- United States

- /

- Software

- /

- NYSE:RAMP

LiveRamp (RAMP): How New Meta Attribution Tools Shape the Valuation Outlook for This Data Collaboration Leader

Reviewed by Simply Wall St

LiveRamp Holdings (RAMP) has just rolled out new measurement capabilities that let retail media networks link outcomes from Meta campaigns to their own sales data. This upgrade enhances how retailers evaluate digital ad performance, especially around Meta platforms.

See our latest analysis for LiveRamp Holdings.

LiveRamp’s new attribution tools come after a choppy year for the stock, with its 1-year total shareholder return sitting at 9.05%. Despite some recent volatility, the company’s three-year total return of 68.77% suggests that longer-term momentum remains positive, even as the share price is down 9.65% year-to-date. Investors seem to be weighing strong product innovation against near-term shifts in risk perception.

If you’re weighing opportunities outside the software space, this might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading at a notable discount to analyst targets and momentum in product innovation, investors may wonder whether LiveRamp is undervalued at current levels or if the market has already priced in future growth potential.

Most Popular Narrative: 31% Undervalued

LiveRamp's fair value, according to the most widely followed narrative, stands at $39.63, placing it well above the last closing price of $27.34. This disconnect highlights bullish sentiment around future growth and a belief that current levels could represent an attractive opportunity.

As digital advertising shifts rapidly towards AI-powered personalization and omni-channel engagement, the proliferation of AI agents and the growing complexity of customer journeys are increasing the need for secure, interoperable data connectivity and identity infrastructure that can maximize the value of first-party, cross-partner, and contextual data. LiveRamp's positioning as a neutral enabler for AI-driven marketing across fragmented data sources is likely to drive sustained multi-year revenue growth.

What powers this ambitious price target? The answer lies in bold growth assumptions for earnings and profit margins that outpace industry norms. Eager to decode which future milestones drive analysts’ confidence? See what’s behind the curtain in the full narrative.

Result: Fair Value of $39.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued reliance on a few large customers and increasing competition could threaten LiveRamp’s growth and challenge the optimistic long-term outlook.

Find out about the key risks to this LiveRamp Holdings narrative.

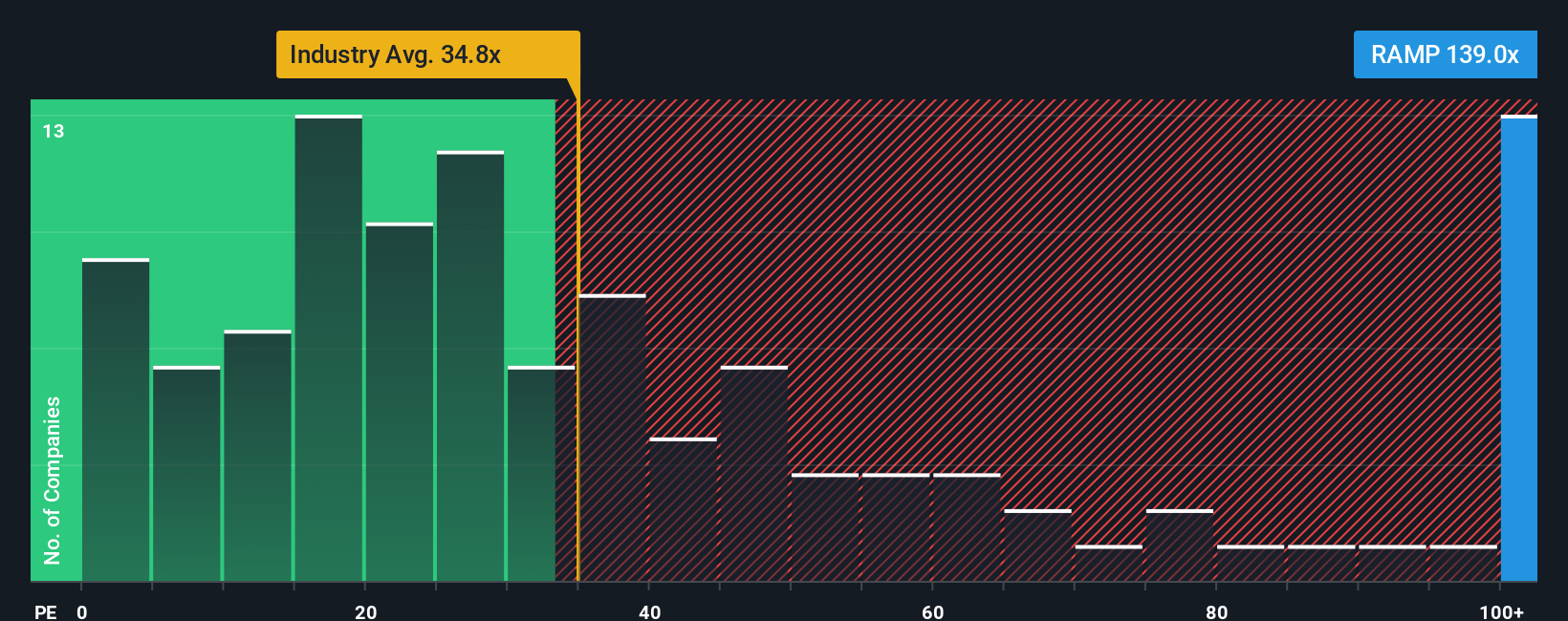

Another View: Market Multiples Tell a Different Story

While analysts see an undervalued opportunity, the market's price-to-earnings ratio for LiveRamp sits at a lofty 140.9x. This is far higher than both peers at 30.5x and the industry average at 34.9x. Even the fair ratio is set at 56.2x. Does this valuation point to risk being overlooked, or is rapid growth set to close the gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LiveRamp Holdings Narrative

If you see things differently or want to dig into the numbers on your own terms, you can build your own LiveRamp investment case in just a few minutes, your way with Do it your way.

A great starting point for your LiveRamp Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Opportunities?

Don't let your next big investment pass you by. Take the lead and power up your portfolio with stock ideas tailored to today's trends and tomorrow's growth.

- Catch rising stars delivering solid financials. Jump on these 3590 penny stocks with strong financials before the crowd spots their potential.

- Capitalize on breakthrough healthcare innovation by reviewing these 33 healthcare AI stocks that is reshaping medicine, diagnostics, and patient outcomes worldwide.

- Unlock value that others overlook by targeting these 840 undervalued stocks based on cash flows, where strong fundamentals meet attractive pricing for savvy investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RAMP

LiveRamp Holdings

A technology company, operates a data collaboration platform in the United States, Europe, the Asia-Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives