- United States

- /

- Professional Services

- /

- NYSE:SRT

StarTek (NYSE:SRT) Might Be Having Difficulty Using Its Capital Effectively

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. However, after investigating StarTek (NYSE:SRT), we don't think it's current trends fit the mold of a multi-bagger.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for StarTek:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

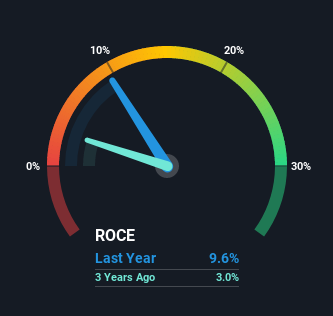

0.096 = US$47m ÷ (US$620m - US$131m) (Based on the trailing twelve months to September 2021).

Therefore, StarTek has an ROCE of 9.6%. In absolute terms, that's a low return and it also under-performs the IT industry average of 14%.

View our latest analysis for StarTek

In the above chart we have measured StarTek's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for StarTek.

What Does the ROCE Trend For StarTek Tell Us?

When we looked at the ROCE trend at StarTek, we didn't gain much confidence. Over the last five years, returns on capital have decreased to 9.6% from 24% five years ago. Meanwhile, the business is utilizing more capital but this hasn't moved the needle much in terms of sales in the past 12 months, so this could reflect longer term investments. It may take some time before the company starts to see any change in earnings from these investments.

On a side note, StarTek has done well to pay down its current liabilities to 21% of total assets. Considering it used to be 82%, that's a huge drop in that ratio and it would explain the decline in ROCE. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.

In Conclusion...

Bringing it all together, while we're somewhat encouraged by StarTek's reinvestment in its own business, we're aware that returns are shrinking. And investors appear hesitant that the trends will pick up because the stock has fallen 28% in the last three years. Therefore based on the analysis done in this article, we don't think StarTek has the makings of a multi-bagger.

One more thing to note, we've identified 1 warning sign with StarTek and understanding it should be part of your investment process.

While StarTek isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SRT

Startek

StarTek, Inc., a business process outsourcing company, provides customer experience, digital transformation, and technology services in various markets.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

Strategic pivot in maximizing corporate value

Buy-out proposal for BARK Inc., at $1.10 has be confirmed by the acquisition group

Paladin Energy: Betting on the Nuclear Renaissance

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks