- United States

- /

- IT

- /

- NYSE:SNOW

Is Now the Right Moment to Consider Snowflake After Its 54% Rally in 2025?

Reviewed by Bailey Pemberton

If you’re eyeing Snowflake and wondering if it’s still a smart play, you’re in good company. After all, deciding what to do with a hot stock like this can feel like trying to catch a moving train. Over the past year, Snowflake has made some big moves, rallying more than 113% in 12 months and surging 54% just since the start of the year. Those kinds of gains grab attention, and for good reason. They often hint at something big happening behind the scenes, whether it’s a shift in the tech landscape or investor excitement about the company’s future potential.

The more recent returns are still strong, with a 7.7% jump in the last 7 days and 7.5% growth in the past month alone. These quick moves might reflect market optimism around Snowflake’s unique cloud data platform and the broader tech sector’s bounce-back, as investors shift their risk appetite and look for the next big winner. But before anyone rushes in, it’s worth pausing and asking the real question: is that growth already baked into the current price, or does Snowflake have room to keep surprising us?

That brings us to the heart of the matter: valuation. Snowflake currently scores a 1 out of 6 on our value check, indicating it’s considered undervalued on just a single measure. That’s a critical piece of the puzzle, but it’s only the start. In the next section, we’ll dig deeper into the standard approaches investors use to assess valuation, and toward the end, I’ll share a method that offers a more complete picture than most traditional metrics alone.

Snowflake scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Snowflake Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. Essentially, this method asks: if you owned all of Snowflake’s future cash, how much would you pay for it right now?

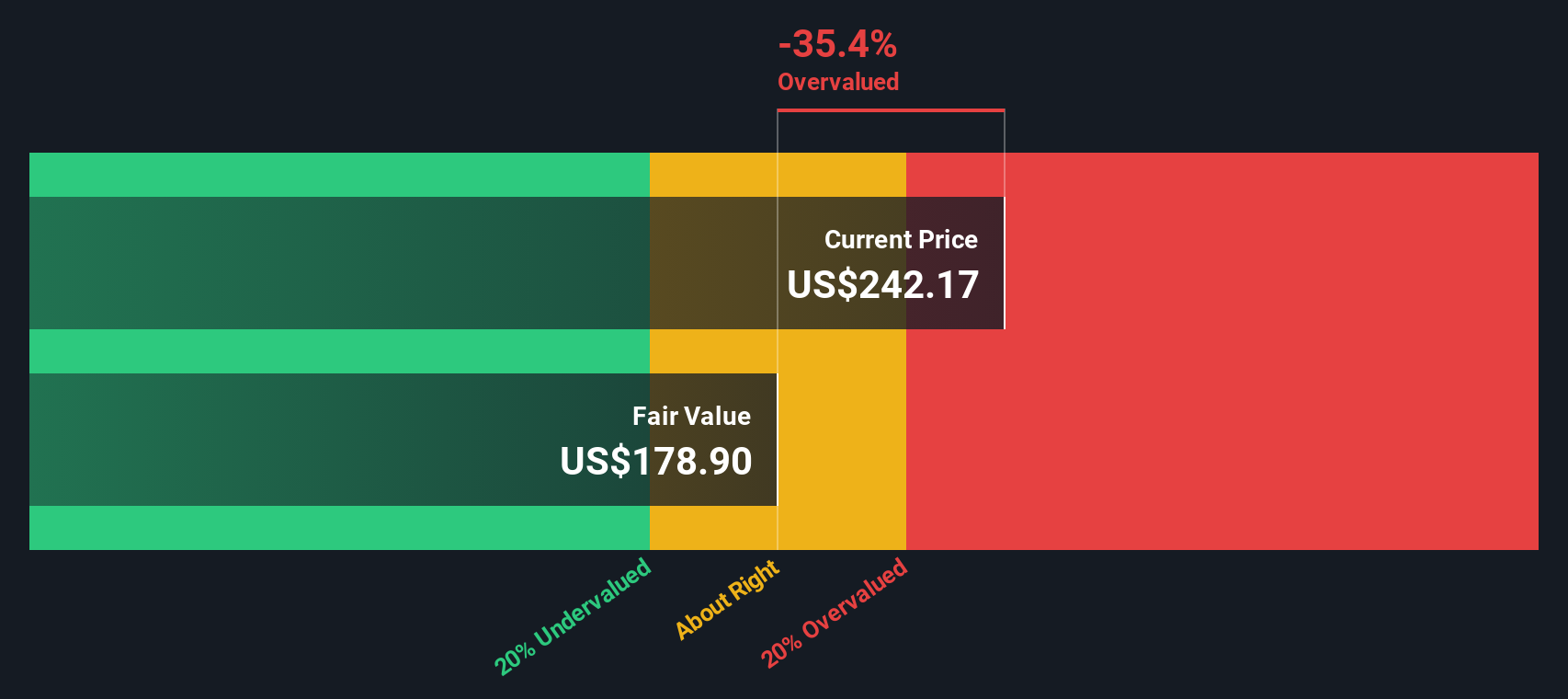

For Snowflake, the current Free Cash Flow stands at $726.9 Million. Looking ahead, analysts project continued growth, with Free Cash Flow expected to reach $3.17 Billion by 2030. It is important to note that only the next five years come from analysts and the later years are extrapolated. These forecasts suggest significant confidence in Snowflake’s ability to scale its cash generation over time, especially as its cloud data platform expands within the IT industry.

After crunching the numbers, the DCF model calculates an intrinsic value of $178.47 per share. However, this result also highlights a clear challenge: the stock is trading at a 35.9% premium versus its estimated fair value. In other words, the market already appears to be pricing in a lot of growth, raising the question of whether there is much upside left for new investors at current levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Snowflake may be overvalued by 35.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Snowflake Price vs Sales

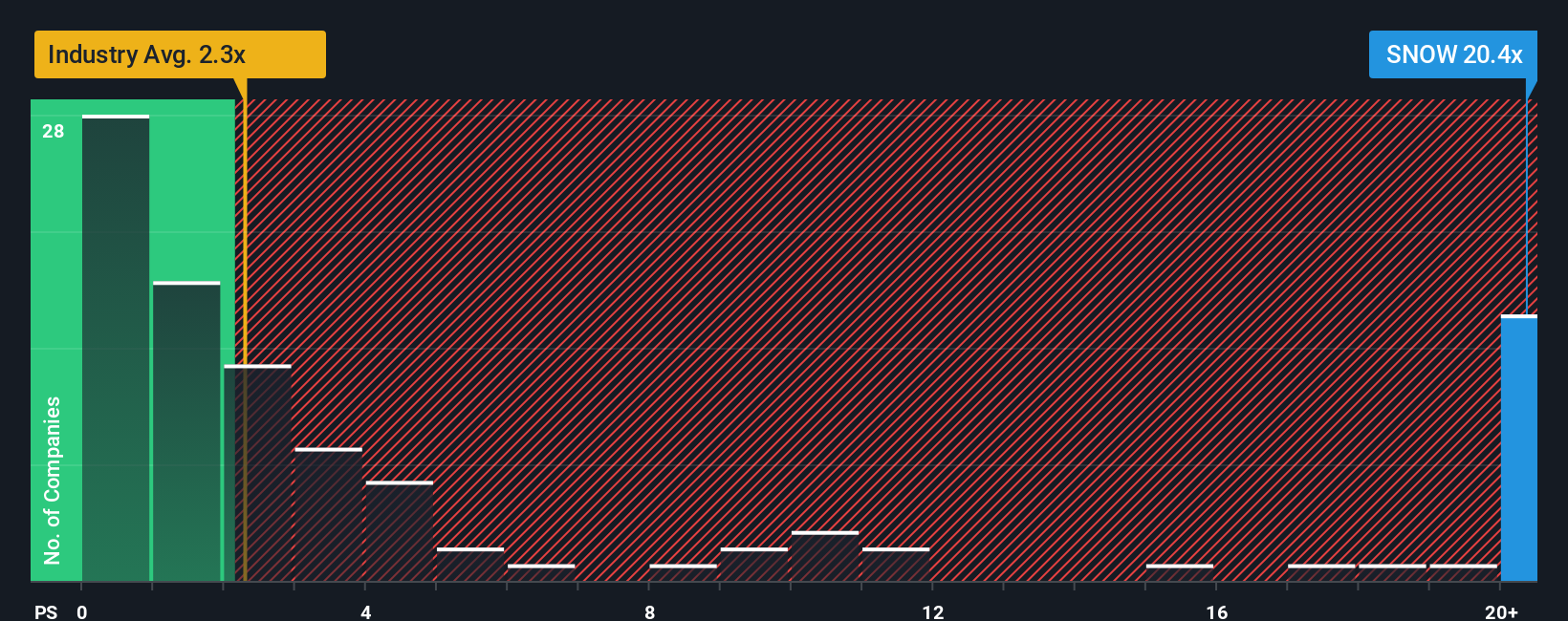

For companies like Snowflake, which are rapidly growing but not yet consistently profitable, the Price-to-Sales (P/S) ratio is often the preferred valuation multiple. The P/S ratio helps investors gauge how much they are paying for every dollar of a company’s sales, making it useful when traditional earnings measures are negative or volatile.

Growth expectations and risk play a big role in determining what is considered a normal or fair sales multiple. Higher expected sales growth or lower business risks can justify a premium P/S ratio. Conversely, slower growth or greater risks would pull that number down toward the industry average.

Right now, Snowflake is trading at a P/S ratio of 20x. For context, the average P/S ratio across its industry is about 2.4x, while its peer group sits higher at 23.4x. This represents a significant premium to both benchmarks and reflects the market’s belief in Snowflake’s outsized growth potential. However, Simply Wall St’s proprietary “Fair Ratio” for Snowflake is 15x. This Fair Ratio aims to provide a more nuanced comparison because it considers the company’s unique combination of projected growth, profit margins, business risks, industry dynamics, and overall market cap.

Since Snowflake’s current P/S ratio of 20x is notably above its Fair Ratio of 15x, the stock appears to be trading at a premium that may be difficult to justify unless the company exceeds the already optimistic growth expectations. Investors should be cautious about jumping in at current prices based on this metric.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Snowflake Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your own story or perspective about a company, explaining why you think it will succeed or struggle, and backing it up with your personal estimates of future revenue, profitability, and risks. This essentially connects the company’s unique story to a financial forecast and, ultimately, a fair value.

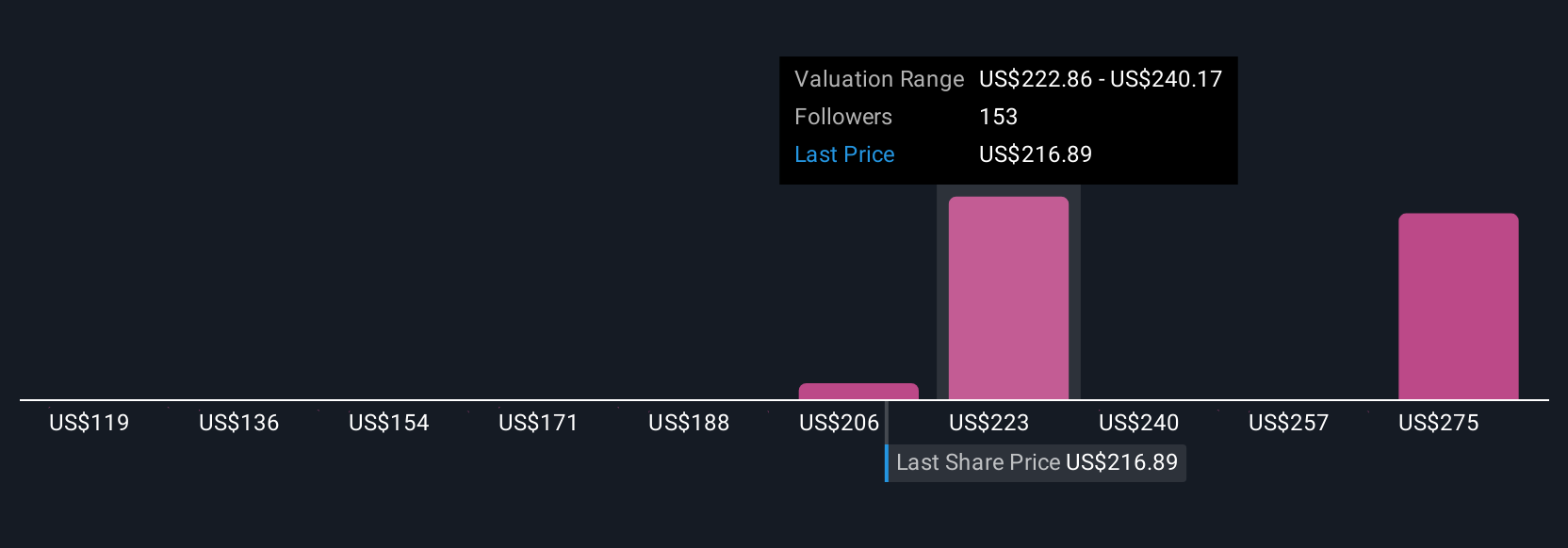

On Simply Wall St’s Community page, anyone can create or follow Narratives that translate complex data into easy-to-understand insights. These are a uniquely accessible tool used by millions of investors. Narratives help you decide when to buy or sell because they compare your calculated Fair Value directly to the current Price, and they update automatically whenever something important changes, such as new earnings releases or breaking news.

For example, one investor’s Narrative for Snowflake might project rapid revenue growth based on unstoppable enterprise AI adoption, leading them to a bullish fair value near $440 per share. Meanwhile, a more cautious investor might focus on early-stage AI monetization and tough competition, arriving at a bearish value as low as $170 per share.

Do you think there's more to the story for Snowflake? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)