- United States

- /

- Software

- /

- NYSE:RBRK

Rubrik (RBRK): Evaluating Valuation After Strong Q2 Growth and Expanded Cybersecurity Offerings

Reviewed by Kshitija Bhandaru

Rubrik (RBRK) surged into the spotlight after reporting fiscal second-quarter revenue growth of 51%, which outpaced consensus estimates and highlighted strong momentum in large enterprise adoption and the company’s evolving cybersecurity focus.

See our latest analysis for Rubrik.

Even with Rubrik’s 51% surge in quarterly revenue making headlines, the stock has notched a robust year-to-date share price return of 16.4%. Its total shareholder return over the past year sits at an impressive 95.3%. That strong one-year figure stands out and signals momentum is building as Rubrik leans into cybersecurity and captures growing enterprise demand, even if recent weeks saw some volatility.

If Rubrik’s breakout year has you scanning for other tech leaders on the rise, you might enjoy exploring See the full list for free..

But with such strong results and soaring one-year returns, the key question now is whether Rubrik's current share price reflects its growth potential, or if the market is leaving room for further upside for new investors to capture.

Most Popular Narrative: 33% Undervalued

Rubrik’s most widely held narrative points to a fair value well above the last close, hinting that analysts see room for meaningful upside from current levels.

Rubrik's innovations and strategic cybersecurity focus enhance market share, revenue growth, and competitive positioning while expanding their total addressable market. Partnerships and enhanced recovery capabilities leverage enterprise needs, improving customer retention and profitability, fueling earnings growth and expanding their data security footprint.

Want to know the bold math behind analysts’ hefty price target? The calculus here depends on sky-high profit and growth assumptions, some borrowed from the industry’s very best. Find out which financial levers are driving this valuation and why future earnings potential is such a flashpoint in the debate.

Result: Fair Value of $115.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, aggressive competition and potential delays in AI and cloud adoption could challenge Rubrik’s growth story and disrupt the optimistic analyst outlook.

Find out about the key risks to this Rubrik narrative.

Another View: What Do Valuation Ratios Say?

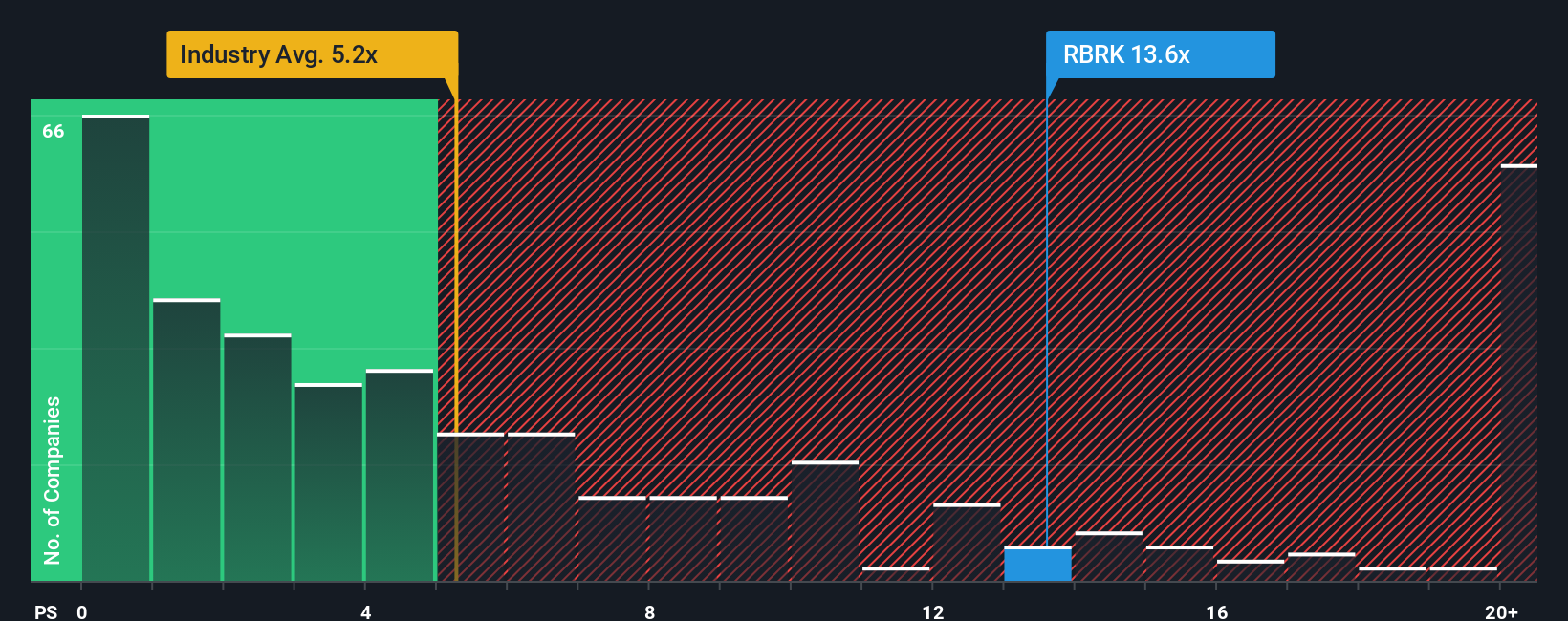

Looking at how the stock is priced versus its sales, Rubrik trades at a 14.1x ratio, which is well above both the average for US software peers (5x) and above what the market suggests would be a fair ratio (12x). This could mean investors are paying a high premium for expected growth. Does this stretch the risk for new buyers, or signal the market is betting on something big ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rubrik Narrative

If you think there’s more to Rubrik’s story or want to run your own numbers, you can quickly craft your own take on the company and share fresh insights. Do it your way.

A great starting point for your Rubrik research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Let your next big move count. The right stock idea, found early, can make all the difference. Tap into smarter investing strategies by checking out these handpicked stock ideas before they start trending and slip away from the spotlight.

- Unlock the potential of future health breakthroughs by checking out these 33 healthcare AI stocks, which targets companies at the forefront of medical technology powered by advanced AI.

- Boost your income stream now by exploring these 18 dividend stocks with yields > 3%, where generous dividend yields and solid business foundations put steady returns within reach.

- Take your portfolio to new heights by scanning these 26 quantum computing stocks, featuring companies pioneering the next era of computing with revolutionary quantum innovations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBRK

Rubrik

Provides data security solutions to individuals and businesses worldwide.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives