- United States

- /

- IT

- /

- NasdaqGS:SHOP

How Shopify's (NYSE:SHOP) Clients May be Acquired by Amazon's "Buy With Prime" Service

Shopify's (NYSE:SHOP) competitive edge comes from letting small retailers become big by helping them build an online store in a cost-effective way. Amazon (NASDAQ:AMZN) has now more aggressively entered this space, with its new "Buy With Prime" service. Today, we will analyze the possible implications of this development.

The key takeaways from our analysis are:

- Shopify has an optimistic EV to FCF of 130.6x, implying a lot of future growth

- Amazon's new Buy With Prime service will initially target larger retailers, but may start clashing with Shopify for market share

- Buy With Prime will allow merchants to use Amazon distribution channels within their online stores

Check out our latest analysis for Shopify

What is Buy With Prime

It is a new feature for U.S. based Prime customers that allows them to purchase products directly from the online stores of trusted merchants. Customers will see the Prime logo and delivery promise within eligible merchant stores.

At first, the program will be available by invite only to merchants using Fulfillment by Amazon (FBA), and will start rolling out this year. Just a reminder, FBA allows merchants to use Amazons warehouses (fulfillment centers), as a starting point for distribution.

For Shopify, this represents a bid to induce merchants to switch their distribution and possibly whole business to Amazon. While Amazon is not as strong outside the U.S. and Shopify's decentralized approach has advantages there, the two companies will now compete significantly closer to each other.

Shopify's Outlook

The company seems to be focused on helping smaller merchants enter and distribute in the market using its platform. They also help merchants develop their business and accept payments, which is why the company has plenty of room to grow. Initially, Amazon may target larger online retailers, but as time passes they may lower the cost of doing business with smaller ones as well.

Below, we will take a look at the income expectations from the analysts covering Shopify, and see how the company stands regarding its fundamentals.

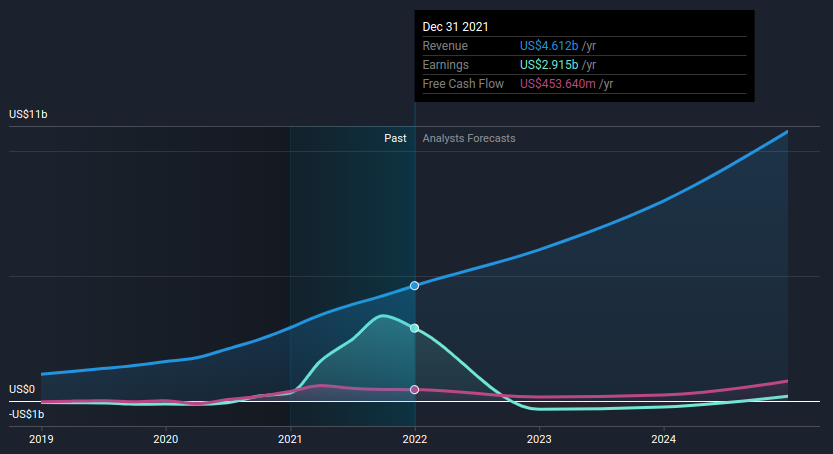

Shopify made a substantial US$2.9b in earnings over the last trailing twelve months, however this is not what the company is expected to produce continually. Analysts expect the company to dip below zero again and by the end of 2022 they expect a net income of US$-334m.

Revenue is still expected to grow at a high rate of 23.4% on average per year. However, recently many analysts have been adjusting their expectations, and it might be good to put the stock on your watchlist in order to be notified of any changes in forecasts or price targets.

By the end of 2024, analysts expect the company to make US$10.8b in revenue, more than double of what it is making today.

For investors, the key figure are free cash flows, and we can see that analysts are still projecting the company to be in the growth phase of development by the end of the forecast period. Young companies like Shopify typically shift from growing to maximizing free cash flows after they are confident that they have obtained enough market share. For this reason, the forecasted future cash flows may underestimate the potential free cash flows the company can reach at maturity, but we should analyze them regardless. By the end of 2024, analysts are expecting Shopify to reach an average of US$796m in free cash flows, a 75% increase from today.

The company is reporting earnings on the 28th of April, so make sure to mark the date as that is usually the time by which larger price movements tend to happen, as institutional investors re-evaluate stocks on an individual basis. You might notice large current movements already, which can also be an indication of investors changing their investments in indices following these stocks.

Relative Valuation

Unfortunately, as we mentioned, the future earnings of Shopify are expected to come down negative. Which is why the trailing 22.7x P/E ratio makes little sense.

However, seeing that we have the free cash flows, along with cash and debt levels, we can compute an EV to FCF ratio - which is a similar measure of price to profitability.

For Shopify, we take the current market cap of $66.2b, add on the debt of $0.91b and subtract its cash position of $7.79b in order to get to the Enterprise Value (the value of assets used in operations) of $59.3b

We divide the EV with the Free Cash Flows and get:

$59.3b / $0.454b = 130.6x

This practically means that there is a lot of future growth implied in the company, and investors are currently willing to wait for that growth to materialize over the years.

Conclusion

Amazon's bid to allow merchants to use their widget and warehouses as a distribution channel is a potential attack on the future growth of Shopify.

With an EV to FCF of 130.6x, we can see that current investors are putting their faith in high growth and free cash flows - likely in the more distant future. This makes the stock more exposed to current risks and shifts in the outlook and macro environment. However, investor that believe that Shopify is capable of reaching its targets may find it easier to handle possible volatility.

You need to take note of risks, for example - Shopify has 3 warning signs (and 2 which are concerning) we think you should know about.

Of course, you might also be able to find a better stock than Shopify. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives