- United States

- /

- Software

- /

- NYSE:S

SentinelOne (S) Q3 2026 Revenue Growth Supports Bullish Scale Narrative Despite Ongoing Losses

Reviewed by Simply Wall St

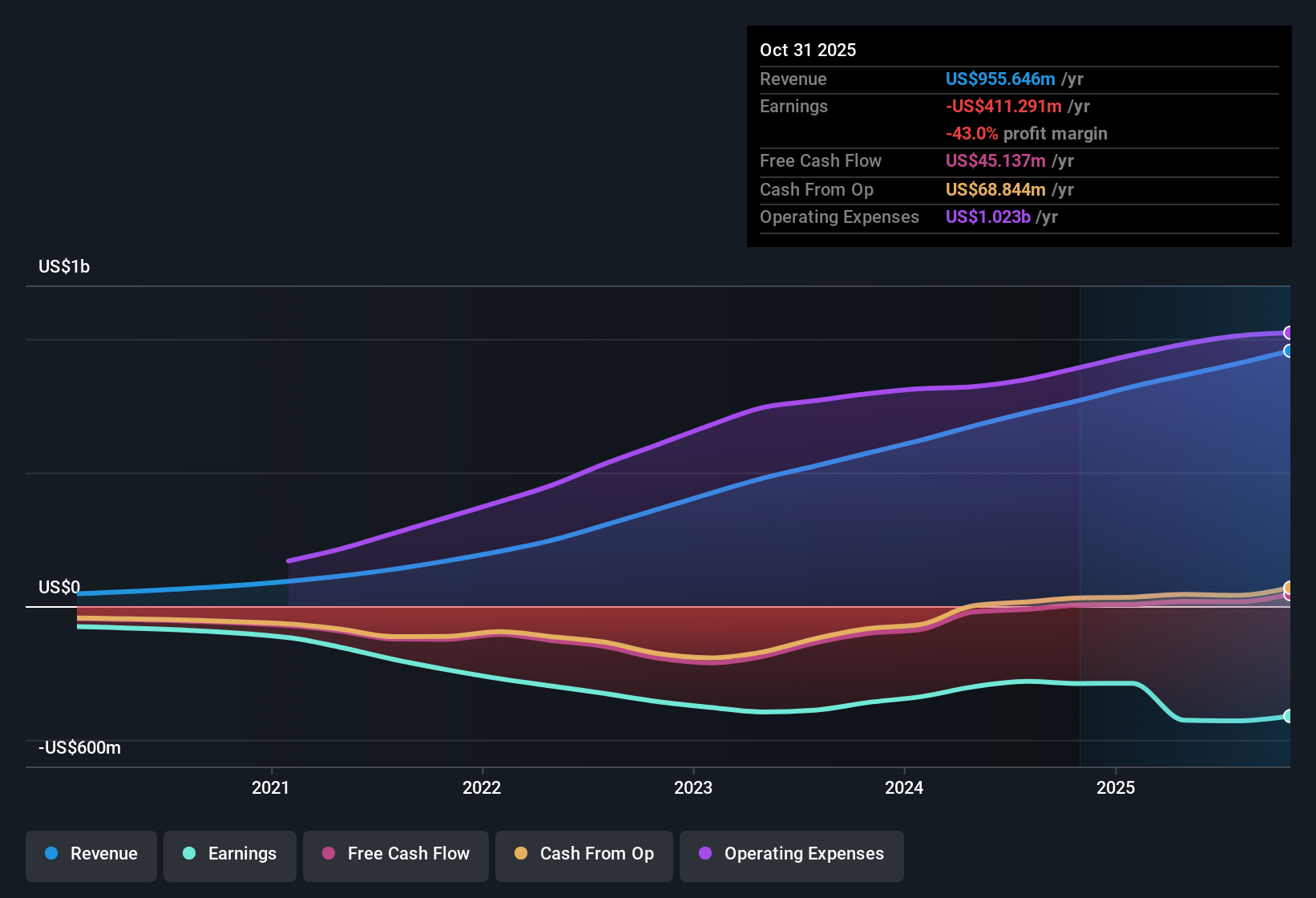

SentinelOne (S) just posted its Q3 2026 numbers, with revenue of about $258.9 million and a basic EPS loss of roughly $0.18, keeping the focus firmly on scaling the top line while managing persistent net losses. The company has seen revenue move from around $210.6 million in Q3 2025 to $258.9 million in the latest quarter, while basic EPS has held in the negative territory, underscoring that growth is still coming with a cost to margins for now. With that backdrop, investors will be watching how quickly the business can convert this expanding revenue base into more efficient, less loss-heavy operations.

See our full analysis for SentinelOne.With the headline numbers on the table, the next step is to line them up against the most popular narratives around SentinelOne to see which stories the data supports and which ones look due for a rethink.

See what the community is saying about SentinelOne

Losses Narrow While Scale Builds

- Net loss excluding extra items improved from about $78.4 million in Q3 2025 to roughly $60.3 million in Q3 2026, while trailing 12 month revenue reached about $955.6 million.

- Consensus narrative leans bullish on SentinelOne’s ability to turn scale into better margins, and the recent numbers partly back that up.

- On the positive side, Q3 2026 net loss of $60.3 million is smaller than the $72.0 million loss in Q2 2026, even as revenue rose from $242.2 million to $258.9 million.

- At the same time, trailing 12 month net loss has widened to about $411.3 million, so the longer term history still reflects the analysts’ view that profitability is not on the near term horizon.

Faster Revenue Growth, Ongoing Red Ink

- Revenue is forecast to grow around 15.8 percent per year, ahead of the 10.6 percent pace expected for the US market, while trailing 12 month net loss sits at about $411.3 million.

- Bulls point to AI driven products and multi product adoption as growth engines, and the current data is broadly consistent with that story but with clear profitability trade offs.

- Forecast revenue growth of 15.82 percent per year lines up with the view that innovation and international expansion can keep the top line growing faster than the broader market.

- However, the expectation that the company will remain unprofitable for at least the next three years aligns with the fact that EPS over the last 12 months is still about negative $1.26, so the bullish case rests on future margin changes rather than what is visible today.

Discounted Valuation With Insider Selling

- With the share price at $14.52 versus a DCF fair value estimate of about $23.73, the stock trades at roughly a 39 percent discount. Recent price to sales of about 5.1 times sits just above the US software industry at 4.9 times and below peers at 6.2 times.

- Bears focus on ongoing losses and insider selling, and the current figures give them concrete risk points alongside the apparent valuation upside.

- The company is expected to stay unprofitable for at least three years and has trailing 12 month net losses of about $411.3 million, which reinforces concerns that a discounted price alone does not guarantee value.

- Significant insider selling over the past three months sits uncomfortably next to the DCF fair value gap, giving skeptics a clear data based reason to question how quickly fundamentals might close that valuation spread.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SentinelOne on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use the same data to build your own view in just a few minutes and share it with the community: Do it your way.

A great starting point for your SentinelOne research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

SentinelOne’s rapid growth comes with heavy, ongoing net losses and insider selling, raising questions about financial resilience and alignment between management and shareholders.

If those red flags concern you, use our solid balance sheet and fundamentals stocks screener (1941 results) today to quickly find companies with stronger finances, lower risk profiles, and business models built for durability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:S

SentinelOne

Operates as a cybersecurity provider in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026