- United States

- /

- Software

- /

- NYSE:PCOR

Procore Technologies (PCOR): Valuation Insights Following Earnings Update, Revenue Growth, and $300 Million Buyback

Reviewed by Simply Wall St

Procore Technologies (PCOR) is making headlines after releasing updated earnings guidance, posting revenue growth in its third-quarter results, and announcing a $300 million share repurchase program. These moves highlight a busy week for the company.

See our latest analysis for Procore Technologies.

These updates come as Procore Technologies enjoys renewed momentum, with the stock posting a 13.8% 1-month share price return and a solid 12.1% total shareholder return over the past year. Recent buyback news and improving results have helped keep sentiment constructive. This has supported a three-year total return of 38.7% and suggests investors are growing more optimistic about the company’s growth path.

If fresh buyback activity has you thinking about other opportunities, now is the perfect time to expand your search and discover fast growing stocks with high insider ownership

With shares rising over the past month and the company touting double-digit revenue growth, investors now face a critical question: Is Procore still undervalued or is the market already factoring in its future success?

Most Popular Narrative: 6% Undervalued

The most highly followed valuation viewpoint puts Procore Technologies’ fair value at $84.28, just above its last close of $79.16. This small premium spotlights a stock that is close to what narrative backers see as fair. There may be more behind the numbers fueling this optimistic stance.

Accelerating adoption of AI-powered solutions in construction, particularly Procore Helix and Agent Builder, is driving increased customer automation, data unification, and workflow efficiency. This positions Procore as an indispensable platform and is likely to boost future revenue growth and support higher pricing, positively impacting both top-line and margins.

Wondering what powers this bullish scenario? It is not just hype. The narrative hinges on ambitious revenue growth, stronger pricing, and game-changing efficiency moves, but the precise assumptions will surprise even seasoned investors. Click through if you want to see which specific financial levers make this fair value tick.

Result: Fair Value of $84.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent economic uncertainty or slower than expected international expansion could challenge Procore’s promising outlook and dampen the pace of its projected growth.

Find out about the key risks to this Procore Technologies narrative.

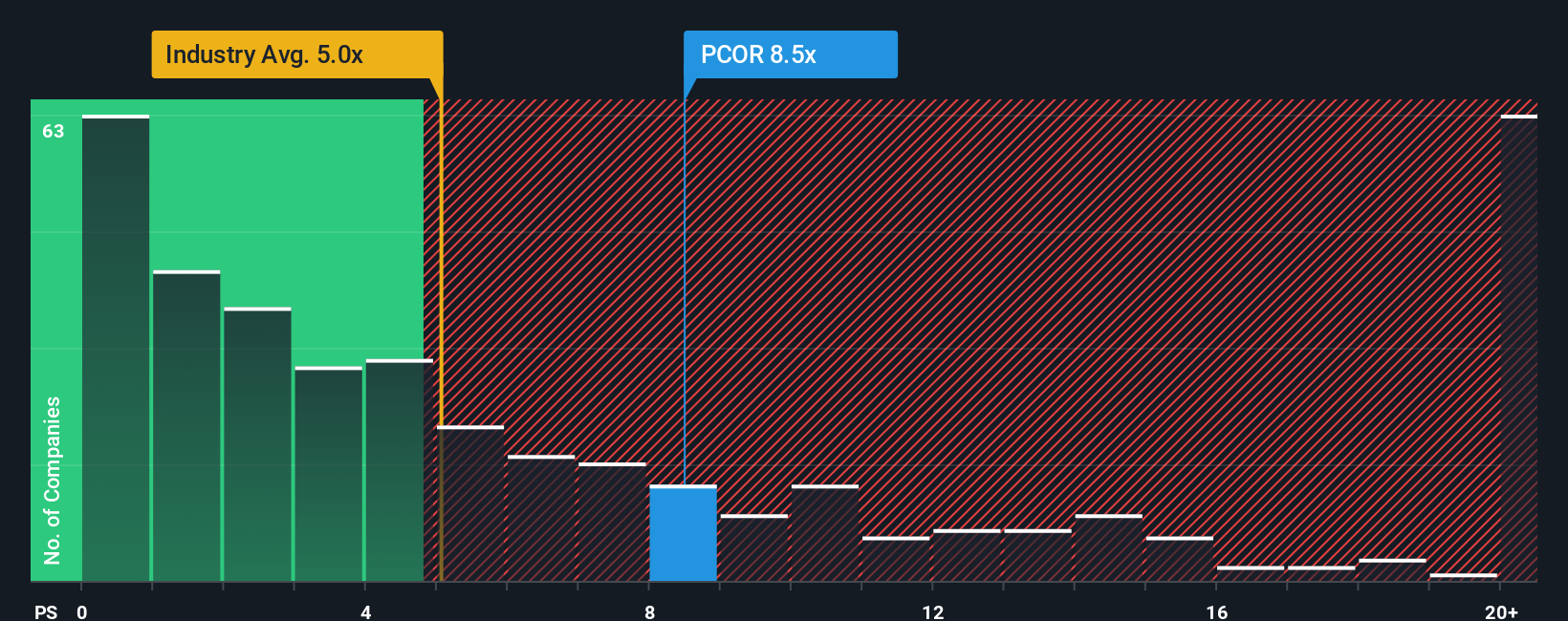

Another View: Price to Sales Comparison

While some believe Procore is fairly valued, looking at its price to sales ratio offers a different perspective. Procore trades at 9.6 times revenue, which is higher than both the industry average of 4.8 and its peers at 9.4. Even in comparison to a fair ratio of 8, Procore’s valuation stands out as a notable premium. This could indicate a higher valuation risk if the company’s growth slows. Are investors potentially paying a premium for anticipated future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Procore Technologies Narrative

If you have a different perspective or want to dive deeper into the numbers, you can craft your own view in just a few minutes using Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Procore Technologies.

Looking for more investment ideas?

Why settle for one opportunity when bold investing moves are just a click away? Use Simply Wall Street’s powerful screener to act on the latest market themes before others catch up.

- Capitalize on undervalued potential by targeting these 865 undervalued stocks based on cash flows, which could deliver strong returns as the market reevaluates them.

- Ride the AI boom and seize new trends with access to these 24 AI penny stocks, harnessing artificial intelligence in tomorrow’s biggest industries.

- Secure steady income from these 16 dividend stocks with yields > 3%, offering yields above 3% and robust dividend histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCOR

Procore Technologies

Provides a cloud-based construction management platform and related products and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives