- United States

- /

- Software

- /

- NYSE:TDC

We Think Teradata's (NYSE:TDC) Statutory Profit Might Understate Its Earnings Potential

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. That said, the current statutory profit is not always a good guide to a company's underlying profitability. In this article, we'll look at how useful this year's statutory profit is, when analysing Teradata (NYSE:TDC).

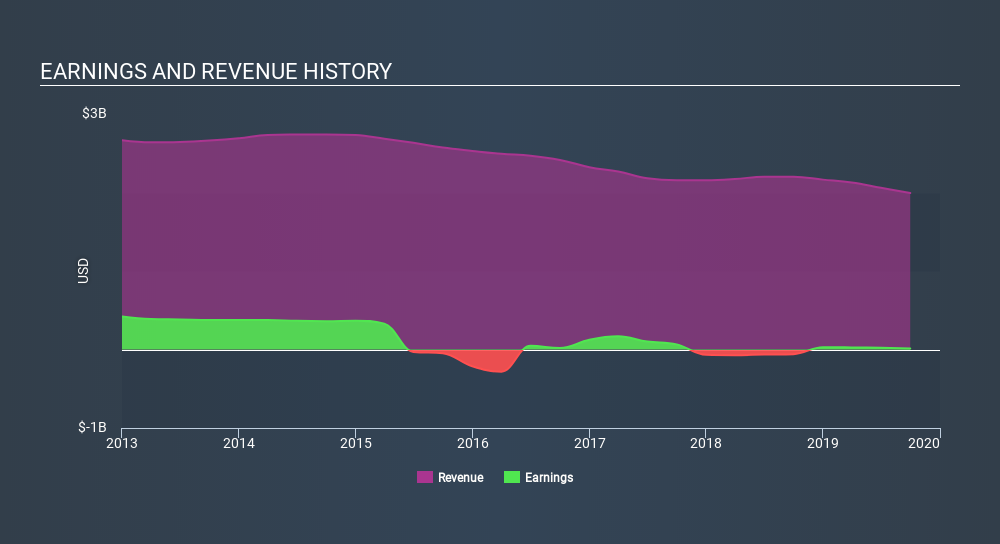

It's good to see that over the last twelve months Teradata made a profit of US$14.0m on revenue of US$1.99b.

Check out our latest analysis for Teradata

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. Therefore, we think it's worth taking a closer look at Teradata's cashflow, as well as examining the impact that unusual items have had on its reported profit. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

A Closer Look At Teradata's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Over the twelve months to September 2019, Teradata recorded an accrual ratio of -0.26. That indicates that its free cash flow quite significantly exceeded its statutory profit. Indeed, in the last twelve months it reported free cash flow of US$92m, well over the US$14.0m it reported in profit. Teradata did see its free cash flow drop year on year, which is less than ideal, like a Simpson's episode without Groundskeeper Willie.

However, that's not all there is to consider. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

The Impact Of Unusual Items On Profit

Teradata's profit was reduced by unusual items worth US$21m in the last twelve months, and this helped it produce high cash conversion, as reflected by its unusual items. In a scenario where those unusual items included non-cash charges, we'd expect to see a strong accrual ratio, which is exactly what has happened in this case. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect Teradata to produce a higher profit next year, all else being equal.

Our Take On Teradata's Profit Performance

In conclusion, both Teradata's accrual ratio and its unusual items suggest that its statutory earnings are probably reasonably conservative. Based on these factors, we think Teradata's underlying earnings potential is as good as, or probably even better, than the statutory profit makes it seem! While it's really important to consider how well a company's statutory earnings represent its true earnings power, it's also worth taking a look at what analysts are forecasting for the future. Luckily, you can check out what analysts are forecsting by clicking here.

Our examination of Teradata has focussed on certain factors that can make its earnings look better than they are. And it has passed with flying colours. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:TDC

Teradata

Provides a connected hybrid cloud analytics and data platform in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026