- United States

- /

- Software

- /

- NYSE:RBRK

Will Cognizant Partnership and Subscription-Based Resilience Shift Rubrik’s (RBRK) Investment Narrative?

Reviewed by Sasha Jovanovic

- In late October 2025, Cognizant announced an expanded partnership with Rubrik to launch Business Resilience-as-a-Service (BRaaS), a subscription-based solution aimed at helping enterprises recover rapidly from cyber incidents and ransomware attacks by aligning IT recovery with business objectives.

- This collaboration marks one of the first pay-as-you-go models for BRaaS, combining advanced AI security and cyber resilience capabilities to address the growing risks associated with enterprise AI adoption and increasingly sophisticated cyber threats.

- We'll explore how this partnership, particularly its focus on subscription-based resilience for AI-driven enterprises, could influence Rubrik's investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Rubrik Investment Narrative Recap

To hold Rubrik stock, an investor needs confidence in the company’s ability to deliver recurring value in enterprise data security and cyber resilience, especially as AI adoption reshapes digital infrastructure. The recent partnership with Cognizant to deliver Business Resilience-as-a-Service (BRaaS) may strengthen Rubrik’s near-term growth story by reinforcing its recurring revenue model, though it does not fully resolve the short-term risk of fierce competition among cyber resilience providers.

Of Rubrik’s recent announcements, the launch of Rubrik Agent Cloud stands out as highly relevant, spotlighting the firm’s focus on safe AI implementation. This aligns directly with the BRaaS offering, since overseeing AI agent security and providing rapid recovery from cyber incidents are now central to enterprise IT strategies, a key area where Rubrik’s ongoing innovation could support customer adoption of both its platform and subscription services.

Conversely, those considering Rubrik should also be aware that intensified competition in cyber resilience could limit potential share gains when...

Read the full narrative on Rubrik (it's free!)

Rubrik's narrative projects $2.0 billion revenue and $257.3 million earnings by 2028. This requires 26.2% yearly revenue growth and a $782.1 million increase in earnings from -$524.8 million today.

Uncover how Rubrik's forecasts yield a $115.20 fair value, a 51% upside to its current price.

Exploring Other Perspectives

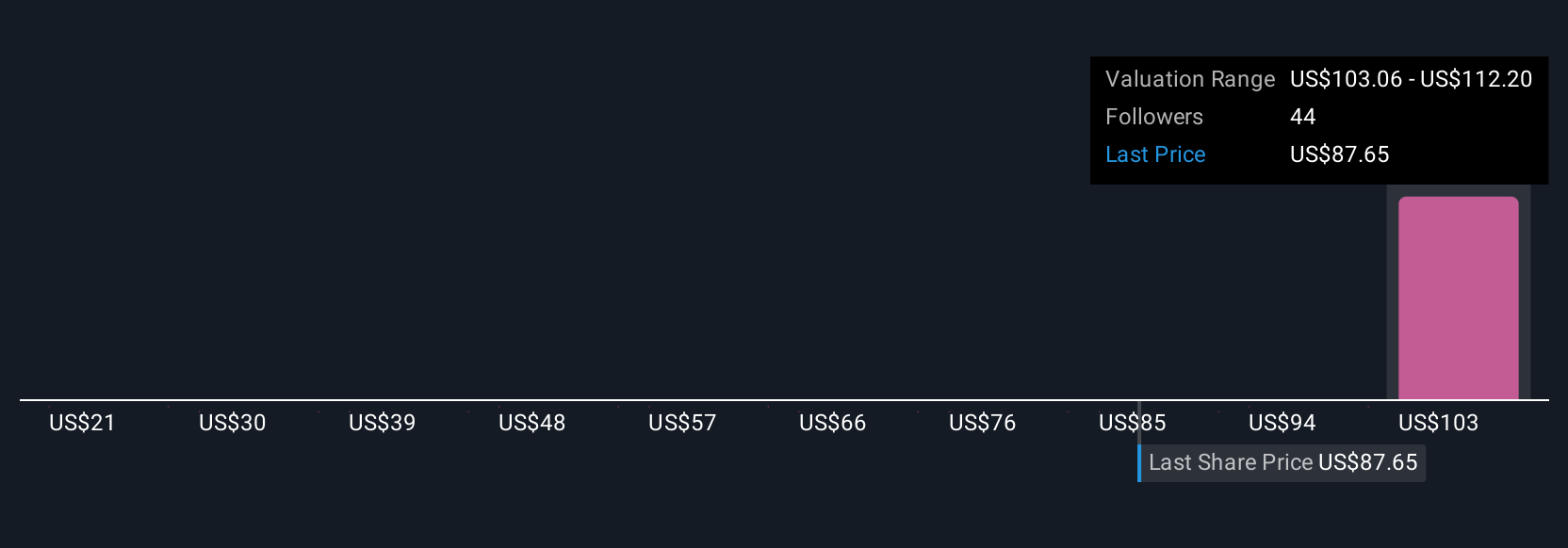

Simply Wall St Community members see fair value for Rubrik between US$20.80 and US$115.85, across 11 opinions. With competition intensifying among cyber resilience firms, these divergent views reflect the broader debate over Rubrik’s ability to outpace rivals and drive sustained customer demand.

Explore 11 other fair value estimates on Rubrik - why the stock might be worth less than half the current price!

Build Your Own Rubrik Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rubrik research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Rubrik research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rubrik's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBRK

Rubrik

Provides data security solutions to individuals and businesses worldwide.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives