- United States

- /

- Software

- /

- NYSE:TRAK

Discovering Undiscovered Gems in the US This February 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it boasts a remarkable 21% increase over the past year with earnings forecasted to grow by 14% annually. In this dynamic environment, discovering stocks that are not only resilient but also poised for growth can be key to uncovering hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

IDT (NYSE:IDT)

Simply Wall St Value Rating: ★★★★★★

Overview: IDT Corporation operates in the communications and payment services sectors across the United States, the United Kingdom, and internationally, with a market capitalization of approximately $1.20 billion.

Operations: IDT's primary revenue streams include Traditional Communications generating $889.39 million, Fintech at $131.23 million, Net2phone with $84.02 million, and National Retail Solutions (NRS) contributing $109.51 million.

IDT Corporation, a dynamic player in the telecom sector, has shown impressive financial performance with earnings surging 99.3% over the past year, outpacing the industry's 8.4% growth. The company is debt-free and boasts high-quality non-cash earnings, emphasizing its robust financial health. Trading at 27.1% below estimated fair value suggests potential undervaluation opportunities for investors. Recent business expansions into Venezuela and Brazil via BOSS Money highlight strategic growth moves following a record holiday season of over two million transfers in December 2024. Additionally, IDT repurchased shares worth $1.34 million recently, reflecting confidence in its market position and future prospects.

- Click to explore a detailed breakdown of our findings in IDT's health report.

Gain insights into IDT's historical performance by reviewing our past performance report.

REX American Resources (NYSE:REX)

Simply Wall St Value Rating: ★★★★★★

Overview: REX American Resources Corporation, along with its subsidiaries, is involved in the production and sale of ethanol in the United States and has a market capitalization of $733.43 million.

Operations: REX generates revenue primarily from the sale of ethanol and its by-products, amounting to $671.88 million. The company's financial performance is reflected in its net profit margin, which has shown fluctuations over recent periods.

REX American Resources, a nimble player in the ethanol sector, is leveraging its debt-free status and robust cash reserves to fuel growth initiatives. The expansion of One Earth Energy's capacity to 175 million gallons annually by mid-2025 could bolster revenue streams. Despite a recent dip in quarterly sales to US$174.88 million from US$221.08 million, net income remained resilient at US$24.5 million compared to the previous year's US$26.08 million. With earnings per share slightly down at US$1.38 from US$1.49, REX continues its strategic push amidst challenges like regulatory hurdles and fluctuating ethanol prices, aiming for sustainable growth with projected annual revenue increases of 9.9% over three years but facing potential margin pressure down to 7.1%.

ReposiTrak (NYSE:TRAK)

Simply Wall St Value Rating: ★★★★★★

Overview: ReposiTrak, Inc. is a North American software-as-a-service provider that specializes in designing, developing, and marketing proprietary software products with a market cap of $383.48 million.

Operations: The company generates revenue through its proprietary software products. With a market cap of $383.48 million, ReposiTrak's financial performance is primarily driven by its software-as-a-service offerings in North America.

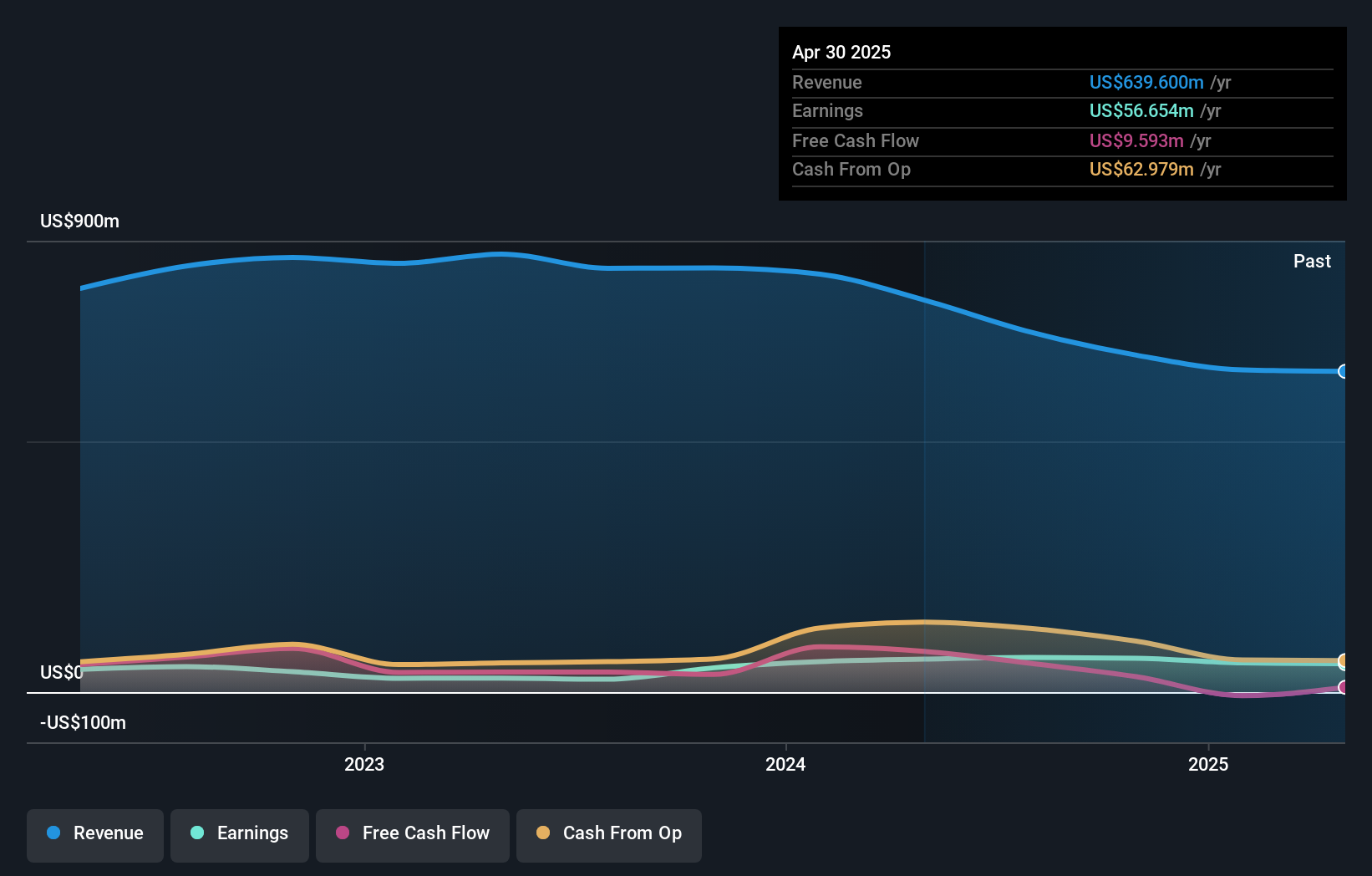

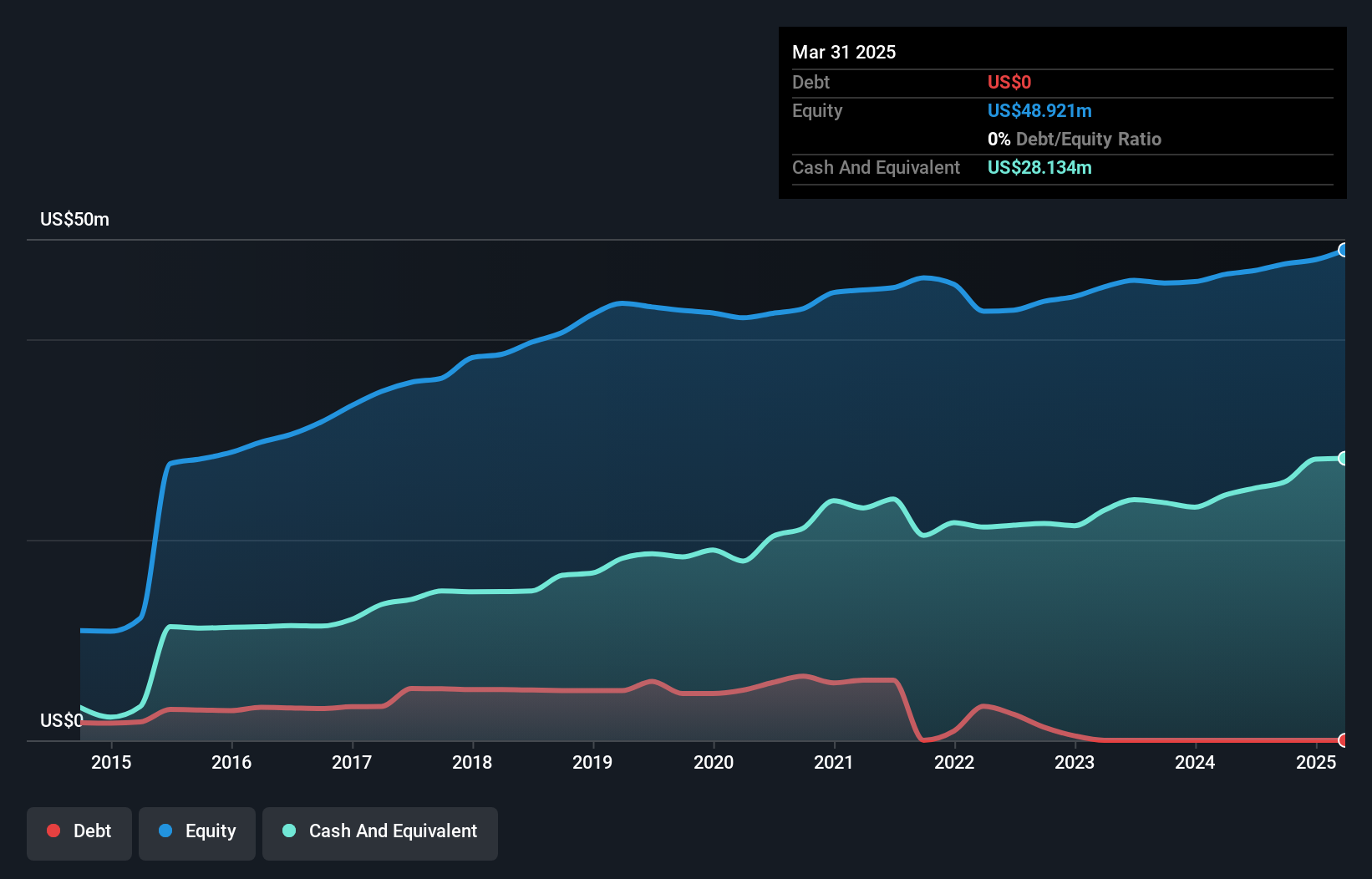

ReposiTrak, a nimble player in the traceability solutions sector, has demonstrated robust growth with earnings expanding 26.8% annually over five years. The company reported a net income of US$1.55 million for Q2 2024, up from US$1.45 million the previous year, alongside sales of US$5.49 million compared to US$5.13 million earlier. With a debt-to-equity ratio reduced from 10.9% to 1.5%, ReposiTrak's financial health appears solid as it leverages strategic partnerships like that with Upshop to enhance supply chain traceability capabilities while aiming for double-digit revenue growth in fiscal year 2025's second half.

Key Takeaways

- Investigate our full lineup of 283 US Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRAK

ReposiTrak

A software-as-a-service provider, designs, develops, and markets proprietary software products in North America.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives