- United States

- /

- Software

- /

- NYSE:QBTS

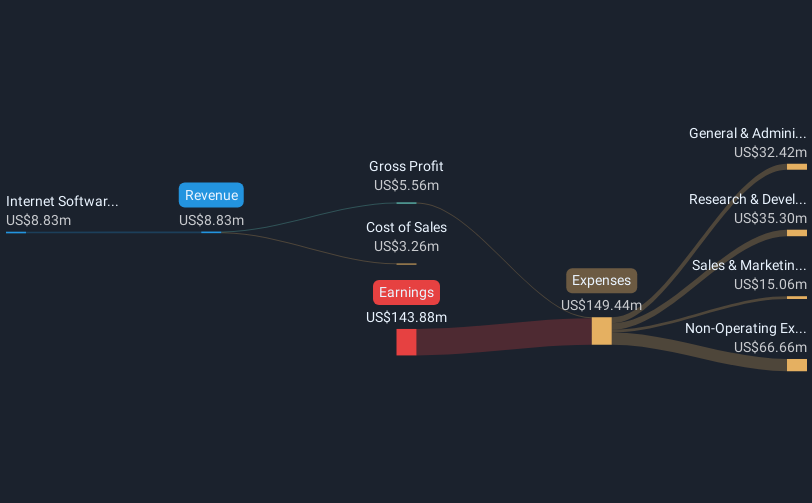

D-Wave Quantum (NYSE:QBTS) Reports US$15 Million Sales, Reduces Net Loss To US$5 Million

Reviewed by Simply Wall St

D-Wave Quantum (NYSE:QBTS) recently reported its first-quarter earnings, showcasing strong revenue growth and a reduced net loss, pivotal developments given the broader stock move of 79% over the last quarter. The company's announcement of significant product advancements and partnerships, including a deal with Ford Otosan, has likely bolstered investor confidence. This occurs against the backdrop of a market that has shown slight gains, with the Dow and Nasdaq reflecting a mixed sentiment due to broader economic factors like US-China trade talks. Overall, D-Wave's developments align positively with recent market trends.

Over the past year, D-Wave Quantum's shares delivered a very large total return of 695.42%, indicating robust long-term performance. In comparison, the company's one-year return significantly outpaced the US market's return of 8.2% and the US Software industry's 15.2% return, showcasing its ability to attract investor attention within a relatively short timeframe.

The company's impressive revenue growth and narrowing of net loss as reported recently suggest a positive impact on its revenue and earnings forecasts. However, despite this positive momentum, D-Wave Quantum's current share price remains slightly below the consensus analyst price target, indicating potential for further growth if company developments continue to inspire investor confidence and materialize as anticipated advancements. The price target stands above the current pricing, reinforcing the market's expectations for continued improvement in the company's fundamentals.

Click to explore a detailed breakdown of our findings in D-Wave Quantum's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QBTS

D-Wave Quantum

Develops and delivers quantum computing systems, software, and services worldwide.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives