- United States

- /

- Software

- /

- NYSE:RNG

Did RingCentral's (RNG) Gartner Recognition and Expo Spotlight Just Shift Its Competitive Edge?

Reviewed by Sasha Jovanovic

- On October 29, 2025, RingCentral presented at the Contact Center Expo in Orlando, shortly after being recognized as a Leader in the 2025 Gartner Magic Quadrant for Unified Communications as a Service for the eleventh consecutive year.

- This acknowledgment from Gartner underscores RingCentral's sustained advancements in AI-driven unified communications and highlights its leading position in contact center solutions amid a competitive industry landscape.

- We'll explore how RingCentral's repeated leadership in the Gartner Magic Quadrant may strengthen its future growth prospects and competitive advantage.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

RingCentral Investment Narrative Recap

To own shares in RingCentral, you need to believe the company will maintain its leadership in unified communications, relying on innovation in AI-powered products and trusted partnerships to drive growth despite increasing competition from bundled productivity suites. Recognition as a Leader in Gartner’s 2025 Magic Quadrant may strengthen perceptions of RingCentral’s competitive edge, but it does not materially change concerns around encroaching bundled competitors, which remain the largest current risk, nor does it clearly shift short-term catalysts ahead of the next earnings release.

Among recent developments, RingCentral’s expanded partnership with NiCE, aimed at enhancing customer engagement with its Contact Center solution, is especially timely, connecting directly to the company's positioning at the Contact Center Expo and underscoring a catalyst: new AI and integration-driven product expansion aimed at boosting customer adoption and sticky, recurring revenue streams.

However, if enterprise customers continue to favor fully bundled suites over specialized solutions, the risk to long-term growth persists and investors should not overlook...

Read the full narrative on RingCentral (it's free!)

RingCentral's narrative projects $2.8 billion revenue and $219.0 million earnings by 2028. This requires 5.0% yearly revenue growth and a $231.2 million earnings increase from the current -$12.2 million.

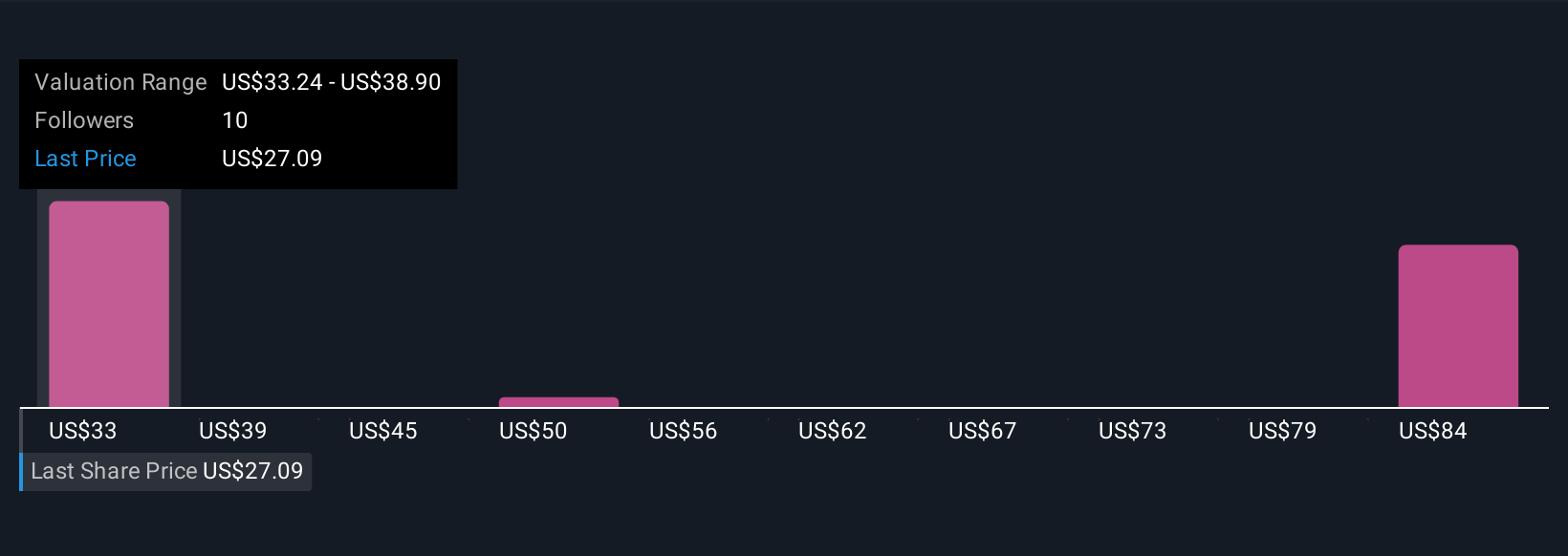

Uncover how RingCentral's forecasts yield a $33.24 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided four fair value opinions ranging from US$33.24 to US$90.61 per share, reflecting very wide expectations for RingCentral’s future. While some participants see deep undervaluation, recurring concerns about pressure from bundled competitors continue to influence broader performance debates, so it pays to consider multiple approaches before deciding where you stand.

Explore 4 other fair value estimates on RingCentral - why the stock might be worth over 2x more than the current price!

Build Your Own RingCentral Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RingCentral research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free RingCentral research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RingCentral's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNG

RingCentral

Provides cloud business communications, contact center, video, and hybrid event solutions in North America and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives