- United States

- /

- Software

- /

- NYSE:TDC

Teradata (TDC) Margin Improvement Challenges Bearish Flat‑Growth Narratives In FY 2025 Results

How Teradata’s latest numbers set up the story for investors

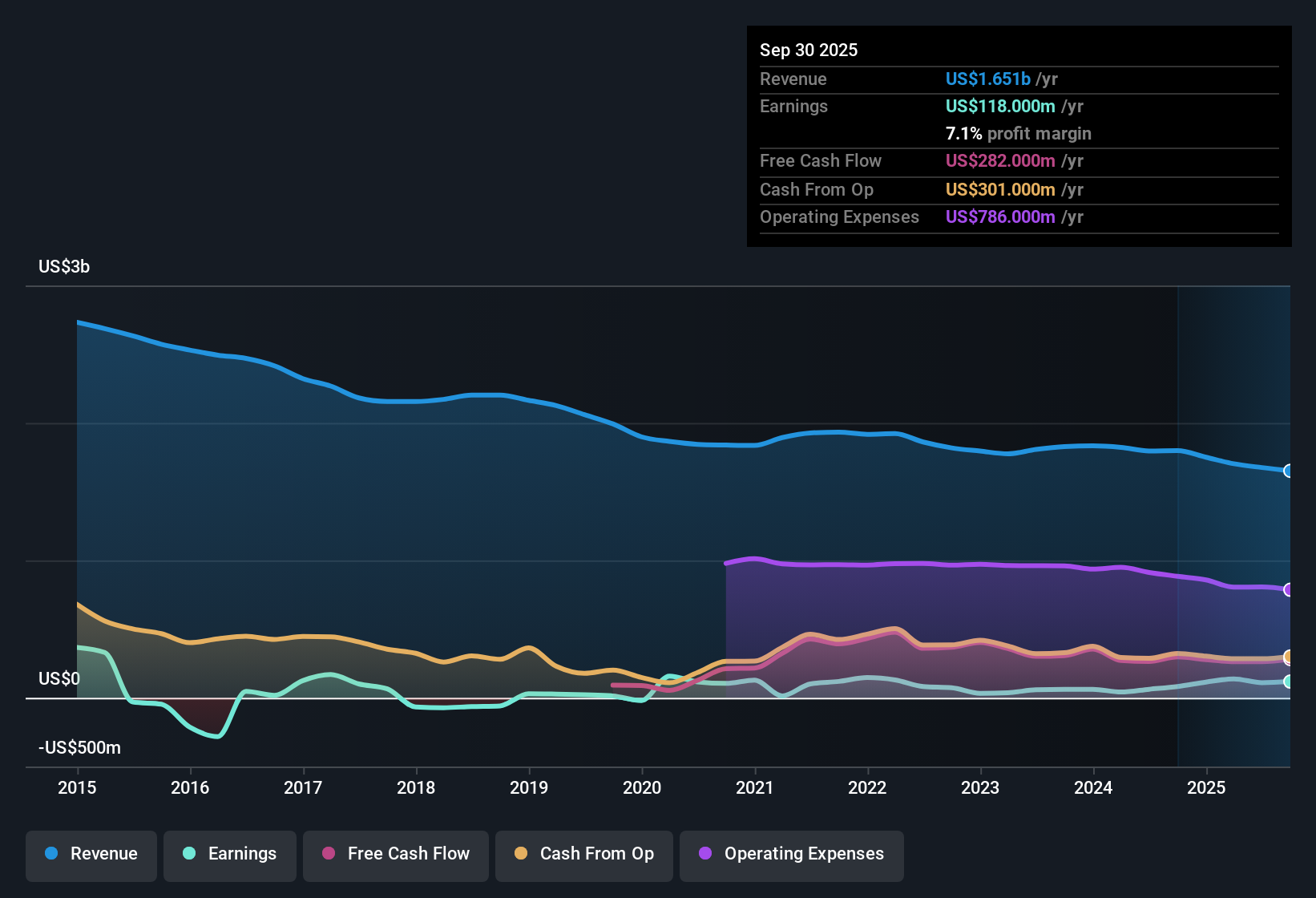

Teradata (TDC) has wrapped up FY 2025 with fourth quarter revenue of US$421 million and basic EPS of US$0.40, alongside trailing 12 month revenue of US$1.7 billion and EPS of US$1.38 that frame the full year picture. Over the last six reported quarters, revenue has moved in a tight band between US$408 million and US$440 million, while quarterly EPS has ranged from US$0.09 to US$0.46, giving you a clear sense of how earnings power has tracked through the year against that relatively steady top line. At a high level, the latest print points to a business where margins and earnings momentum matter more than headline revenue shifts.

See our full analysis for Teradata.With the headline results on the table, the next step is to see how these numbers line up with the widely held narratives about Teradata’s growth, profitability and long term earnings profile, and where those stories might need a rethink.

See what the community is saying about Teradata

Margins firm up as net income reaches US$130 million

- Over the last 12 months, Teradata generated US$1.7b in revenue and US$130 million in net income, which works out to a 7.8% net margin compared with 6.5% a year earlier.

- Supporters of the bullish view point to this higher margin as evidence that earnings quality is improving, even while revenue growth is modest at 0.7% per year.

- That mix of slow top line growth and a firmer 7.8% margin aligns with the idea that profitability, rather than revenue expansion, is doing the heavy lifting in the story right now.

- At the same time, the latest 12 month earnings growth of 14% versus a 5 year average of 3.7% per year shows the acceleration bulls focus on, but it still depends on margins staying close to current levels.

Flat revenue trend contrasts with earnings acceleration

- On a trailing basis, revenue has hovered around US$1.7b with 0.7% growth per year, while earnings for the last year are up 14% and quarterly sales have stayed between US$408 million and US$440 million across the last six reported quarters.

- Bears argue that this slow revenue trend leaves Teradata exposed if margin gains level off, and they highlight that earnings are forecast to grow about 8.7% per year, which is below the 15.7% per year benchmark cited for the broader US market.

- The combination of 0.7% revenue growth and 8.7% forecast earnings growth gives skeptics a basis to question how durable the recent 14% earnings increase is if top line momentum does not improve.

- Compared with the wider market’s 10.4% revenue growth rate, Teradata’s near flat sales path makes the bearish concern about long term revenue stability very focused on whether cost control can keep doing the work.

P/E of 24x sits below peers and DCF fair value

- With the share price at US$33.54 and trailing EPS of US$1.38, Teradata trades on a P/E of about 24x, below the US software industry at 27.1x and below the peer group at 31.6x, while a DCF fair value of US$67.10 is cited as a reference point.

- Consensus narrative points out that this discount to industry and peers, together with that DCF fair value, suggests some valuation support, but it is paired with expectations that revenue could decline about 0.9% per year and margins could soften slightly over the next few years.

- The gap between the current price of US$33.54 and the US$67.10 DCF fair value is wide, yet the same consensus also expects earnings to move from US$110 million to about US$101.6 million over time, which makes the valuation story very dependent on the quality of current cash flows.

- A projected shift in margins from 6.6% to 6.2% alongside that P/E discount shows why some investors see room for upside while others focus on the risk that softer profitability could justify the current multiple.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Teradata on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this data points you in another direction, shape that view into your own narrative in just a few minutes, starting with Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Teradata.

See What Else Is Out There

Teradata’s near flat 0.7% revenue growth, modest 6.6% to 6.2% margin expectations and earnings forecasts below the wider US market highlight a growth constraint.

If that slow top line and softer margin outlook feels limiting, put today’s results in context by checking out 55 high quality undervalued stocks that pair stronger fundamentals with more appealing upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradata might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDC

Teradata

Provides a connected hybrid cloud analytics and data platform in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Very Bullish

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

This strategic transformation of TTE? Significant re-rating potential

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.