- United States

- /

- Software

- /

- NYSE:RBRK

Rubrik (RBRK): Evaluating Valuation After New AWS Partnership Highlights Cybersecurity and AI Ambitions

Reviewed by Simply Wall St

Rubrik (RBRK) announced a new strategic collaboration agreement with Amazon Web Services. The partnership aims to advance cybersecurity and AI-powered data protection for organizations using the cloud. This move highlights Rubrik’s focus on strengthening cyber resilience and recovery capabilities.

See our latest analysis for Rubrik.

Rubrik’s strategic tie-up with AWS has sparked investor enthusiasm, as shown by a 4.16% jump in the share price on the day of the announcement. While the last month saw a -7.61% share price return, momentum has been strong overall. Rubrik’s year-to-date share price is up 14.65%, and the 1-year total shareholder return stands out at 71.64% as the market grows confident in its expansion story.

If the cybersecurity spotlight on Rubrik caught your attention, it’s worth discovering what’s happening with other innovative tech and AI companies. See the full list here: See the full list for free.

Given the rapid share price gains and robust expansion in partnership with AWS, the question now is whether Rubrik’s valuation still offers upside for investors or if the market has already priced in its growth story.

Most Popular Narrative: 34% Undervalued

Compared to Rubrik's last close at $76.07, the most-watched narrative sees fair value at $115.20. This substantial gap highlights high expectations for future growth and margin expansion, inviting debate about what is driving such a premium.

Rubrik's strategic focus on cyber resilience, particularly through innovations like their Rubrik Security Cloud and integration with DSPM, positions them strongly against competitors. This suggests potential future gains in market share and revenue growth. The company's pivotal role at the intersection of data security and AI, especially through products like Annapurna, can expand their total addressable market (TAM). This could potentially drive future revenue growth and enhance their market position in this expanding field.

Wondering what powers such a large upside? The narrative hinges on bold assumptions, including a relentless pace of revenue expansion, transformative new product strategies, and a profit margin leap that would outpace almost all peers. Can Rubrik actually achieve these lofty financial targets and justify this high fair value? The full story holds the keys.

Result: Fair Value of $115.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, aggressive competition and the uncertain pace of AI adoption remain significant risks. These factors could challenge Rubrik’s ambitious growth projections in the years ahead.

Find out about the key risks to this Rubrik narrative.

Another View: Multiples Tell a Different Story

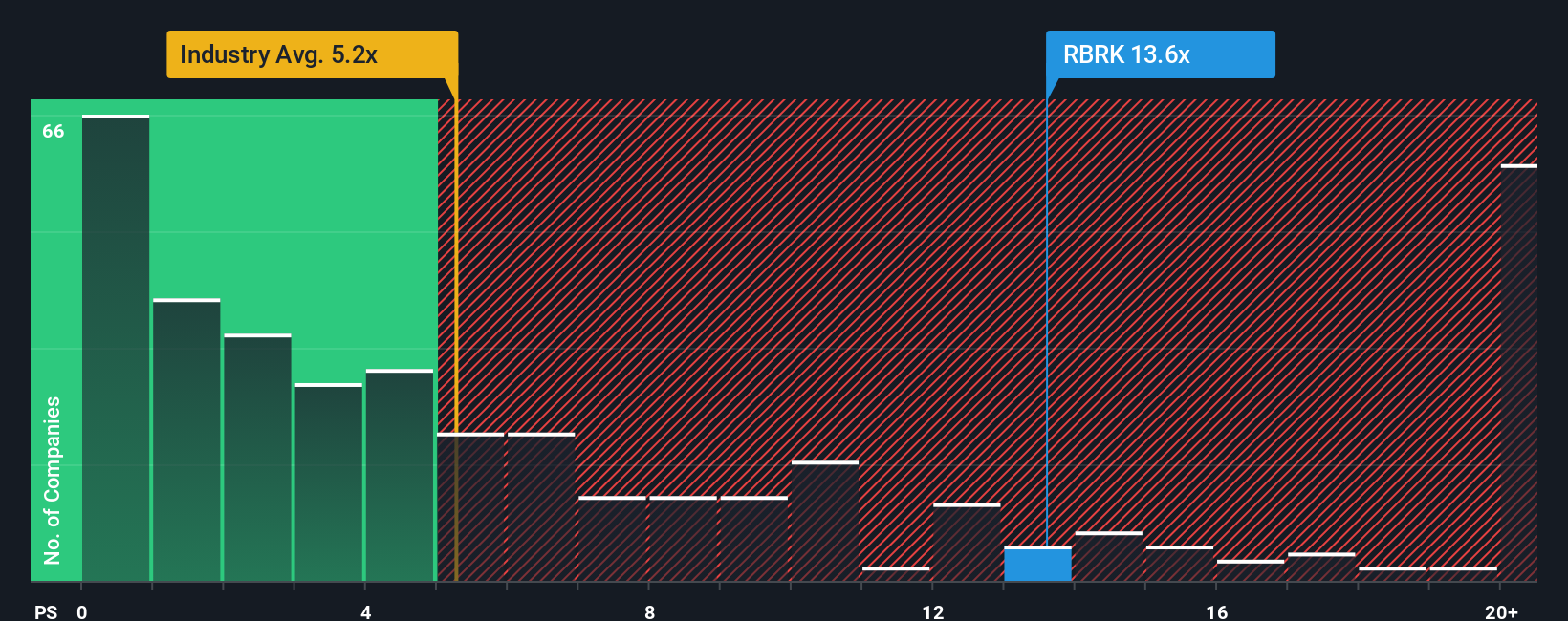

Looking at Rubrik through its price-to-sales ratio, the shares look expensive compared to both the US Software industry and close peers. Rubrik trades at 13.9 times sales, while the industry average is just 4.8 and the peer group sits at 8.4. Even the fair ratio, estimated at 11.9, is lower than where Rubrik trades today. This gap flags a valuation risk if growth does not accelerate or if market sentiment shifts suddenly. Could high expectations run ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rubrik Narrative

If you have a different perspective or want to dig into the numbers on your own, you can craft a personal analysis in just a few minutes. Do it your way

A great starting point for your Rubrik research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready to Uncover More Opportunities?

Smart investors never settle for just the obvious choice. Make your next move count by finding high-potential stocks others might overlook using these hand-picked ideas:

- Tap into steady cash returns by evaluating top companies offering attractive yields through these 16 dividend stocks with yields > 3%.

- Seize the chance to get ahead of trends with technology pioneers shaping tomorrow’s breakthroughs using these 24 AI penny stocks.

- Find undervalued gems primed for strong future returns by investigating these 863 undervalued stocks based on cash flows before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBRK

Rubrik

Provides data security solutions to individuals and businesses worldwide.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives