Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that RingCentral, Inc. (NYSE:RNG) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for RingCentral

What Is RingCentral's Net Debt?

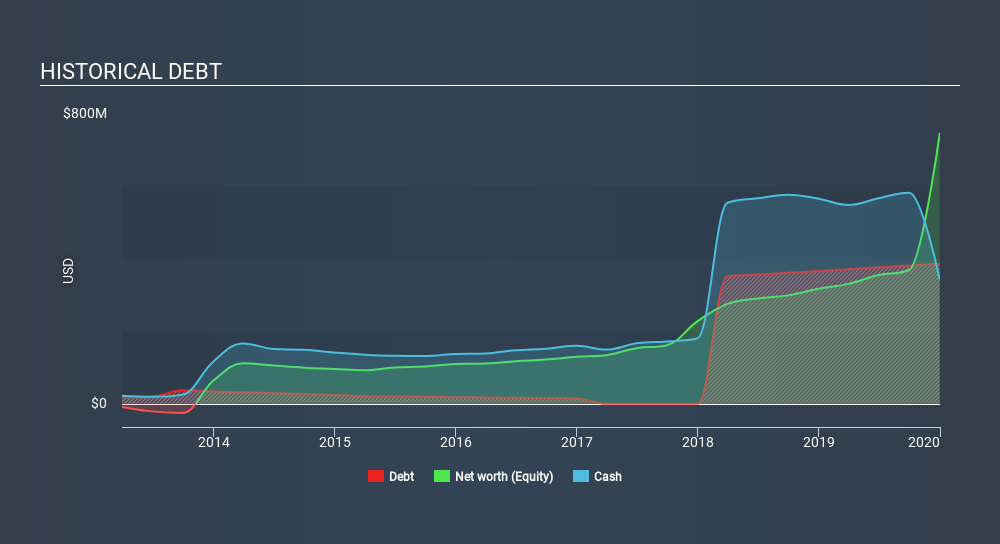

As you can see below, at the end of December 2019, RingCentral had US$386.9m of debt, up from US$366.6m a year ago. Click the image for more detail. However, because it has a cash reserve of US$343.6m, its net debt is less, at about US$43.3m.

How Healthy Is RingCentral's Balance Sheet?

We can see from the most recent balance sheet that RingCentral had liabilities of US$280.7m falling due within a year, and liabilities of US$424.3m due beyond that. On the other hand, it had cash of US$343.6m and US$130.0m worth of receivables due within a year. So it has liabilities totalling US$231.5m more than its cash and near-term receivables, combined.

This state of affairs indicates that RingCentral's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the US$16.6b company is short on cash, but still worth keeping an eye on the balance sheet. Carrying virtually no net debt, RingCentral has a very light debt load indeed. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine RingCentral's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year RingCentral wasn't profitable at an EBIT level, but managed to grow its revenue by 34%, to US$903m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

While we can certainly savour RingCentral's tasty revenue growth, its negative earnings before interest and tax (EBIT) leaves a bitter aftertaste. To be specific the EBIT loss came in at US$33m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. However, it doesn't help that it burned through US$69m of cash over the last year. So suffice it to say we do consider the stock to be risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with RingCentral (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:RNG

RingCentral

Provides cloud business communications, contact center, video, and hybrid event solutions in North America and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives