- United States

- /

- Software

- /

- NYSE:RBRK

Rubrik (RBRK) Revenue Jumps With Improved Earnings Guidance For Fiscal Year 2026

Reviewed by Simply Wall St

Rubrik (RBRK) recently reported a 13% share price increase over the last month, amid notable developments including its earnings announcement revealing a significant improvement in financial metrics. The company's second quarter revenue surged to $310 million, coupled with a narrowed net loss, reflecting operational advancements. Market trends like new highs in the S&P 500 and Nasdaq, along with lower wholesale inflation indications from the PPI data, also played a supportive role. Rubrik's positive guidance for the upcoming quarter aligns with optimism seen across tech sectors, with Oracle's AI-driven boom further highlighting the sector's robust outlook.

The recent 13% rise in Rubrik's share price amidst positive earnings, improved financial metrics, and supportive market conditions reinforces the company's strategic focus on growth areas like cyber resilience and data security. These developments align with Rubrik's expansions in its total addressable market and competitive positioning. Over the last year, Rubrik delivered a total return of 211.91%, significantly outperforming both the US Software industry, which returned 27.3%, and the broader US Market with its 20% return. This substantial performance provides a strong context for current investor sentiment and expected future growth.

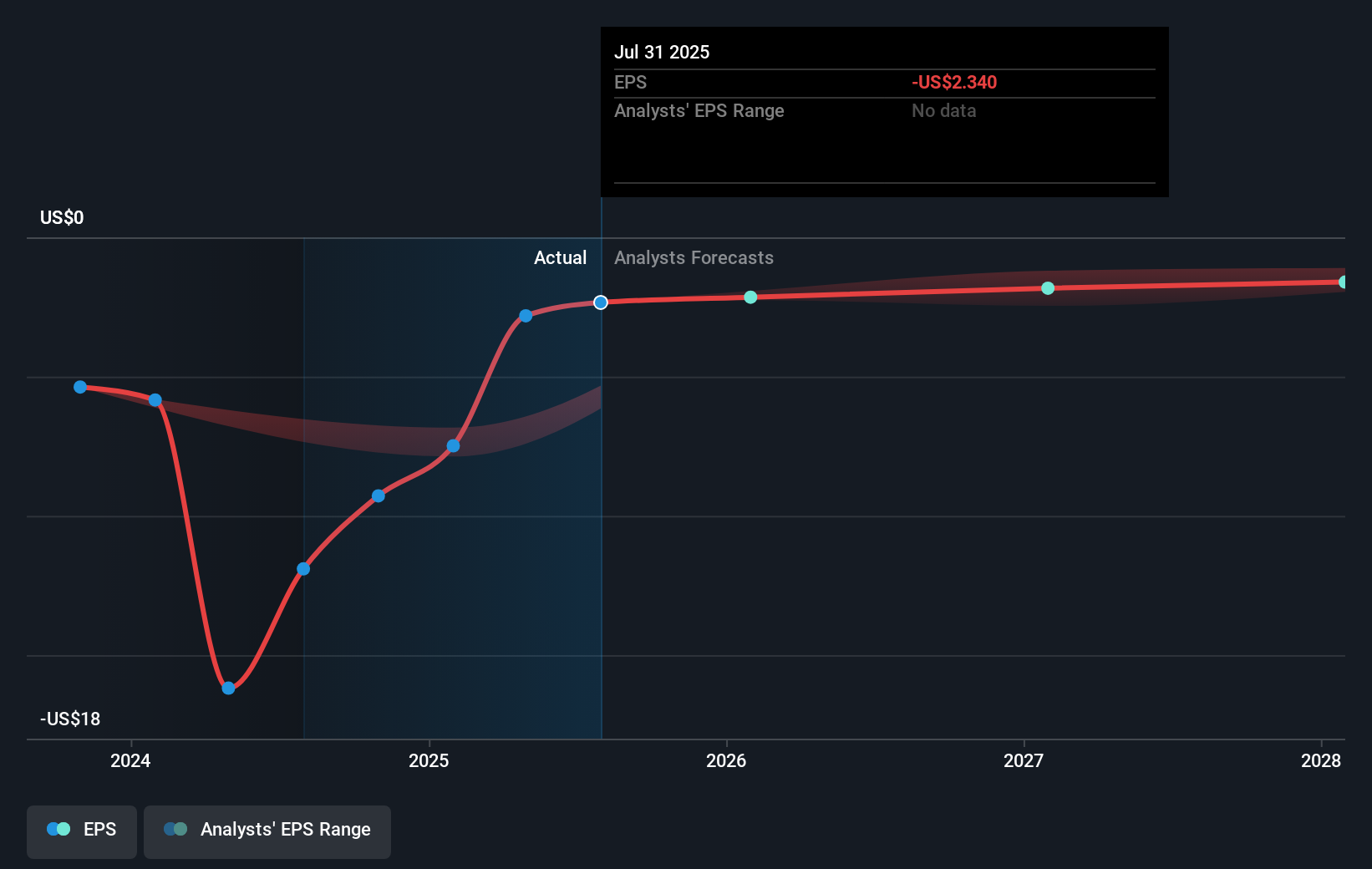

The positive developments announced by Rubrik are likely to enhance revenue and earnings forecasts, driven by its advancements in identity recovery and strategic partnerships. With a current share price of US$98.50, the target price of US$112.68 suggests potential upside, representing a 14.40% discount to the consensus target. While Rubrik's revenue is forecast to grow at 19.09% annually, it remains unprofitable, reflecting the industry's broader challenges. This context is crucial for assessing Rubrik's valuation and growth potential amidst existing market risks and opportunities.

Examine Rubrik's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBRK

Rubrik

Provides data security solutions to individuals and businesses worldwide.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success