- United States

- /

- Software

- /

- NYSE:S

Taking Stock of SentinelOne (S) Valuation After Earnings Beat, AWS Integrations and Leadership Changes

Reviewed by Simply Wall St

SentinelOne (S) just packed several catalysts into a few days, combining stronger quarterly results, fresh revenue guidance, new Amazon Web Services integrations, and leadership changes that together give investors plenty to reassess.

See our latest analysis for SentinelOne.

Those earnings beats, fresh $1.0 billion revenue outlook and new AWS integrations have helped the 7 day share price return reach 6.46%. However, the year to date share price return of negative 24.81% and 1 year total shareholder return of negative 31.82% show investors are still treating SentinelOne as a higher risk, long term growth story rather than a momentum trade.

If this kind of AI driven cybersecurity story is on your radar, it is worth seeing what else is out there with high growth tech and AI stocks as potential next wave candidates.

With revenue now tracking toward $1 billion and the stock still trading well below average analyst targets, investors face a key question: Is SentinelOne undervalued after a bruising year, or already pricing in its next growth leg?

Most Popular Narrative Narrative: 27.8% Undervalued

With SentinelOne last closing at $16.97 versus a narrative fair value near $23.50, the gap points to meaningful upside if the thesis holds.

The new SentinelOne Flex licensing model is accelerating multi product adoption, leading to larger deal sizes, increased platform retention, and rising recurring revenue, all of which support both near term and long term net margin expansion through reduced sales friction and deeper customer integration.

Curious how recurring revenue, margin expansion, and aggressive growth forecasts all combine into that punchy fair value? Want to see which bold assumptions drive it? Dive in.

Result: Fair Value of $23.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained partner dependence and intensifying platform consolidation could squeeze margins, slow adoption, and quickly challenge the current undervalued narrative.

Find out about the key risks to this SentinelOne narrative.

Another View: Market Ratios Send a Different Signal

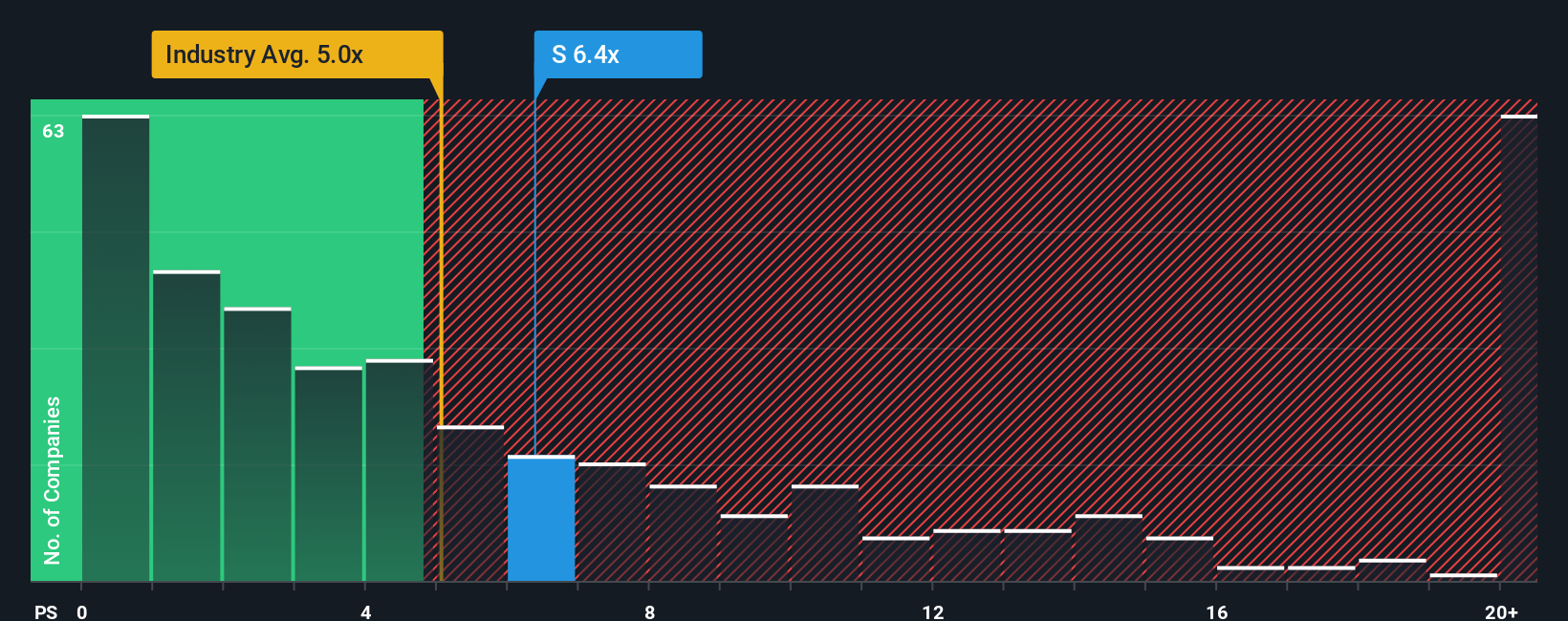

While narratives and fair value estimates suggest upside, the market’s own yardstick is less generous. SentinelOne trades on a price to sales ratio of 6.3 times, slightly richer than both US software peers at 5 times and direct peers at 6.2 times. This implies there is little margin for execution missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SentinelOne Narrative

If you see things differently or prefer to dig into the numbers yourself, you can shape a fresh narrative in just a few minutes. Do it your way

A great starting point for your SentinelOne research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover targeted stock ideas that match your strategy before the market catches on.

- Capitalize on mispriced potential by hunting for companies that may trade below their intrinsic worth with these 912 undervalued stocks based on cash flows tailored to cash flow strength.

- Ride the next wave of innovation by focusing on automation, data driven platforms, and smart infrastructure through these 26 AI penny stocks.

- Lock in reliable cash returns by targeting steady payers with robust balance sheets via these 15 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:S

SentinelOne

Operates as a cybersecurity provider in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026