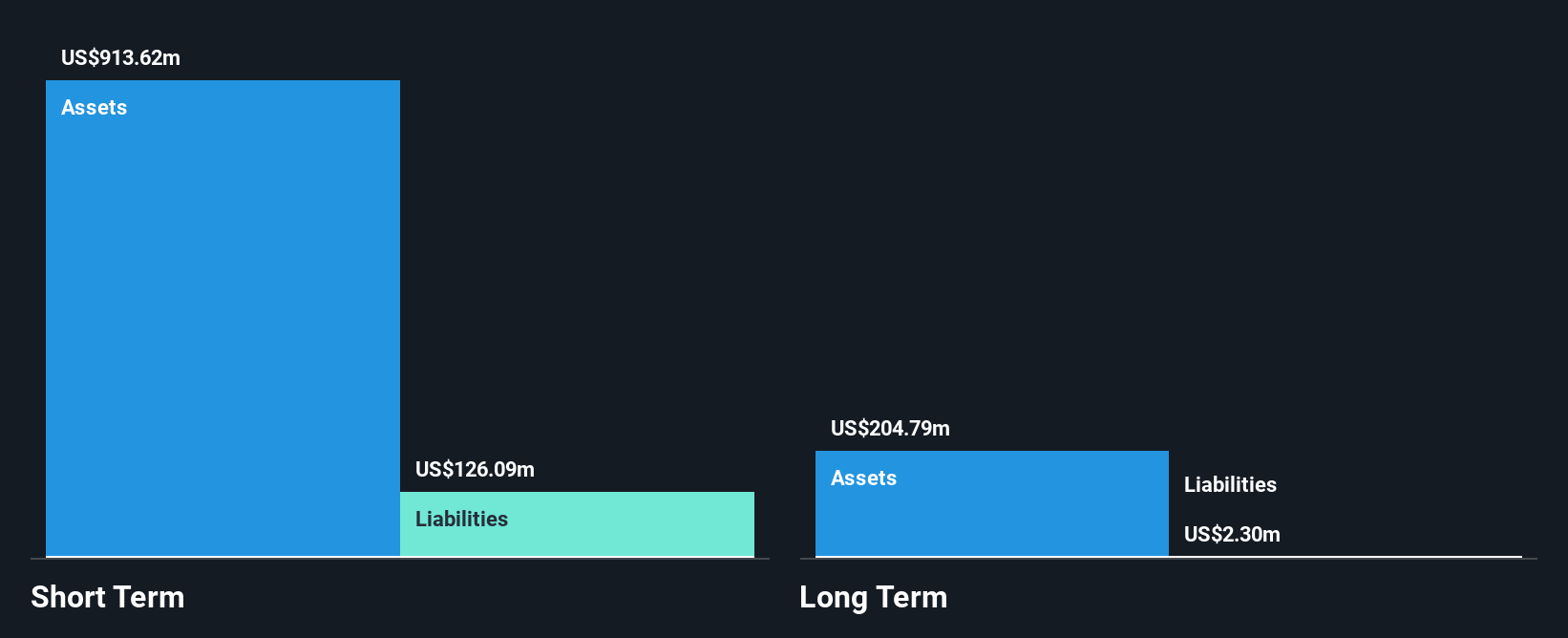

Connect Biopharma Holdings, a clinical-stage biopharmaceutical company, remains pre-revenue with only US$0.76 million in revenue and is currently unprofitable. Despite this, it boasts a debt-free balance sheet and sufficient short-term assets (US$62.6 million) to cover liabilities, providing a financial buffer. The company's cash runway extends over a year if current free cash flow trends continue. However, the management team is relatively new with an average tenure of 1.4 years, which may impact strategic continuity. Recent earnings reports show increased losses compared to the previous year, highlighting ongoing financial challenges amidst high share price volatility.

- Jump into the full analysis health report here for a deeper understanding of Connect Biopharma Holdings.

- Gain insights into Connect Biopharma Holdings' future direction by reviewing our growth report.

Tuya (TUYA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tuya Inc. operates as an AI cloud platform service provider in the People's Republic of China, with a market cap of approximately $1.37 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, totaling $319.36 million.

Market Cap: $1.37B

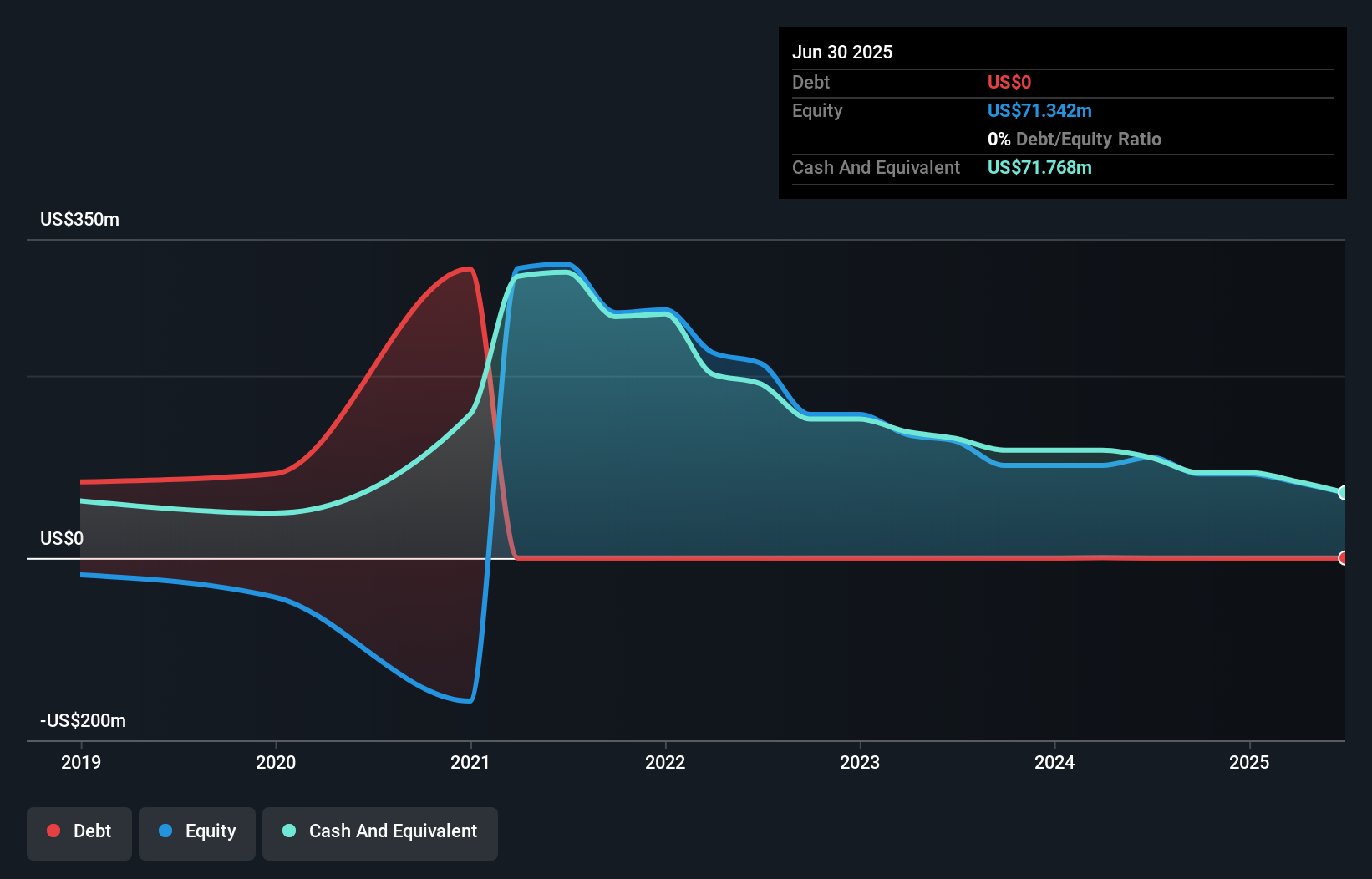

Tuya Inc. has shown significant improvement, transitioning to profitability with a net income of US$38.58 million for the first nine months of 2025, up from a loss the previous year. The company operates debt-free, with short-term assets of US$1 billion comfortably exceeding liabilities. Despite low return on equity at 4.8%, Tuya's earnings are forecasted to grow by 14.56% annually, reflecting potential for further financial strengthening. Recent participation in global sustainability initiatives highlights its strategic focus on AIoT solutions and energy management innovations, potentially enhancing its market position and driving future growth opportunities within this niche sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Tuya.

- Learn about Tuya's future growth trajectory here.

NameSilo Technologies (URLO.F)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NameSilo Technologies Corp. operates through its subsidiaries to offer domain name registration services across the United States, East and South Asia, South East Asia, Australasia, and other international markets, with a market cap of $94.07 million.

Operations: The company's revenue is primarily derived from Domain Registration and Related Services, totaling CA$63.82 million.

Market Cap: $94.07M

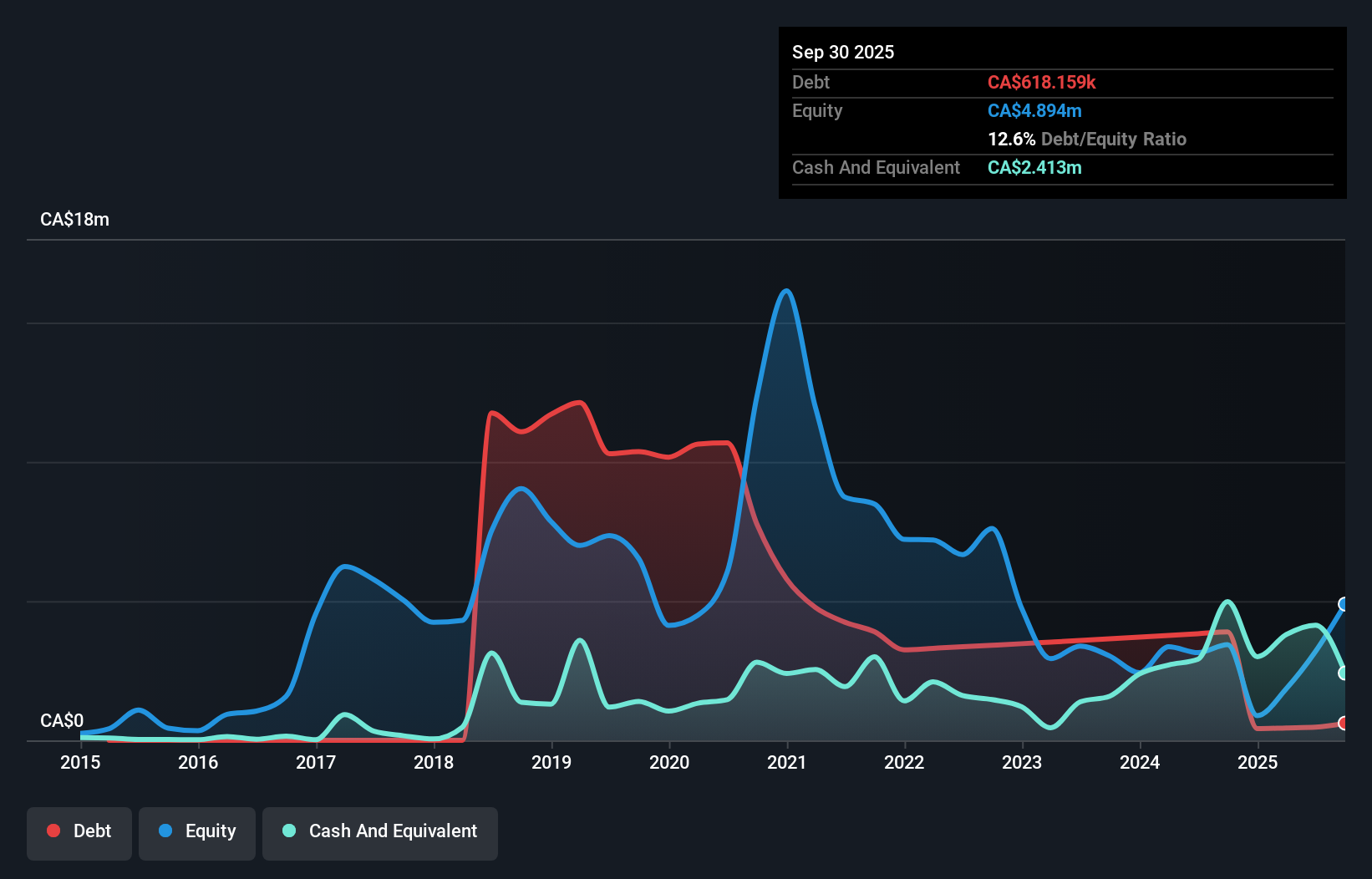

NameSilo Technologies Corp. has demonstrated solid financial health with earnings growth of 19.7% over the past year, surpassing industry averages. The company reported third-quarter sales of CA$16.92 million, up from CA$14.35 million the previous year, and net income increased to CA$0.65 million from CA$0.25 million a year ago. Its debt is well-covered by operating cash flow, and it holds more cash than total debt, indicating strong liquidity management despite short-term liabilities exceeding assets by CA$13.2M. Trading at a discount to its estimated fair value suggests potential upside for investors seeking value in penny stocks.

- Dive into the specifics of NameSilo Technologies here with our thorough balance sheet health report.

- Examine NameSilo Technologies' past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Reveal the 340 hidden gems among our US Penny Stocks screener with a single click here.

- Looking For Alternative Opportunities? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tuya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TUYA

Tuya

Provides AI cloud platform services in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion