- United States

- /

- Software

- /

- NYSE:QTWO

Q2 Holdings (QTWO) Is Down 13.2% After Return to Profitability and Upgraded 2025 Outlook – What's Changed

Reviewed by Simply Wall St

- Q2 Holdings recently reported its second quarter results for 2025, achieving US$195.15 million in sales and posting net income of US$11.76 million after a loss in the previous year, alongside issuing an improved revenue outlook for both the next quarter and full year.

- Notably, the company also announced a new integration with Greenlight, expanding its digital banking platform's capabilities in financial literacy and family finance tools for its clients' account holders.

- We'll explore how Q2 Holdings' return to profitability and optimistic revenue guidance impact its overall investment narrative going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Q2 Holdings Investment Narrative Recap

To be a shareholder in Q2 Holdings, you would need to believe in the ongoing digitization of banking services and the company's ability to grow its subscription-based business with financial institutions. The recent return to profitability and raised revenue guidance directly strengthen the top short-term catalyst, growth in high-margin, recurring revenue streams. However, the biggest risk remains any slowdown in client renewals or expansions, which could still be influenced by broader economic conditions. These results do not eliminate that uncertainty, but they do add reassurance for now.

The recent integration of Greenlight into Q2 Holdings’ digital banking platform stands out, as it enhances financial literacy and family finance offerings for clients’ account holders. This move aligns with the company’s emphasis on expanding client value through innovation, supporting the catalyst of deepening customer engagement and retention. As Q2 focuses on building additional digital tools for its user base, partnerships like this reinforce its earnings visibility through sticky, subscription recurring revenues.

Yet, in contrast to this improved outlook, investors should be aware that customer renewal decisions remain a key unknown...

Read the full narrative on Q2 Holdings (it's free!)

Q2 Holdings' outlook anticipates $979.1 million in revenue and $104.5 million in earnings by 2028. This is based on an annual revenue growth rate of 10.8% and reflects a $124.4 million increase in earnings from the current -$19.9 million.

Uncover how Q2 Holdings' forecasts yield a $101.26 fair value, a 29% upside to its current price.

Exploring Other Perspectives

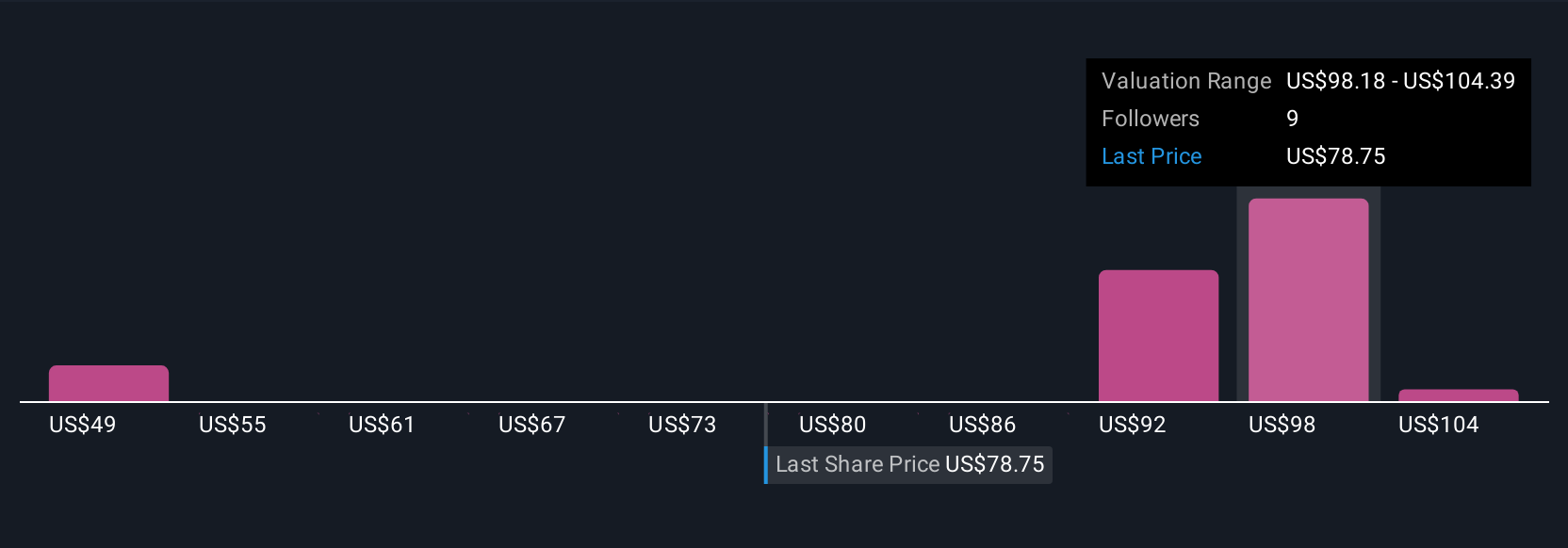

Fair value estimates from the Simply Wall St Community span from US$48.51 to US$110.60, reflecting five very different individual opinions. Subscription revenue growth underpins earnings momentum, but you can see how many viewpoints shape the company's broader outlook.

Explore 5 other fair value estimates on Q2 Holdings - why the stock might be worth as much as 40% more than the current price!

Build Your Own Q2 Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Q2 Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Q2 Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Q2 Holdings' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q2 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QTWO

Q2 Holdings

Provides digital solutions to financial institutions, financial technology companies, FinTechs, and alternative finance companies (Alt-FIs) in the United States.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives