- United States

- /

- Software

- /

- NYSE:PCOR

Procore Technologies (PCOR): Reassessing Valuation After New AI Suite, AWS Deal and CEO Transition

Reviewed by Simply Wall St

Procore Technologies (PCOR) just lined up three meaningful catalysts at once: its new Groundbreak AI suite, an expanded AWS partnership, and an incoming CEO, all converging ahead of the next earnings stretch.

See our latest analysis for Procore Technologies.

Those moves are arriving just as momentum has quietly improved, with an 8.6 percent 1 month share price return and a solid 3 year total shareholder return of about 53 percent, despite a softer 1 year total shareholder return.

If Procore’s AI push has you thinking more broadly about digital transformation, it could be a good moment to explore other high growth tech and AI stocks that might be setting up for similar growth stories.

With revenue still growing double digits, but shares sitting roughly 9 percent below their 1 year level and about 12 percent under analyst targets, is this setting up a fresh entry point, or is the market already banking on future growth?

Most Popular Narrative Narrative: 11.2% Undervalued

With Procore Technologies last closing at $76.79 against a narrative fair value of $86.44, the valuation case hinges on aggressive long term assumptions.

The demonstrated operating leverage from recent go to market changes and increased sales efficiency is already delivering improved operating margins; management's commitment to further expand margins (targeting 25% 40% FCF margins long term) suggests future earnings and cash flow growth may be underestimated in current valuations.

Curious how a still unprofitable construction software platform earns such a rich future multiple? The narrative leans on bold margin expansion and compounding revenue. Want to see which specific growth and profitability paths are baked into that fair value?

Result: Fair Value of $86.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on continued construction spending and successful global expansion, both of which could stall if macro conditions worsen or if competitive pressure intensifies.

Find out about the key risks to this Procore Technologies narrative.

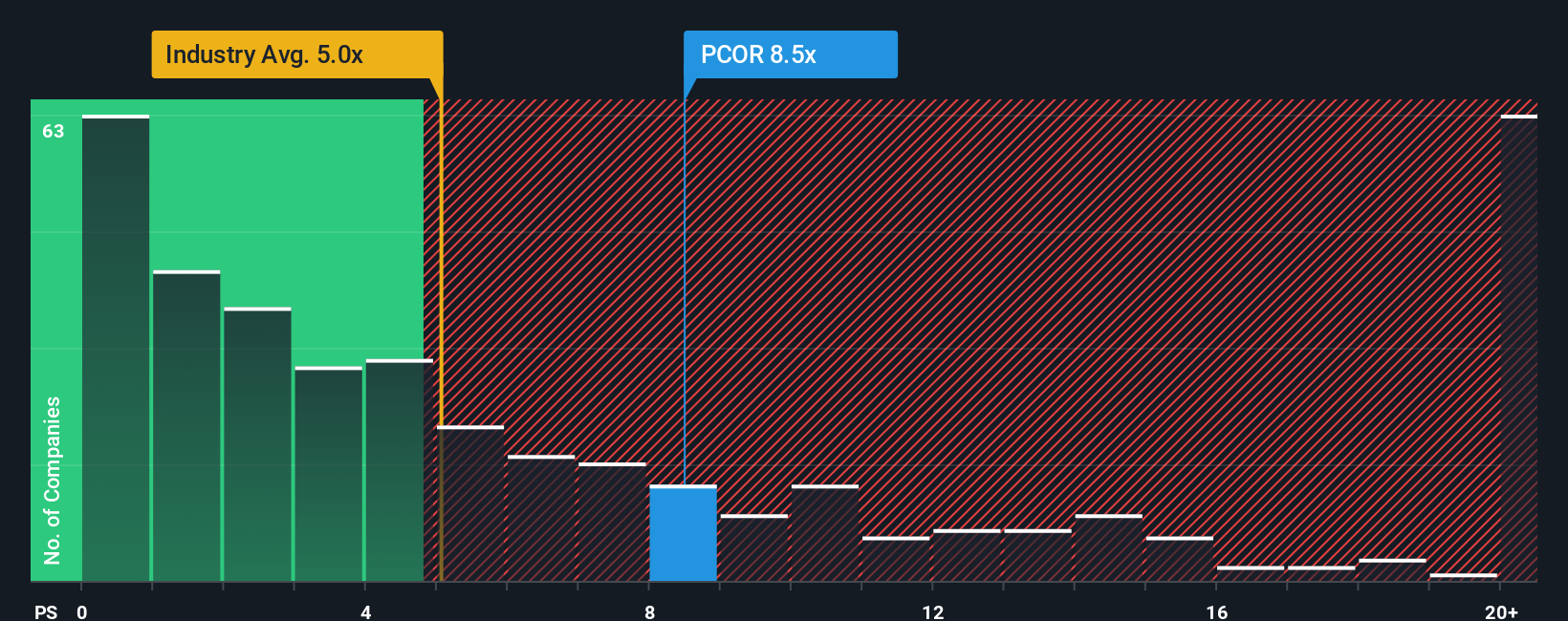

Another View Using Market Ratios

While the narrative fair value suggests upside, the market’s own yardsticks tell a cooler story. On a price to sales of 9.4 times versus a fair ratio of 7.4 times, and 4.9 times for the wider US software space and 8 times for peers, Procore looks richly priced, leaving less margin for error if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Procore Technologies Narrative

If this perspective does not match your own, or you would rather dig into the numbers yourself, you can build a custom view in just minutes, Do it your way.

A great starting point for your Procore Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Use the Simply Wall St Screener now to uncover focused, data driven opportunities that others are missing, before the next wave of market interest hits.

- Find potential growth at lower prices by targeting companies that look overlooked on cash flows with these 908 undervalued stocks based on cash flows.

- Explore innovation in automation, data, and software by reviewing these 26 AI penny stocks.

- Identify income opportunities while rates shift by scanning these 15 dividend stocks with yields > 3% for dividend-paying companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCOR

Procore Technologies

Provides a cloud-based construction management platform and related products and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026