- United States

- /

- Software

- /

- NYSE:SEMR

Is Now the Right Time to Reevaluate Semrush Stock Amid 37% Decline in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Semrush Holdings stock? You are not alone. It has been a bumpy ride for shareholders this year, with the stock closing recently at $7.35 and down an eye-popping 37.3% year to date. Over the last 12 months, the slide has been even steeper at 46.4%. Those are big numbers, and they certainly grab your attention if you are already invested or considering stepping in. Even so, the past week saw a small 1.0% uptick, which shows there is both volatility and a spark of optimism brewing beneath the surface.

Much of this shift in perception is connected to broader tech market trends, rather than single events. As the digital marketing landscape continues to evolve, investor sentiment toward companies like Semrush Holdings changes rapidly based on where growth narratives are heading next. These swings hint at shifting risk tolerance and an ongoing debate about how to value a business that is so connected to the future of digital business.

Should we be worried, or is this the kind of shakeout that creates opportunity? Here is where things get interesting: based on six different valuation checks, Semrush Holdings currently rates a perfect 6 out of 6 on value. That is not something you see every day, and it definitely raises questions about whether the market is missing something here.

Next, we will dig into the core valuation methods and see what story the numbers are really telling. But do not miss the final section, where we will look at an even smarter way to think about valuing Semrush Holdings, one that might just change your perspective entirely.

Why Semrush Holdings is lagging behind its peers

Approach 1: Semrush Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach helps investors gauge what a business is really worth based on how much cash it is expected to generate going forward.

For Semrush Holdings, the most recent reported Free Cash Flow sits at approximately $31.0 million. Analysts project robust annual growth, with cash flows expected to reach $75.1 million by 2026. Further out, projections show Free Cash Flow growing to nearly $189.8 million by 2035. These longer-term numbers are extrapolations rather than analyst estimates.

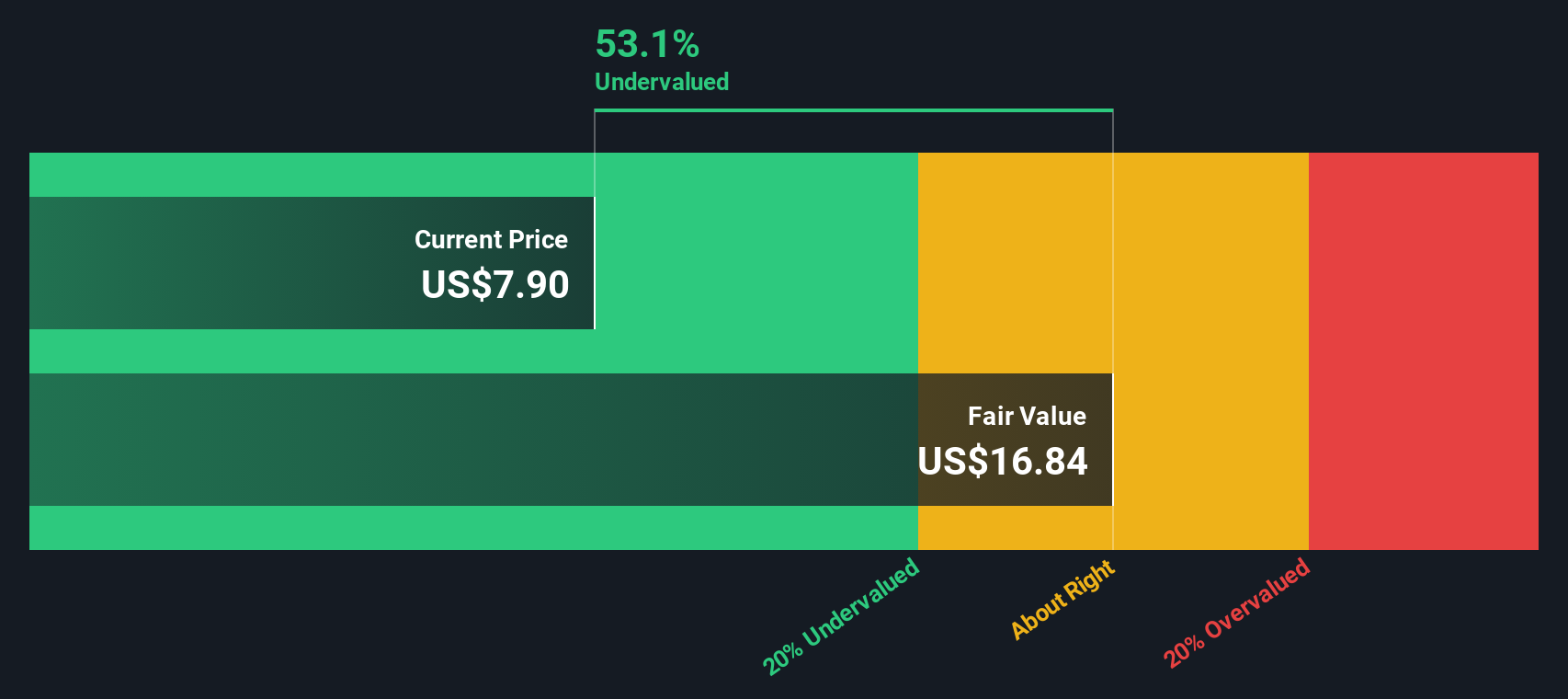

Using these projections and discounting them back to present value, the DCF model arrives at an intrinsic fair value of $16.71 per share. With Semrush Holdings currently trading at $7.35, the model suggests shares are trading at a 56.0% discount to their calculated fair value.

This substantial gap indicates the stock is considerably undervalued based on future cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Semrush Holdings is undervalued by 56.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Semrush Holdings Price vs Sales

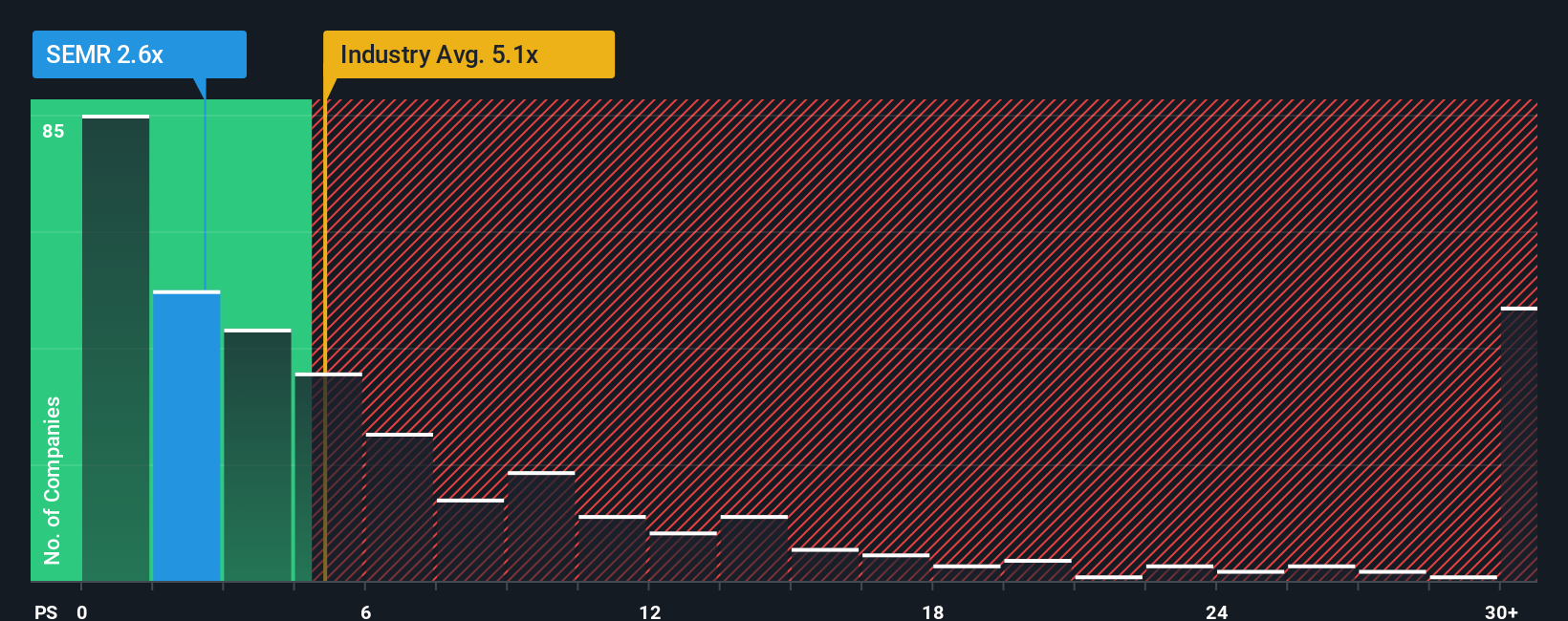

For technology businesses that are still growing or reinvesting heavily, the Price-to-Sales (P/S) ratio is often the most relevant valuation metric. This is particularly true for companies like Semrush Holdings, where net income might not fully reflect the value of a scalable, recurring revenue business. The P/S ratio helps investors compare what they are paying for each dollar of a company’s sales, making it a practical metric for assessing the value of SaaS and digital firms before sustained profits kick in.

It is important to note that growth prospects and perceived risks typically influence what represents a "normal" or "fair" P/S ratio. Higher expected growth or lower risk profiles often justify a premium multiple. On the other hand, slower-growing companies with more uncertainty tend to have lower ratios.

Right now, Semrush Holdings trades at a 2.64x P/S multiple, while the average among its software industry peers is 3.12x and the broader industry average is 5.29x. In addition, Simply Wall St's proprietary "Fair Ratio" model, which takes into account growth, profit margins, market cap, industry structure and company-specific risks, arrives at a fair multiple of 4.98x for Semrush Holdings. The Fair Ratio is designed to be more insightful than simply comparing with peers or sector averages because it captures the factors that actually drive long-term value.

With the stock’s current P/S multiple sitting well below its calculated Fair Ratio, there appears to be a significant discount implied by the market.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Semrush Holdings Narrative

Earlier we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your version of Semrush Holdings’ story, connecting what you believe about its future—such as revenue, profit margins, and growth rates—to an estimated fair value. Instead of just relying on raw numbers, Narratives let you blend your perspective on the company’s business model, industry changes, and market opportunity directly with a financial forecast in a way that is simple and transparent.

With Narratives, available right on Simply Wall St’s Community page (used by millions of investors), you can instantly see how your story stacks up against others and compare your calculated Fair Value with the current share price. This can help you decide when an opportunity looks attractive or when it might be time to take profits. These Narratives update automatically with the latest data and news, so as new earnings or announcements come in, your analysis stays relevant without manual work.

For example, some investors see Semrush Holdings thriving from AI-driven enterprise adoption and assign a fair value as high as $13.00, while others believe margin pressures or tougher competition could limit upside, setting fair value closer to $9.00. Each Narrative turns market debate into actionable investing signals, making it easy for you to focus on what matters most to your decisions.

Do you think there's more to the story for Semrush Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEMR

Semrush Holdings

Develops an online visibility management software-as-a-service platform in the United States, the United Kingdom, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives