- United States

- /

- Software

- /

- NYSE:S

SentinelOne (NYSE:S) Unveils Purple AI 'Athena' To Revolutionize Cybersecurity With Advanced AI Capabilities

Reviewed by Simply Wall St

The recent 14% price increase for SentinelOne (NYSE:S) over the last week coincided with the unveiling of their next-gen Purple AI 'Athena' at RSA Conference 2025, featuring enhanced security capabilities that likely bolstered investor confidence. Additionally, a strategic collaboration with Nord Security aimed at enhancing cybersecurity for SMBs may have positively impacted sentiment. While these developments occurred amidst an overall market rise, the company's innovations in AI and security solutions contributed uniquely to its momentum. Broader market trends, such as investor optimism following solid earnings and a potential easing of tariff concerns, likely provided additional upward pressure.

We've spotted 2 warning signs for SentinelOne you should be aware of.

The unveiling of SentinelOne's Purple AI 'Athena' and collaboration with Nord Security are significant moves that could influence the company's trajectory in AI-native cybersecurity. These announcements could enhance revenue prospects by attracting clients seeking advanced security solutions, particularly among SMBs. However, despite these developments, SentinelOne's total return, including share price and dividends, was 14.93% lower over the past year. This contrasts sharply with the broader U.S. market's 7.7% increase and underperformance against the software industry, which grew by 7.6% over the same period.

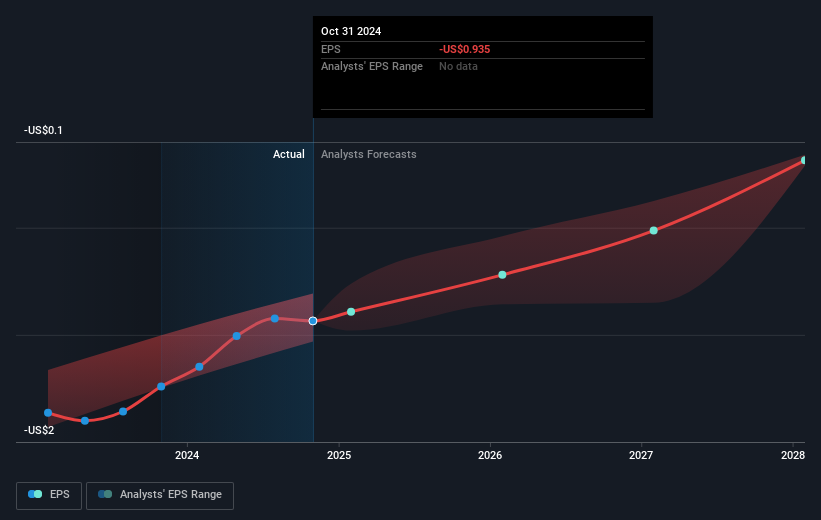

This recent price increase also places SentinelOne's shares in an interesting position concerning the analyst consensus price target of US$24.28. With the current share price at US$16.36, there's a 32.6% discount to the target, potentially indicating significant upside if revenue and earnings align with analyst expectations. The anticipated revenue growth of 15.89% annually and strategic alliances could drive fulfilment of these projections. Still, SentinelOne's forecasted unprofitability over the coming years suggests a cautious approach, keeping in mind the ongoing reliance on non-GAAP financial measures and economic uncertainties. Investors may view this news as a positive momentum catalyst, yet the company's path to profitability remains a critical consideration in future analyses.

Review our growth performance report to gain insights into SentinelOne's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SentinelOne, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:S

SentinelOne

Operates as a cybersecurity provider in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives