- United States

- /

- Software

- /

- NYSE:RBRK

What Rubrik (RBRK)'s Expanded Amazon Cloud Data Protection Means For Shareholders

Reviewed by Simply Wall St

- Earlier this month, Rubrik expanded its data protection services, unveiling upcoming support for Amazon DynamoDB and launching a proprietary cyber resilience offering for Amazon RDS for PostgreSQL, aiming to address rising data security, compliance, and backup challenges.

- This development provides customers with centralized control, cost efficiency, and automated, immutable protection for critical cloud databases, fulfilling demand for robust and unified cloud data security solutions.

- We'll examine how Rubrik's enhanced support for Amazon cloud databases may influence its outlook in the enterprise security market.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

Rubrik Investment Narrative Recap

To be a Rubrik shareholder, you generally have to believe in the company’s ability to lead in cloud data security as enterprises move more workloads to the cloud. The recent expansion to Amazon DynamoDB and RDS for PostgreSQL directly supports the key short-term catalyst: increased adoption of Rubrik’s cyber resilience services among cloud-first enterprises, while the largest current risk, intense competition in the cyber resilience market, remains unchanged by this event.

Among recent company announcements, the launch of the Rackspace Cyber Recovery Service in May 2025 is particularly relevant. This collaboration amplifies Rubrik’s capabilities in ransomware recovery, tying in closely with the company’s broad push into automated, scalable cloud security, a theme reinforced by last week’s news on expanded database protection features.

Yet, while Rubrik’s new database offerings could help grow its user base, investors should also be aware of the ongoing risks from aggressive competition...

Read the full narrative on Rubrik (it's free!)

Rubrik's outlook estimates $2.0 billion in revenue and $261.3 million in earnings by 2028. This scenario requires 26.4% annual revenue growth and a $786.1 million improvement in earnings from the current -$524.8 million.

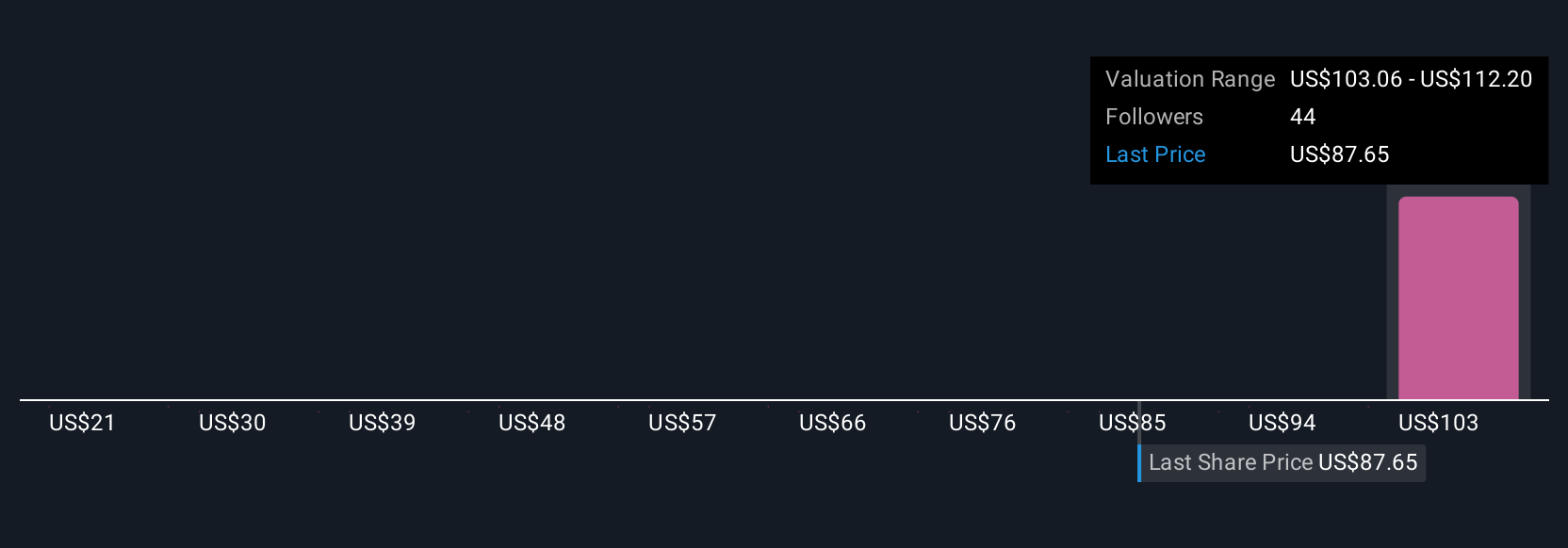

Uncover how Rubrik's forecasts yield a $112.20 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community fair value estimates for Rubrik range widely from US$20.80 to US$112.20 per share. While opinions diverge, rapid expansion in cloud cyber resilience offerings could affect future growth expectations.

Explore 6 other fair value estimates on Rubrik - why the stock might be worth as much as 29% more than the current price!

Build Your Own Rubrik Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rubrik research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Rubrik research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rubrik's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBRK

Rubrik

Provides data security solutions to individuals and businesses worldwide.

Fair value low.

Similar Companies

Market Insights

Community Narratives