- United States

- /

- Software

- /

- NYSE:QTWO

Will Q2 Holdings (QTWO) Gain Competitive Ground by Deepening Family Banking Features?

Reviewed by Simply Wall St

- Greenlight recently announced an integration with Q2 Holdings' Digital Banking Platform through the Q2 Partner Accelerator Program, enabling financial institutions to offer Greenlight's debit card and financial literacy app directly within their digital banking applications.

- This collaboration brings Greenlight’s interactive financial literacy tools to Q2 clients’ families, equipping parents and children with hands-on financial management and education features inside familiar banking platforms.

- We'll examine how integrating Greenlight's financial literacy features could enhance Q2 Holdings' appeal to financial institutions seeking expanded client value.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Q2 Holdings Investment Narrative Recap

For an investor to be optimistic about Q2 Holdings, Inc., belief in the company’s ability to broaden digital banking capabilities for clients, especially through innovation that drives recurring subscription revenue, is key. The Greenlight integration, while boosting the platform’s suite of family and financial literacy tools, is not expected to materially impact near-term revenue expansion, and uncertainties remain about how quickly it will enhance retention or new client acquisition. The most immediate risk is ongoing pressure on the revenue mix due to a shift away from services revenue as macroeconomic and discretionary spending headwinds persist.

A relevant prior announcement is the launch of Direct ERP, which integrates banking directly with ERP systems to improve treasury management for commercial clients. This effort, like the Greenlight integration, fits Q2 Holdings' broader push to reinforce their platform’s value and grow subscription-based revenue, but the overall effectiveness remains tied to demand from financial institutions amid cautious spending.

By contrast, investors should also consider the impact of continued declines in services revenue on Q2’s revenue mix and what this could mean for future growth…

Read the full narrative on Q2 Holdings (it's free!)

Q2 Holdings' outlook anticipates $979.1 million in revenue and $104.5 million in earnings by 2028. This is based on a 10.8% annual revenue growth rate and a $124.4 million earnings increase from current earnings of -$19.9 million.

Uncover how Q2 Holdings' forecasts yield a $101.26 fair value, a 12% upside to its current price.

Exploring Other Perspectives

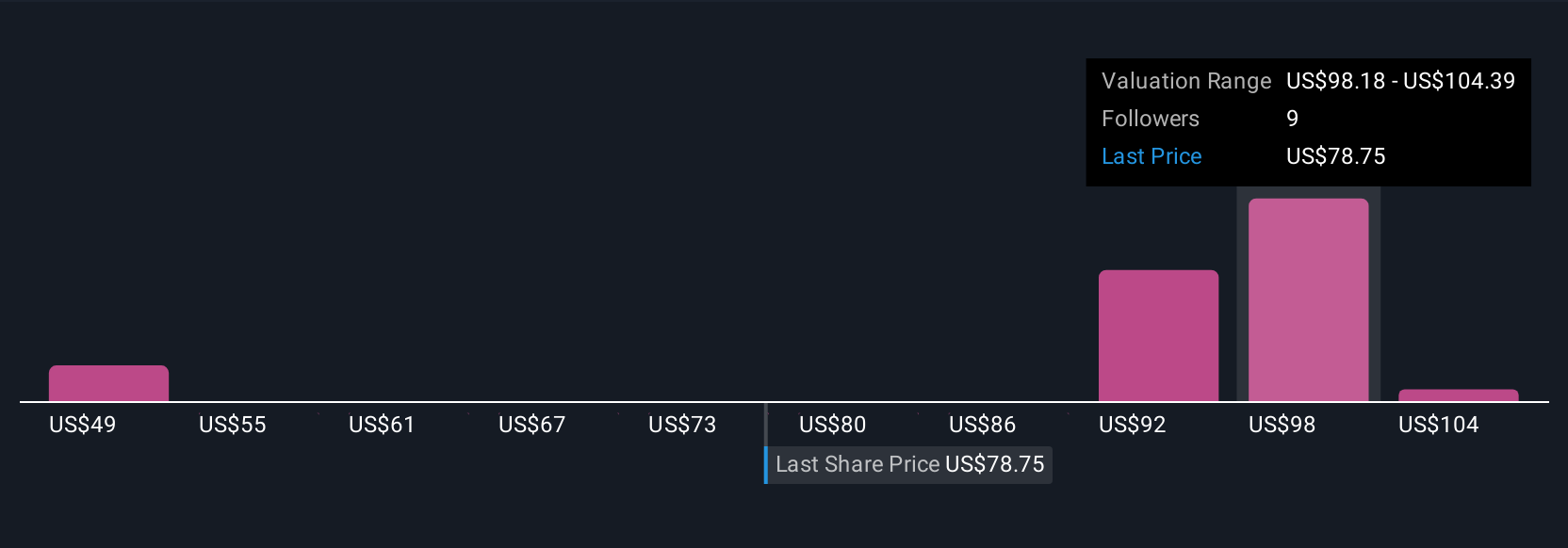

Five private investors in the Simply Wall St Community placed fair values for Q2 Holdings between US$48.51 and US$110.60 per share. While many see an expanding toolkit as a growth engine, ongoing shifts in revenue mix show how opinions and expectations around future performance can differ widely, so it’s worth exploring several perspectives.

Explore 5 other fair value estimates on Q2 Holdings - why the stock might be worth 47% less than the current price!

Build Your Own Q2 Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Q2 Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Q2 Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Q2 Holdings' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q2 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QTWO

Q2 Holdings

Provides digital solutions to financial institutions, financial technology companies, FinTechs, and alternative finance companies (Alt-FIs) in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives