- United States

- /

- Software

- /

- NYSE:RNG

US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As U.S. markets grapple with a tech selloff and concerns about the labor market, investors are seeking stability amid volatility. In this environment, stocks of growth companies with high insider ownership can be particularly appealing due to the confidence that insiders have in their own businesses.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95.9% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| BBB Foods (NYSE:TBBB) | 22.9% | 91.3% |

Here we highlight a subset of our preferred stocks from the screener.

Oddity Tech (NasdaqGM:ODD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Oddity Tech Ltd. is a consumer tech company that creates digital-first brands for the beauty and wellness industries, with a market cap of $2.03 billion.

Operations: The company generates $596.12 million in revenue from its personal products segment.

Insider Ownership: 24.6%

Oddity Tech is currently trading at 59.5% below its estimated fair value, with insider ownership indicating strong confidence in its future. The company forecasts annual earnings growth of 17.07%, outpacing the US market's average of 14.9%. Recent changes include appointing Dr. Ido Bachelet as Chief Science Officer and raising full-year revenue guidance to $633 million-$640 million, reflecting robust sales performance and strategic buybacks totaling $10 million in June 2024 amidst ongoing legal challenges.

- Click to explore a detailed breakdown of our findings in Oddity Tech's earnings growth report.

- Our valuation report here indicates Oddity Tech may be undervalued.

RingCentral (NYSE:RNG)

Simply Wall St Growth Rating: ★★★★☆☆

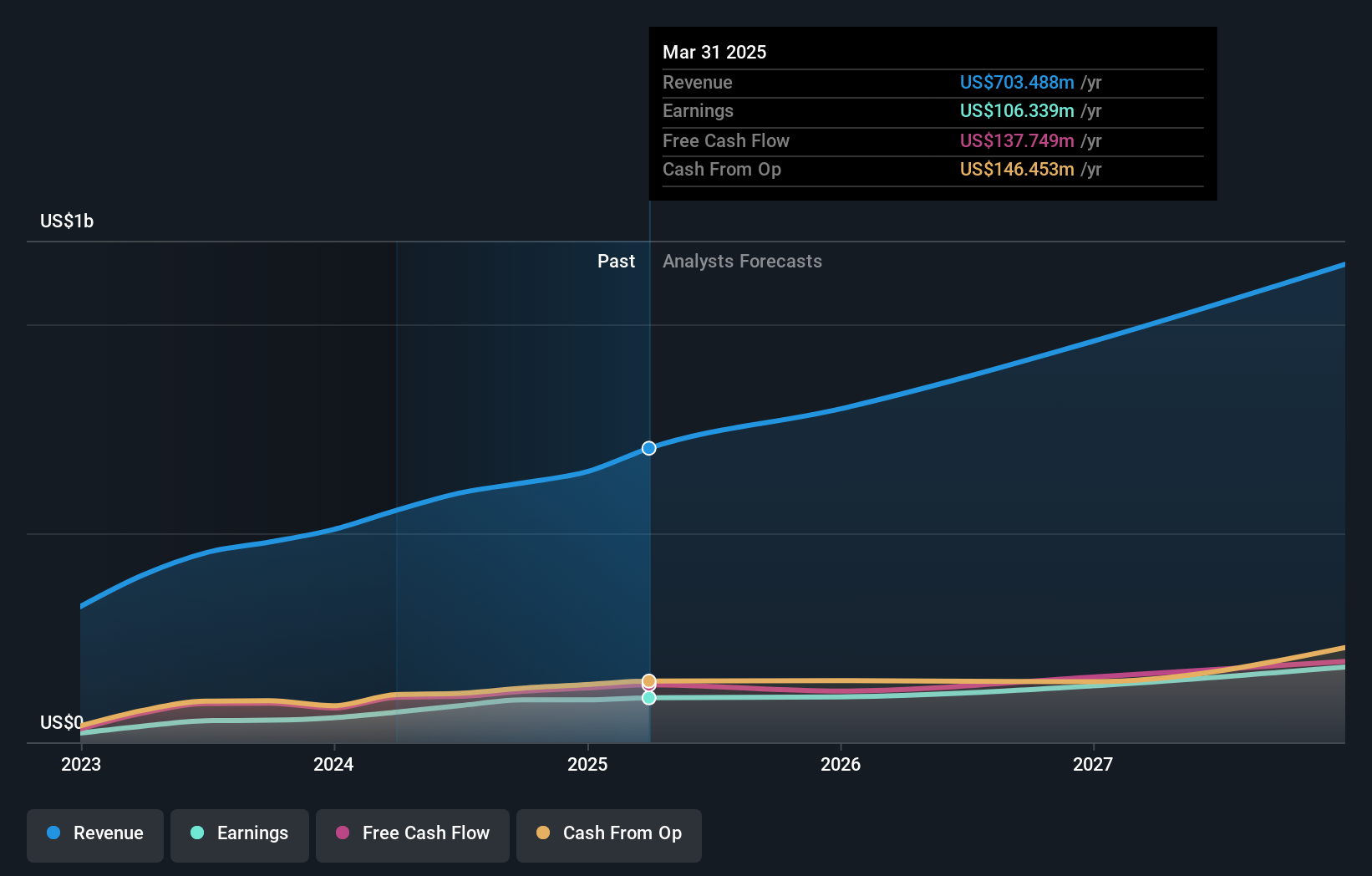

Overview: RingCentral, Inc., with a market cap of $2.68 billion, offers cloud communications, video meetings, collaboration, and contact center software-as-a-service solutions globally.

Operations: The company's revenue from Internet Software & Services is $2.31 billion.

Insider Ownership: 10.3%

RingCentral has shown significant insider confidence with substantial share buybacks, repurchasing 2.65% of shares for US$79.27 million in Q2 2024. Despite a net loss of US$14.75 million in Q2, revenue increased to US$592.91 million from the previous year, and the company raised its full-year revenue guidance to US$2.393 billion-US$2.399 billion, indicating growth potential. The recent resignation of CFO Sonalee Parekh is not related to any financial disagreements within the company.

- Delve into the full analysis future growth report here for a deeper understanding of RingCentral.

- Our valuation report unveils the possibility RingCentral's shares may be trading at a discount.

Warby Parker (NYSE:WRBY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Warby Parker Inc. (NYSE:WRBY) provides eyewear products in the United States and Canada, with a market cap of $1.65 billion.

Operations: Warby Parker generates $719.93 million in revenue from its Medical - Optical Supplies segment in the United States and Canada.

Insider Ownership: 19.7%

Warby Parker has demonstrated strong growth potential with earnings forecasted to grow 116.18% annually and revenue expected to rise 11.4% per year, outpacing the US market average. Insider confidence is evident as more shares were bought than sold in the past three months. Despite recent shareholder dilution, Warby Parker's updated guidance projects net revenue of US$757 million to US$762 million for 2024, reflecting a 13%-14% increase from the previous year.

- Get an in-depth perspective on Warby Parker's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Warby Parker implies its share price may be too high.

Turning Ideas Into Actions

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 179 more companies for you to explore.Click here to unveil our expertly curated list of 182 Fast Growing US Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNG

RingCentral

Provides cloud communications, video meetings, collaboration, and contact center software-as-a-service solutions worldwide.

Undervalued with reasonable growth potential.