- United States

- /

- Software

- /

- NYSE:PRO

PROS Holdings, Inc. (NYSE:PRO) Shares Fly 30% But Investors Aren't Buying For Growth

PROS Holdings, Inc. (NYSE:PRO) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 35% over that time.

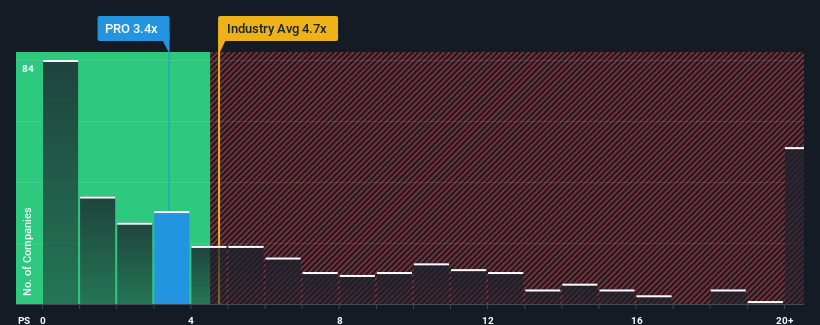

Although its price has surged higher, PROS Holdings may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 3.4x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 5.2x and even P/S higher than 13x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for PROS Holdings

What Does PROS Holdings' P/S Mean For Shareholders?

PROS Holdings could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PROS Holdings.How Is PROS Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like PROS Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 8.7%. Pleasingly, revenue has also lifted 31% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 9.4% over the next year. Meanwhile, the rest of the industry is forecast to expand by 25%, which is noticeably more attractive.

In light of this, it's understandable that PROS Holdings' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Despite PROS Holdings' share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of PROS Holdings' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with PROS Holdings (at least 1 which shouldn't be ignored), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PRO

PROS Holdings

Provides software solutions that optimize the processes of selling and shopping in the digital economy in Europe, the Asia Pacific, the Middle East, Africa, and internationally.

Undervalued low.