- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

Square's (NYSE:SQ) Lofty Valuation Definitely Justifies a Full Time CEO

Yesterday Jack Dorsey resigned as CEO of Twitter ( NYSE:TWTR ). This move will allow him to focus 100% of his time on his job as CEO of Square, Inc. ( NYSE:SQ ) the fintech company he founded in 2009. Twitter was probably in need of fresh leadership, so this is a good move from that perspective. However, it also makes sense for Dorsey to focus on Square which now earns four times the revenue of Twitter.

Square’s share price has been a notable underperformer recently, so this news may present an opportunity for investors. To assess the potential opportunity we need to look at the current valuation and future prospects.

Square’s share price has fallen nearly 30% since August, but is still trading on a price-to-earnings ratio (or "P/E's") of 182.8x. This is 10 times the P/E ratio for the US equity market and well above the US IT industry average P/E of 34.7x. A high P/E ratio like this implies that investors are expecting a lot of earnings growth for Square.

Want the full picture on analyst estimates for the company? Then our free report on Square will help you uncover what's on the horizon.

Is There Enough Growth For Square?

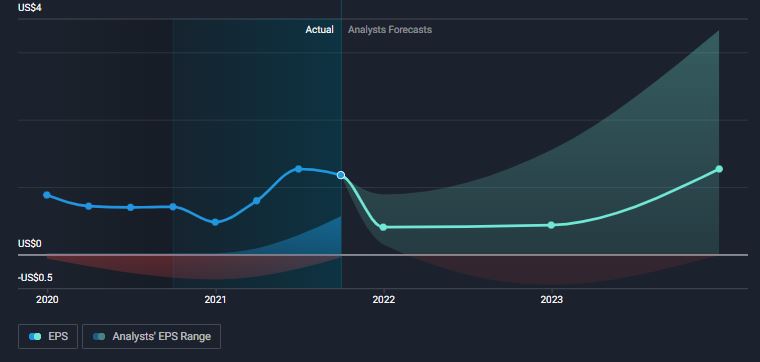

For a company to justify a P/E of 182x, it will need to grow earnings at a substantial rate for the foreseeable future. When we look at the current earnings forecast from analysts who cover Square, we see a lot of disparity between the best and worst forecasts. Just two years out, EPS estimates range from $0 to $4 a share, compared to $1.18 for the last 12 months. This also puts the forward P/E at a minimum of 53x which is high given the level of uncertainty and the fact that we are talking about EPS two years away.

The Bottom Line On Square's P/E

Square has a lot going for it on a qualitative level. While it isn’t the biggest fintech company ( PayPal’s ( NASDAQ: PYPL ) market cap is 2.2 times higher), Square has the widest range of services around. It also has a very large total addressable market, implying a long growth runway ahead.

The challenge is the valuation and the growth rates that can be achieved in the next few years. It’s likely that growth will be lumpy as it’s been in the past, and there is a risk that there won’t be enough of it to justify the high P/E.

The good news is that Jack Dorsey owns more than 10% of the company , so his interests are aligned with shareholders - and he can now devote 100% of his time to the company. If you would like to stay up to date with Square, take a look at our comprehensive analysis which includes growth forecasts and few red flags that we have identified.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026